Trader Reacts to 5 EMA Strategy by Power of Stocks | Make it Better

Interesting full videos highly rated Days Moving Average, Simple Moving Average Forex, Market Indicators, Term Trend, and How to Use Ema in Trading, Trader Reacts to 5 EMA Strategy by Power of Stocks | Make it Better.

I’m sure many of you have watched the 5 EMA video. There are a few flaws that can trigger your SL and make you less profitable.

In this video I will try to fine tune it so that you can become more profitable.

The information provided here is only for educational purpose and is not intended to be any kind of financial, trading, or investment advice.

Investment in stock market is subject to market risk and trading in stocks, options or futures involves financial risk.

I am not a SEBI registered analyst. Before taking a decision based on the video, it is advised that you consult your financial advisor and do you own analysis.

How to Use Ema in Trading, Trader Reacts to 5 EMA Strategy by Power of Stocks | Make it Better.

3 Things You Require To Understand About Variety Trading

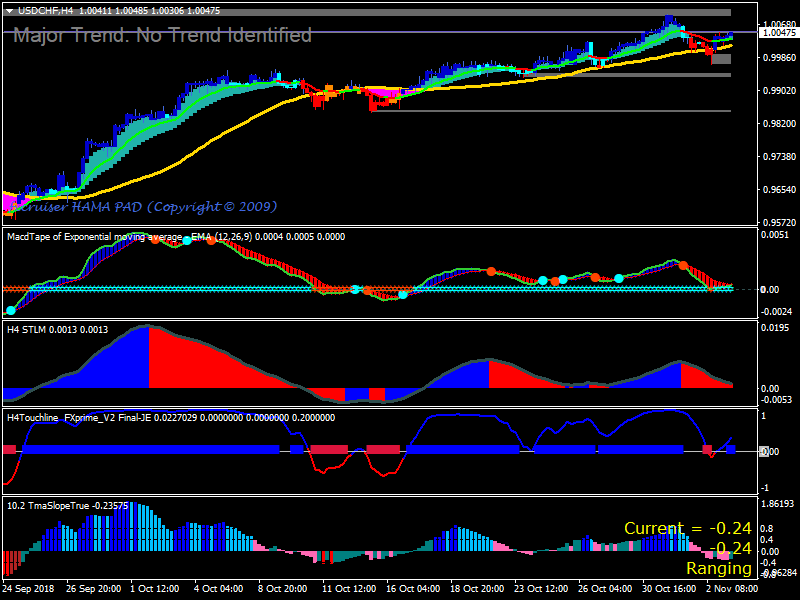

So, when the marketplace is varying, the very best trading strategy is variety trading. For the functions of this short article lets remain focused on the SMA. You can and need to chart all kinds of stocks including penny stocks.

Trader Reacts to 5 EMA Strategy by Power of Stocks | Make it Better, Search latest complete videos relevant with How to Use Ema in Trading.

Forex Strategies Exposed – See It Firsthand What An Expert Trader Needs To State!

The post with the most points does not win the ‘more than likely to be successful’ contest. Did you lose cash in 2008 stock exchange down turn? They expect that is how rewarding traders make their cash.

Here I am going to show you how to accomplish forex trading success with an easy approach which is rational, proven and you can use immediately for big earnings. Let’s have a look at it.

However, if there is a breakout through among the external bands, the rate will tend to continue in the same direction for a while and robustly so if there is an increase Moving Average Trader in volume.

Technical Analysis uses historic prices and volume patterns to anticipate future behavior. From Wikipedia:”Technical analysis is often contrasted with essential Analysis, the study of economic elements that some analysts state can influence rates in financial markets. Technical analysis holds that rates already show all such influences before financiers understand them, hence the study of price action alone”. Technical Experts highly believe that by studying historic costs and other essential variables you can forecast the future price of a stock. Absolutely nothing is absolute in the stock market, however increasing your probabilities that a stock will go the instructions you expect it to based upon cautious technical analysis is more precise.

Forex MA Trading She wrote a greater strike rate this time around because the pattern appeared to be accelerating and she didn’t want to miss out on out on excessive capital growth if it continued to rally.

She looked into her child’s eyes and smiled, believing “How simple was that?” She had just drawn up a Stocks MA Trading plan for a put option trade based upon her analysis of that very chart – she believed the cost would decrease; how incorrect would she have been?

Another forex trader does care too much about getting a roi and experiences a loss. This trader loses and his wins are on average, much bigger than losing. When he wins the video game, he wins double what was lost. This reveals a balancing in losing and winning and keeps the investments open to get a revenue at a later time.

It’s really true that the marketplace pays a lot of attention to technical levels. We can show you chart after chart, breakout after breakout, bounce after bounce where the only thing that made the difference was a line drawn on a chart. Moving averages for example are ideal research studies in when big blocks of money will purchase or sell. View the action surrounding a 200 day moving average and you will see first hand the warfare that happens as shorts try and drive it under, and longs buy for the bounce. It’s cool to view.

Always know your emotions and never make a trade out of worry or greed. This is harder than it seems. Many amateur traders will pull out of a trade based on what is happening. But I ensure you this is constantly bad. To earn money regularly you must develop a method and persevere. So be it if this means setting targets and stops and leaving the room! This might be more difficult to practice than it sounds but unless you get control of your feelings you will never ever be an effective trader.

Moving averages can inform you how quickly a trend is moving and in what direction. In many instances we can, but ONLY if the volume boosts. Once again another fantastic system that no one actually talks about.

If you are finding most engaging comparisons related to How to Use Ema in Trading, and Counter Trend Trade, Forex Tools, Learning Forex you are requested to list your email address in email list for free.