But Don't Count the Bear Market Rally Out Just Yet

Trending full videos top searched Moving Average, Exponential Moving Average, Forex Candlestick, Chart Stocks, and What Happens When 50 Sma Crosses 200 Sma, But Don't Count the Bear Market Rally Out Just Yet.

The S&P 500 and Nasdaq-100 are likely to head lower but with strong buying support below, the Bear market rally isn’t over yet. The bigger opportunity may be with the Russell 2000 which looks to head higher.

A weekly look at the breadth indicators, technical momentum indicators, volume profile, and the charts for the S&P 500 (SPY), Nasdaq-100 (QQQ), Russell 2000 (IWM), and High-Yield or Junk Bonds (HYG).

Momentum Timer Pro™

https://stevenvanmetre.com/momentum-timer-pro/

Portfolio Shield™

https://stevenvanmetre.com/portfolio-shield/

Website

http://stevenvanmetre.com/

Social Media

Tweets by MetreSteven

https://www.linkedin.com/in/steven-van-metre-b4a08b182/

https://www.facebook.com/svmfin/

Watermark Artwork by Jasmine Miller Twitter: @jazcreative

Portfolio Shield™ and Momentum Timer Pro™ are unregistered trademarks of Steven Van Metre Financial.

Atlas Financial Advisors, Inc. (AFA) is a registered investment adviser and the opinions expressed by (AFA) on this show are their own and do not reflect the opinions of YouTube. All statements and opinions expressed are based upon information considered reliable although it should not be relied upon as such. Any statements or opinions are subject to change without notice.

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed.

Information expressed does not take into account your specific situation or objectives, and is not intended as recommendations appropriate for any individual. Listeners are encouraged to seek advice from a qualified tax, legal, or investment adviser to determine whether any information presented may be suitable for their specific situation. Past performance is not indicative of future performance.

What Happens When 50 Sma Crosses 200 Sma, But Don't Count the Bear Market Rally Out Just Yet.

Forex Trading Guide – The Significance Of Your Own Forex Trading System

They are support, resistance, volume, stochastic and 18 bar moving average. What they want is a forex strategy that turns into a profit within minutes of getting in into the trade. Sometimes, the modifications can take place suddenly.

But Don't Count the Bear Market Rally Out Just Yet, Search new updated videos about What Happens When 50 Sma Crosses 200 Sma.

Free Day Trading System

After all, too many signs can lead to decision paralysis. To discover a good place for a stop, pretend that you’re considering a sell the instructions of the stop. A downtrend is indicated by lower highs and lower lows.

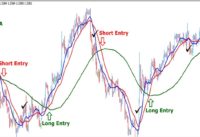

Moving averages are popular indicators in the forex. Most traders utilize them, and some individuals use them exclusively as their own indicator. However what is the function of moving averages, and how do you actually earn money from them?

Nasdaq has actually rallied 310 points in three months, and struck a brand-new four-year high at 2,201 Fri Moving Average Trader morning. The financial data suggest market pullbacks will be restricted, although we have actually entered the seasonally weak period of Jul-Aug-Sep after a huge run-up. As a result, there might be a combination period instead of a correction over the next couple of months.

Grooved range can also hold. If the selling is extreme, it may press the stock right past the grooved area – the longer a stock stays at a level, the stronger the support.

Picking an amount of time: If your day trading, buying and offering intra day, a 3 year chart will not assist you. For intra day trading you desire to use 3,5 and 15 minute charts. Depending upon your longterm financial investment strategy you can take a look at a 1 year, which I use usually to a 10 year chart. The yearly chart provide me a take a look at how the stock is doing now in today’s market. I’ll look longer for historical support and resistance points but will Forex MA Trading my buys and offers based on what I see in front of me in the yearly.

A Forex trading strategy needs three Stocks MA Trading basic bands. These bands are the time frame picked to trade over it, the technical analysis utilized to determine if there is a cost trend for the currency pair, and the entry and exit points.

Here is a perfect example of a technique that is simple, yet creative sufficient to assure you some included wealth. Start by choosing a specific trade that you believe pays, say EUR/USD or GBP/USD. When done, select 2 signs: weighted MA and basic MA. It is advised that you utilize a 20 point weighted moving average and a 30 point moving average on your 1 hour chart. The next action is to watch out for the signal to sell.

For these type of traders short-term momentum trading is the very best forex trading method. The aim of this short term momentum trading method is to strike the profit target as early as possible. When the momentum is on your side, this is accomplished by getting in the market long or short.

At the day level there are periods also that the rate does not mainly and periods that the rate modification mostly. When London stock opens ad when U.S.A. stock opens, the dangerous time periods are. Also there are big changes when Berlin stock opens. After every one opens, there are typically big changes in the costs for a guy hours. The most risky time periods is the time at which 2 stocks are overlapped in time.

First look at the last couple of days, then the last few weeks, months and then year. A drop is shown by lower highs and lower lows. When done, select two signs: weighted MA and basic MA.

If you are finding updated and engaging videos about What Happens When 50 Sma Crosses 200 Sma, and Buy Signal, Sector Trends dont forget to subscribe in newsletter totally free.