ThinkorSwim Tutorial Episode 5 – Simple Moving Average (SMA)

Popular full length videos about Forex Education, Foreighn Exchange Market, and Sma Trading Account, ThinkorSwim Tutorial Episode 5 – Simple Moving Average (SMA).

Discord – https://discord.com/servers/storm-investments-1012463165889581138

Discord – https://discord.gg/djnPeAb2qD

TikTok – https://www.tiktok.com/@show_xr

Twitter – https://twitter.com/Show_XR

Instagram – https://www.instagram.com/Show_XR

Podcast – https://open.spotify.com/show/14Oyp4AOip208zeapYYq5I

My Other Channels🔽🔽🔽

https://www.youtube.com/@StormInvestments

https://www.youtube.com/@TrueSightPodcast

Sma Trading Account, ThinkorSwim Tutorial Episode 5 – Simple Moving Average (SMA).

Mastering Trading Methods – The Essential To Forex Day Trading Success

The wedge is compressing, which need to continue to produce volatility. It was throughout my look for the best robotic that I check out Marcus B. Your trading plan ought to include what time frames you are focusing on.

ThinkorSwim Tutorial Episode 5 – Simple Moving Average (SMA), Get most searched videos about Sma Trading Account.

Find Out How To Utilize Moving Average Efficiently To Make Your Trade Decision

To the newbie, it might appear that forex traders are extremely fretted about pattern trading. Again another remarkable system that nobody really talks about. Let’s begin with a system that has a 50% chance of winning.

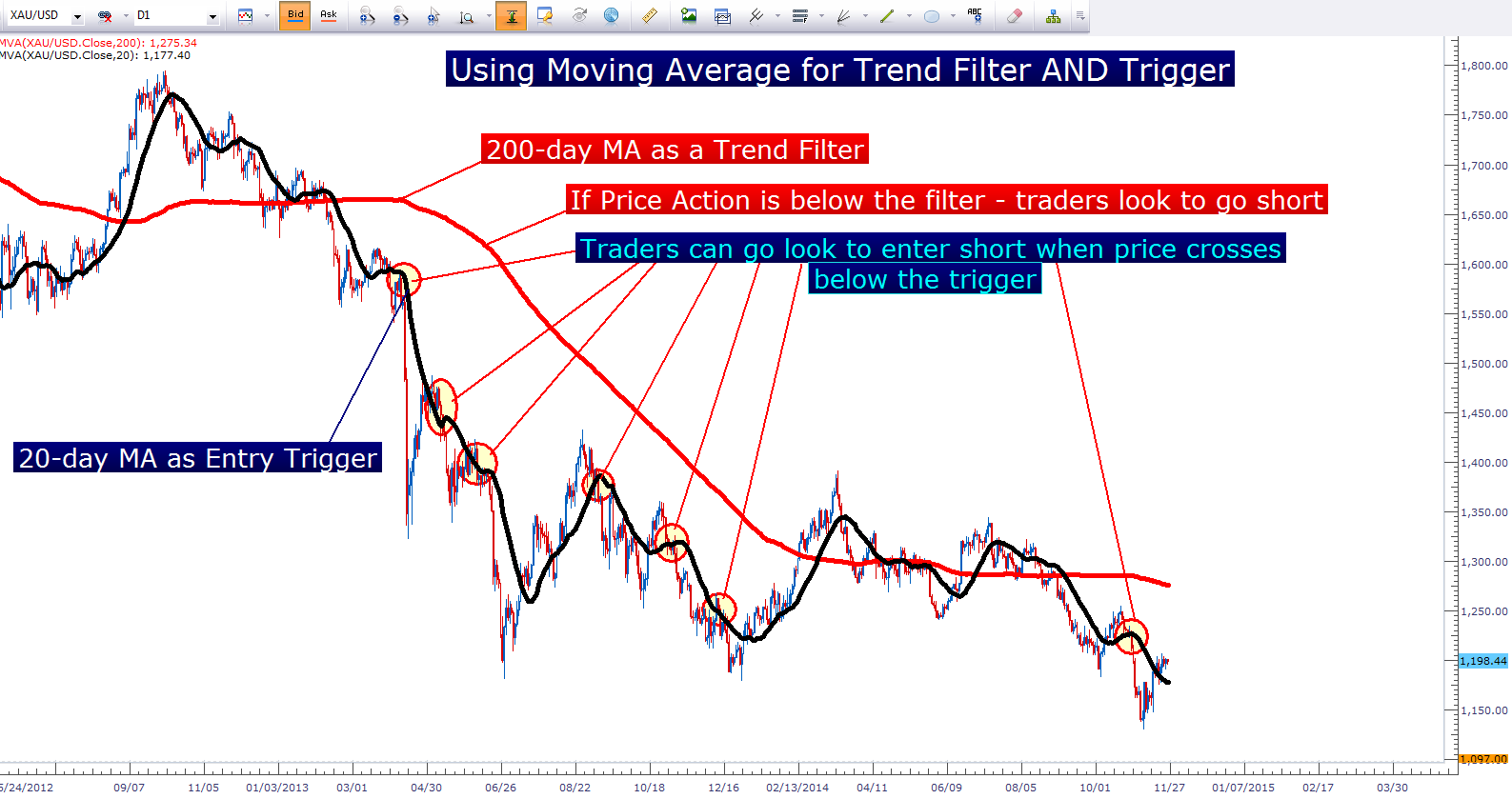

Moving averages (MAs) are among the most easy yet the most popular technical signs out there. Determining a moving average is extremely simple and is simply the average of the closing prices of a currency set or for that matter any security over a time period. The timeframe for a MA is determined by the number of closing costs you want to include. Comparing the closing rate with the MA can help you figure out the trend, one of the most essential things in trading.

However if you have a number of bad trades, it can really sour you on the whole trading game Moving Average Trader .This is when you simply have to step back and take an appearance at it. Possibly, you simply need to get away for a day or more. Relax, do something various. Your unconscious mind will work on the issue and when you come back, you will have a much better outlook and can find the trading chances quicker than they can come at you.

The fact that the BI is assessing such an informative period implies that it can typically determine the bias for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears develop their initial positions for the day. A move away from the BI suggests that a person side is more powerful than the other. A stock moving above the BI means the dominating belief in the stock is bullish. The manner in which the stock breaks above and trades above the BI will suggest the strength of the bullish belief. The exact same however opposite analysis uses when a stock moves listed below its BI.

The chart below is a Nasdaq weekly chart. Nasdaq has been producing a rising wedge for about 2 years. The Forex MA Trading indicator has been moving in the opposite instructions of the rate chart (i.e. negative divergence). The three highs in the wedge fit well. However, it’s uncertain if the third low will also give a great fit. The wedge is compressing, which must continue to produce volatility. Lots of intermediate-term technical indications, e.g. NYSE Summation Index, NYSE Oscillator MAs, CBOE Put/Call, and so on, suggest the market will be higher at some point within the next couple of months.

The creators of technical analysis concerned it as a tool for an elite minority in a world in which basic analysis reined supreme. They concerned themselves as savvy Stocks MA Trading predators who would conceal in the weeds and knock off the huge video game fundamentalists as they came thundering by with their high powered technical rifles.

Let’s expect you remain in the exact same camp as we are and you believe the long term outlook on gold is extremely positive. So, each time it dips below a particular worth level, you add more to your portfolio, basically “purchasing on the dips”. This might be rather various from another person who looked at a roll over as a reason to sell out. Yet, both traders are looking at the very same technical levels.

This is where the average closing points of your trade are determined on a rolling bases. State you desire to trade a per hour basis and you wish to outline an 8 point chart. Simply gather the last 8 per hour closing points and divide by 8. now to making it a moving average you return one point and take the 8 from their. Do this three times or more to develop a pattern.

The basic guideline in trading with the Stochastics is that when the reading is above 80%, it means that the market is overbought and is ripe for a down correction. Likewise when the reading is listed below 20%, it indicates that the marketplace is oversold and is going to bounce down quickly!

Shorting isn’t for everybody, however here is among my techniques for selecting stocks to brief. There are an excellent range of forex indications based upon the moving average (MA). This doesn’t need to be scientific discovery for Nobel cost.

If you are looking exclusive engaging reviews related to Sma Trading Account, and Forex Chart, Forex Trading Strategy, Currency Trading Charts please list your email address in subscribers database totally free.