EMA Trading Strategy: How to Use Exponential Moving Average

Interesting overview about Knowing When to Buy and Sell Stocks, Stock Tips, and How to Use Ema Trading, EMA Trading Strategy: How to Use Exponential Moving Average.

Start trading now: https://bit.ly/3yf6Ibz

Here’s an overview of a simple yet effective EMA trading strategy. Watch the video to learn all you need to know about Exponential Moving Average. We Use Exponential Moving Averages in our daily trading and want to tell you how to do the same. Take your Forex trading to the next level.

More insights in the Twitter:

Tweets by FBS_broker

Download the FBS Personal Area app:

Worldwide https://bit.ly/36qlgeC

Indonesia https://bit.ly/3qxOQFQ

Visit our website for more information: https://bit.ly/3vIzmR1

Facebook https://bit.ly/3ELXjLm

Twitter https://bit.ly/3Ow9Zum

Instagram https://bit.ly/3s16Vgb

Telegram https://bit.ly/3xTwsf3

Timestamps:

00:00 – Intro

00:23 – What’s Exponential Moving Average?

01:04 – Why use Exponential Moving Average?

01:19 – Choosing EMA period

02:06 – EMA trading strategy

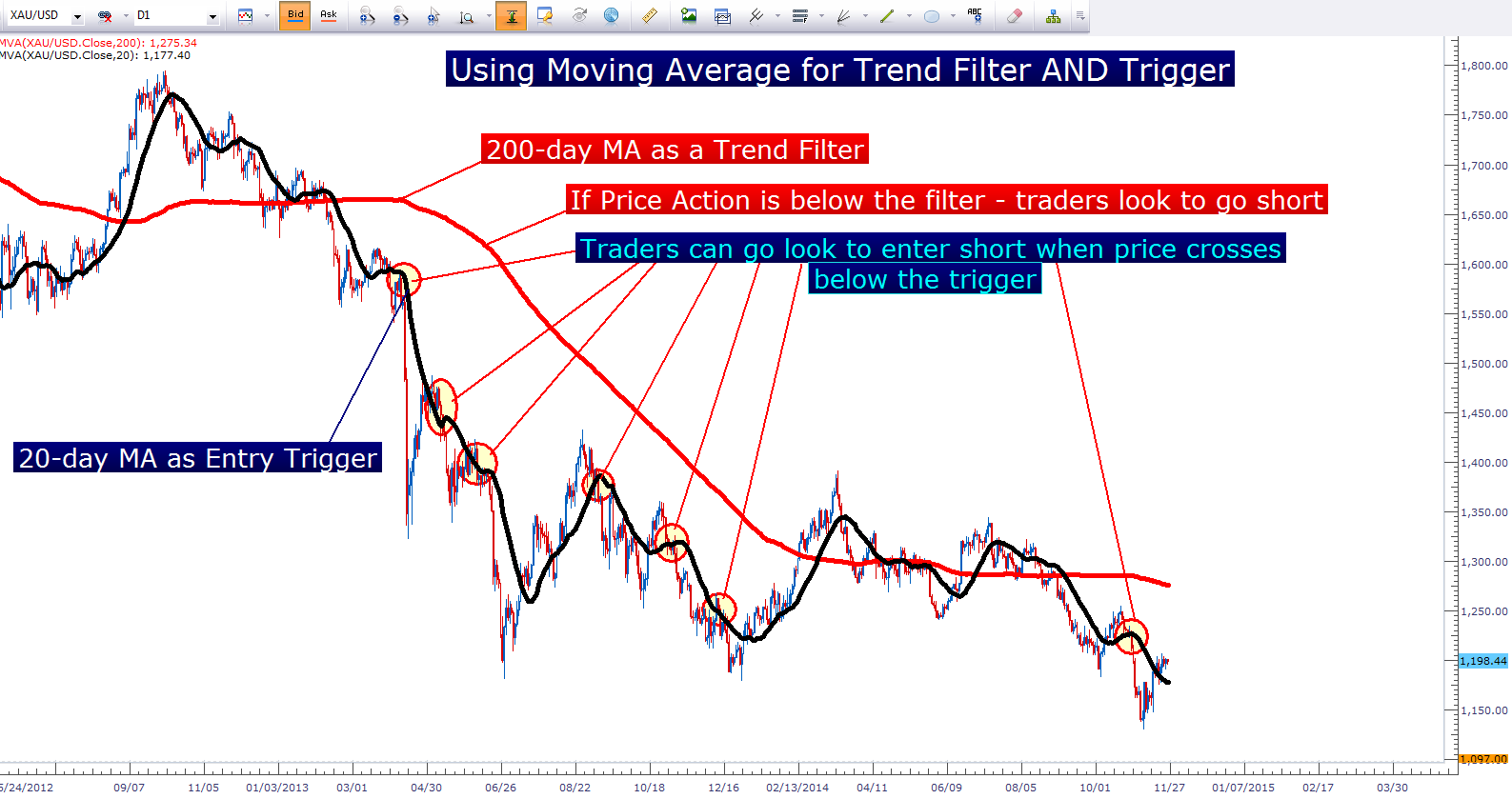

03:41 – Examples of EMA trading strategy

05:30 – Making your strategy better

#EMA #movingaverage #fbs #trading

How to Use Ema Trading, EMA Trading Strategy: How to Use Exponential Moving Average.

A Quick Currency Trading Tutorial – How To Get Started

My point is this – it does not really matter which one you utilize. Assuming you did not see any news, you need to put down a forex trade placing design. This is to forecast the future trend of the rate.

EMA Trading Strategy: How to Use Exponential Moving Average, Watch latest explained videos relevant with How to Use Ema Trading.

Stop Losses In The Forex Market

They did this by appropriately examining the everyday cost and volume action of the NASDAQ. There are lots of technical indications out there. Throughout these times, the market regularly breaks support and resistance.

Moving averages (MAs) are one of the most basic yet the most popular technical indicators out there. Calculating a moving average is really simple and is simply the average of the closing rates of a currency set or for that matter any security over an amount of time. The timeframe for a MA is identified by the number of closing costs you wish to include. Comparing the closing price with the MA can help you determine the trend, among the most important things in trading.

This environment would show that the currency pair’s cost is trending up or down and breaking out of its existing trading variety. When there are modifications impacting the currency’s country, this generally takes place. When the cost of the currency set rises below or above the 21 Exponential Moving Average and then going back to it, a fast trending day can be seen. A Moving Average Trader ought to study the fundamentals of the country before deciding how to trade next.

The most fundamental application of the BI concept is that when a stock is trading above its Bias Sign you ought to have a bullish predisposition, and when it is trading listed below its Predisposition Indication you ought to have a bearish predisposition.

The dictionary prices quote a typical as “the Forex MA Trading ratio of any amount divided by the number of its terms” so if you were exercising a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would include them together and divide them by 10, so the average would be 55.

This implies that you require to understand how to manage the trade prior to you take an entry. In a trade management strategy, you need to have composed out precisely how you will control the trade after it is gotten in into the Stocks MA Trading so you understand what to do when things show up. Conquering trade management is very essential for success in trading. This part of the system should include details about how you will react to all type of conditions one you enter the trade.

At its core your FOREX trading system needs to be able to find trends early and also be able to prevent sharp rises or falls due to a particularly unpredictable market. In the beginning glimpse this may seem like a challenging thing to achieve and to be honest no FOREX trading system will perform both functions flawlessly 100% of the time. Nevertheless, what we can do is develop a trading system that works for the vast majority of the time – this is what we’ll focus on when developing our own FOREX trading system.

When the hype calms down and the CME finishes its margin boost on Monday, we should see silver costs support. From my perspective, I see $33 as a level I might very carefully begin to buy. I think support will be around $29 till the Fed chooses it’s time to cool inflation if silver breaks listed below that level.

5 distribution days during March of 2000 signified the NASDAQ top. Likewise important is the fact that many leading stocks were revealing leading signals at the exact same time. The best stock market operators went mostly, or all in cash at this time, and kept their amazing gains from the previous 4 or 5 years. They did this by effectively examining the everyday price and volume action of the NASDAQ. It makes no sense at all to watch significant revenues disappear. As soon as you find out to recognize market tops, and take proper action, your total trading outcomes will enhance considerably.

You need to set really specified set of swing trading rules. As soon as you have enjoyed share market you must understand how it works. You should develop your own system of day trading.

If you are searching more entertaining videos related to How to Use Ema Trading, and Forex Trading Ideas, Current Sector Trends, Forex Trading Tips, Trading Tips you should subscribe in email list now.