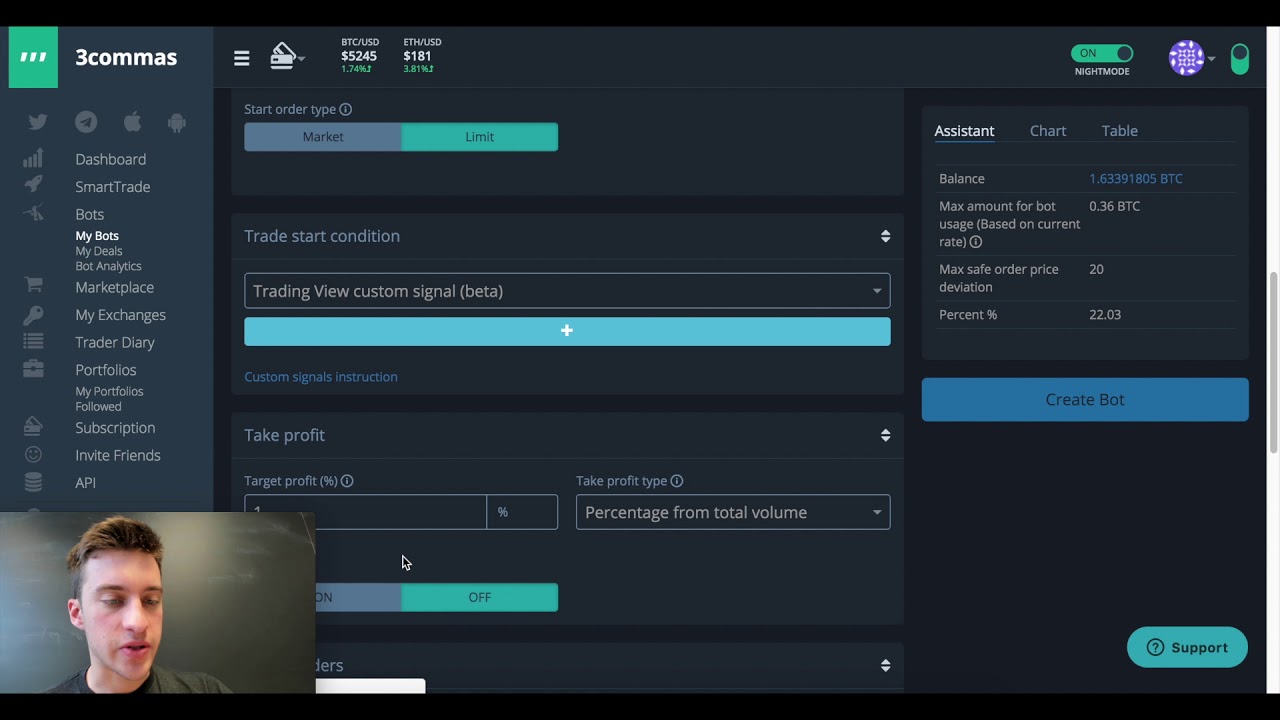

Automate any Tradingview Strategy with 3commas

Trending videos related to Currency Exchange Rate, Forex Trading Ideas, Share Market, and Ema Trading Bot, Automate any Tradingview Strategy with 3commas.

This video shows how you can automate any tradingview strategy via 3commas. If you have any additional questions or strategy adjustments, feel free to post in the comments or in our discord. For a 3-day free trial + discount on paid plans, click the link below!

https://3commas.io/?c=BTC+%2B+%2C%2C%2C

Get access to life-changing private trading techniques for only 15 dollars: https://www.buymeacoffee.com/btchangout

_________________________________________________________________________________________________

Disclaimer: The content covered in this video is NOT investment advice and I am not a financial advisor. The material covered within these videos is for educational purposes only. Always do your own research and only invest based on your own findings and personal judgment. Happy Trading!

Ema Trading Bot, Automate any Tradingview Strategy with 3commas.

How Discovering New Rsi Concepts Can Turn Your Trading Around Overnight

You might notice on stock charting sites a line called MA, SMA, or EMA. Nasdaq has actually been developing a rising wedge for about two years. The understanding and use of easy moving averages will achieve this.

Automate any Tradingview Strategy with 3commas, Enjoy most shared complete videos related to Ema Trading Bot.

The Currency Trading Revolution

The strongest signal is where the current cost goes through both the SMAs at a high angle. On April 28, the gold-silver ratio was about 30, reasonably low. I have been trading futures, choices and equities for around 23 years.

The Bollinger Bands were developed by John Bollinger in the late 1980s. Bollinger studied moving averages and explored with a brand-new envelope (channel) indication. This research study was among the first to measure volatility as a dynamic motion. This tool provides a relative meaning of price highs/lows in regards to upper and lower bands.

Technical analysis can be very beneficial for Moving Average Trader to time our entries and exits of the trade. It should not be used alone since it can be confusing info if not used effectively.

Assistance & Resistance. Support-this term describes the bottom of a stock’s trading range. It’s like a flooring that a stock price finds it difficult to penetrate through. Resistance-this term explains the top of a stock’s trading range.It’s like a ceiling which a stock’s price does not appear to increase above. When to sell a stock or purchase, assistance and resistance levels are necessary ideas as to. Lots of successful traders buy a stock at assistance levels and sell brief stock at resistance. If a stock manages to break through resistance it could go much higher, and if a stock breaks its support it might signify a breakdown of the stock, and it may go down much further.

There is a plethora of investment idea sheets and newsletters on the internet. Sadly, numerous if not most of them are paid to advertise the stocks they advise. Rather of blindly following the recommendations of others you require to establish swing trading guidelines that will trigger you to get in a trade. This Forex MA Trading be the stock crossing a moving average; it may be a divergence in between the stock cost and an indicator that you are following or it might be as easy as looking for support and resistance levels on the chart.

Taking the high, low, close and open values of the previous day’s price action, tactical levels can be recognized which Stocks MA Trading or may not have an influence on rate action. Pivot point trading puts emphasis on these levels, and utilizes them to direct entry and exit points for trades.

Great forex trading and investing includes increasing revenues and decreasing possibilities of loss. This is refrained from doing, particularly by newbies in the field. They do not know correct trading techniques.

For these kind of traders brief term momentum trading is the best forex trading strategy. The goal of this brief term momentum trading strategy is to strike the earnings target as early as possible. When the momentum is on your side, this is accomplished by getting in the market long or short.

Do not just buy and hold shares, at the exact same time active trading is not for everyone. When to be in or out of the S&P 500, utilize the 420 day SMA as a line to choose. When the market falls below the 420 day SMA, traders can also look to trade brief.

This is mentioning the apparent, but it is typically overlooked when choosing a trading method. Constantly know your feelings and never ever make a trade out of worry or greed. Also active trading can affect your tax rates.

If you are finding rare and engaging reviews relevant with Ema Trading Bot, and Counter Trend Trade, Forex Tools, Learning Forex please join for email list for free.