The Ultimate 5 Minute Scalping Strategy for Quick and Easy Profits – You Have to Try This!

Best videos relevant with Best Forex Technical Analysis, Forex Education, and Which Sma For Day Trading, The Ultimate 5 Minute Scalping Strategy for Quick and Easy Profits – You Have to Try This!.

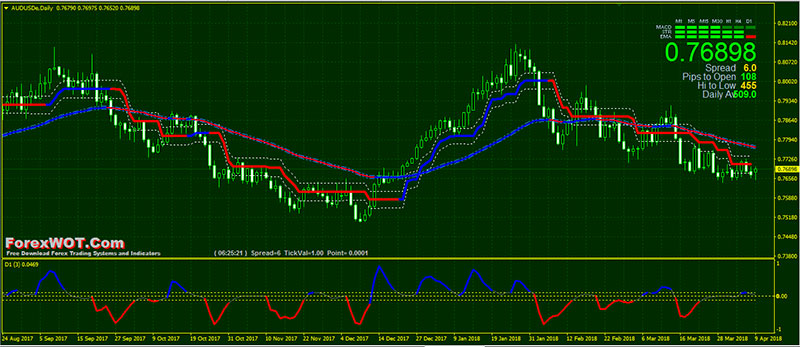

Finally a 5 Minute scalping strategy that works! This video highlights one of the best 5 Minute scalping strategies that can be used in day trading. Whether you are trading forex, crypto or indices, this Scalping strategy will work incredibly well. This 5 minute Scalping Strategy also works on 1 min and 5 min time frame and can turn into long term position holding.

Get Brute Force V2 indicator here:

https://www.trdfloor.com/

FunderPro

Start your funded account challenge HERE (20% discount with link)

https://funderpro.com/get-funded-with-tma-and-funderpro

my twitter https://twitter.com/artybryja

For charts Use Trading View

https://www.tradingview.com/?aff_id=113274

New Official Telegram Group

TMA OFFICIAL®

https://t.me/TMAbyArty

Looking for a forex broker?

I use Osprey

https://ospreyfx.com/tradewithtma

regulated broker i recommend is Blueberry markets

https://bit.ly/blueberrytma

Try a $100,000 funded account from OspreyFX

https://ospreyfx.com/tradewithtma

Use coupon code

movingaverage50

To get $50 off

Get a free audio book from audible

https://tmafocus.com/2WyXSqa

Links to the indicators

TMA Overlay

https://www.tradingview.com/script/zX3fvduH-TMA-Overlay/

TMA Divergence indicator

https://tmafocus.com/3nfcEfd

TMA shop

https://shop.spreadshirt.com/themovingaverage/

Get some free stocks from WEBULL

https://tmafocus.com/3p0vatP

also

Get some free stocks from Public

https://tmafocus.com/3GUUojh

What is scalping?

Scalping is a trading strategy designed to profit from small price changes, with profits on these trades taken quickly and once a trade has become profitable. All forms of trading require discipline, but because the number of trades is so large, and the gains from each individual trade so small, a scalper must have a rigid adherence to their trading system, avoiding one large loss that could wipe out dozens of successful trades.

Scalpers will take many small profits, and not run any winners, in order to seize gains as and when they appear. The aim is for a successful trading strategy through the large number of winners, rather than a few successful trades with large winning sizes.

Scalping relies on the idea of lower exposure risk, since the actual time in the market on each trade is quite small, lessening the risk of an adverse event causing a big move. In addition, it takes the view that smaller moves are easier to get than larger ones, and that smaller moves are more frequent than larger ones.

NOT FINANCIAL ADVICE DISCLAIMER

The information contained here and the resources available for download through this website is not intended as, and shall not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor, nor am I holding myself out to be, and the information contained on this Website is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation.

We have done our best to ensure that the information provided here and the resources available for download are accurate and provide valuable information. Regardless of anything to the contrary, nothing available on or through this Website should be understood as a recommendation that you should not consult with a financial professional to address your particular information. The Company expressly recommends that you seek advice from a professional.

*None of this is meant to be construed as investment advice, it’s for entertainment purposes only. Links above include affiliate commission or referrals. I’m part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.

Which Sma For Day Trading, The Ultimate 5 Minute Scalping Strategy for Quick and Easy Profits – You Have to Try This!.

Trading Forex – Finest Currencies To Trade

Start by choosing a particular trade that you think is lucrative, state EUR/USD or GBP/USD. Those 3 things are the foundation for an excellent trading system. When done, choose 2 indications: weighted MA and basic MA.

The Ultimate 5 Minute Scalping Strategy for Quick and Easy Profits – You Have to Try This!, Explore more explained videos related to Which Sma For Day Trading.

How To Trade Stocks – Part 4 – Bearishness, Booming Market, What The H?

Another forex trader does care excessive about getting a roi and experiences a loss. All over the internet there are discussions about trading methods – what truly works and what doesn’t.

Moving averages (MAs) are one of the most simple yet the most popular technical indications out there. Computing a moving average is really basic and is just the average of the closing costs of a currency set or for that matter any security over a time period. The timeframe for a MA is figured out by the number of closing rates you desire to include. Comparing the closing rate with the MA can help you figure out the trend, among the most crucial things in trading.

Technical analysis can be extremely useful for Moving Average Trader to time our entries and exits of the trade. It shouldn’t be used alone because it can be confusing info if not utilized properly.

Likewise getting in and out of markets although cheaper than in the past still costs money. Not simply commission but the spread (difference in between purchasing and selling rate). Likewise active trading can affect your tax rates.

Market timing is based upon the “truth” that 80% of stocks will follow the instructions of the broad market. It is based upon the “truth” that the Forex MA Trading pattern in time, have been doing so considering that the start of freely traded markets.

Let us state that we want to make a short-term trade, between 1-10 days. Do a screen for Stocks MA Trading in a new up trend. Bring up the chart of the stock you have an interest in and bring up the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving typical the stock is going to continue up and ought to be bought. However as quickly as the 9 day crosses over the 4 day it is a sell signal. It is that basic.

The most used MA figures include the 20 Day MA, the 50 Day MA and the 200 Day MA. The 20 Day MA takes a look at the short term average, the 50 Day looks that a more intermediate amount of time and the 200 Day takes a look at a longer amount of time. The entire function for this technique is to only be invested when the security is over their moving average. It is perfect when it is over all three averages, but that typically isn’t the case. To keep risks down, I recommend simply choosing the 200 Day Moving Typical.

Understanding where to set your stop loss can be challenging – you wish to limit just how much you could perhaps lose so you ‘d be tempted to set a very little range, but at the exact same time you wish to permit short-term fluctuates so that you don’t leave your position too early.

Integrating these two moving averages provides you a good foundation for any trading plan. If you wait for the 10-day EMA to agree with the 200-day SMA, then chances are excellent that you will have the ability to earn money. Just use excellent finance, do not run the risk of too much on each trade, and you need to be fine.

In a varying market, heavy losses will happen. Numerous stocks, particularly tech stocks, fell greatly on above average profits and assistance. Two bottom lines must be thought about for effective trading.

If you are looking instant exciting comparisons about Which Sma For Day Trading, and Commitment of Traders, Disciplined Trader, Stock Tips dont forget to signup our email subscription DB totally free.