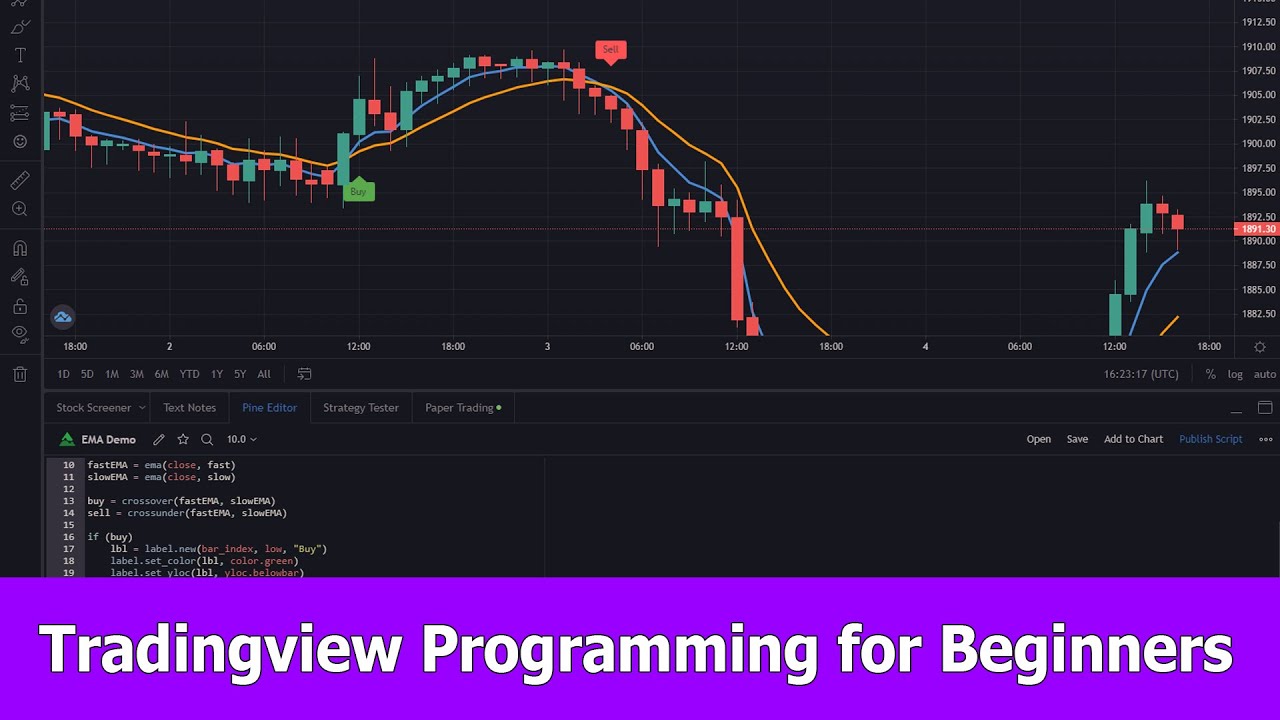

Tradingview Pine Script Programming Beginner Tutorial

Trending full length videos related to Best Moving Averages, Best Forex Technical Analysis, Best Forex, and Tradingview How To Sma, Tradingview Pine Script Programming Beginner Tutorial.

This is a tradingview programming tutorial for beginners to pine script. I show how to code an indicator using tow exponetional moving averages (EMA) and calculate the crossover and crossunder to define the crossing point that can be used as sell or buy signal in the chart.

Then I display the signal in the chart as a label with an arrow (up or down) and a text (buy or sell).

Tradingview is a great and free trading tool that can be accessed here:

https://www.tradingview.com/

Join this channel to get access to perks:

https://www.youtube.com/channel/UCs5J4GVRB8s2P4hE-O0izrg/join

See my social profiles here:

Instagram: https://www.instagram.com/jayanamgames/

Twitter: https://twitter.com/jayanamgames

Facebook: https://www.facebook.com/jayanamgames

Patreon: https://www.patreon.com/jayanam

Merch Store: https://teespring.com/de/stores/jayanam-gamedev

Production Music courtesy of Epidemic Sound: http://www.epidemicsound.com

Tradingview How To Sma, Tradingview Pine Script Programming Beginner Tutorial.

Number 1 Loser Sign – Why Trading Moving Averages Fail

Occasionally the technical indicators begin making news. Rather, you need to focus on 4 to 5 indicators to make a trading decision. These type of traders can’t see their trade going versus them.

Tradingview Pine Script Programming Beginner Tutorial, Play most searched videos related to Tradingview How To Sma.

Forex Trading – Simplicity In Two Colored Lines

What were these basic experts missing out on? When a trend remains in motion, we like to route stops behind the 40 day ma. An uptrend is shown by greater highs and greater lows. Due to the fact that they are lagging signs.

If you trade stocks, you should understand how to chart them. Some individuals explore charts to discover buy or sell signals. I discover this wasteful of a stock traders time. You can and require to chart all types of stocks including cent stocks. Charting informs you where you are on a stocks price pattern this means it informs you when to purchase or sell. There are a lot of terrific business out there, you don’t wish to get caught buying them at their 52 week high and having to wait around while you hope the cost comes back to the price you paid.

Using the same 5% stop, our trading system went from losing nearly $10,000 to acquiring $4635.26 over the same 10 years of information! The efficiency is now a positive 9.27%. There were 142 lucrative trades with 198 unprofitable trades with the Moving Average Trader revenue being $175.92 and typical loss being $102.76. Now we have a much better trading system!

“Again, I have drawn a swing chart over the cost bars on this everyday chart. Once you comprehend swing charts, you will have the ability to draw these lines in your mind and you will not need to draw them on your charts anymore,” Peter stated.

Market timing is based upon the “fact” that 80% of stocks will follow the instructions of the broad market. It is based on the “reality” that the Forex MA Trading trend over time, have actually been doing so considering that the beginning of easily traded markets.

The online Stocks MA Trading platforms provide a great deal of advanced trading tools as the Bolling Bands sign and the Stochastics. The Bolling Bands is consisting of a moving typical line, the upper requirement and lower basic discrepancy. The most utilized moving average is the 21-bar.

At its core your FOREX trading system needs to be able to spot patterns early and likewise have the ability to avoid sharp rises or falls due to a particularly unpredictable market. In the beginning glance this may look like a hard thing to accomplish and to be sincere no FOREX trading system will carry out both functions flawlessly 100% of the time. Nevertheless, what we can do is design a trading system that works for the large majority of the time – this is what we’ll focus on when designing our own FOREX trading system.

It’s very real that the market pays a great deal of attention to technical levels. We can show you chart after chart, breakout after breakout, bounce after bounce where the only thing that made the distinction was a line drawn on a chart. Moving averages for example are best studies in when big blocks of cash will buy or sell. See the action surrounding a 200 day moving average and you will see very first hand the warfare that occurs as shorts try and drive it under, and longs purchase for the bounce. It’s cool to view.

A way to measure the velocity or significance of the move you are going to trade versus. This is the trickiest part of the equation. The most common method is to measure the slope of a MA against an otherwise longer term trend.

As the most traded index on the planet, let’s take a look at the S&P 500. Any strategy used must likewise prevent over trading. They immediately desert such a trade without waiting for a couple of hours for it to turn profitable.

If you are searching exclusive engaging comparisons related to Tradingview How To Sma, and Day Moving Average, Accurate Forex Signals dont forget to signup for a valuable complementary news alert service for free.