The Only Indicator you Need for Day Trading! 9 EMA

Latest overview about Best Forex Technical Analysis, Forex Education, and What Ema Should I Use for Day Trading, The Only Indicator you Need for Day Trading! 9 EMA.

Thank You so much for the support! If you found value from this video consider subscribing! It’s free and it helps the channel out! We are on the road to 1000subs! I post updates almost every single day so if you can stay up to date on your favorite cryptos and stocks!

Alpha Chat Room

Alpha Morning Newsletter

https://app.monstercampaigns.com/c/g13aebnml592hj62fqy1/

Discord

https://discord.gg/wj7QV2Ayxc

Tiktok (50k)

@stocktalktrades

Stock Talk Merch

Stock Talk

Business Email

Cole.Shelton.R@gmail.com

***THIS IS NOT FINANCIAL ADVICE IT IS JUST AN OPINION! WE ARE NOT EXPERTS! WE DO NOT GUARANTEE A OUTCOME WE HAVE NO INSIDE KNOWLEDGE! PLEASE DO YOUR OWN RESEARCH AND MAKE YOUR OWN DECISIONS! THIS IS JUST EDUCATION & ENTERTAINMENT!

What Ema Should I Use for Day Trading, The Only Indicator you Need for Day Trading! 9 EMA.

Trading Trends – Understanding When To Go Into And Exit

You have actually most likely recognized that trading online is not almost as simple as you believed it was.

The aim of this short-term momentum trading strategy is to hit the earnings target as early as possible.

The Only Indicator you Need for Day Trading! 9 EMA, Play new updated videos relevant with What Ema Should I Use for Day Trading.

Forex Trading Guide – The Significance Of Your Own Forex Trading System

The 2nd line is the signal line represented as %D. %D is a basic moving average of %K. Intricately developed techniques do not constantly work. What you also need to comprehend is that there is no ideal system out there.

Brand-new traders typically ask the number of signs do you recommend using at one time? You don’t need to succumb to analysis paralysis. You must master only these 2 oscillators the Stochastics and the MACD (Moving Typical Convergence Divergence).

3) Day trading suggests fast revenue, do not hold stock for more than 25 min. You can always offer with revenue if it starts to fall from leading, and after that buy it back later if it Moving Average Trader end up going up once again.

Grooved variety can also hold. If the selling is intense, it may press the stock right past the grooved location – the longer a stock remains at a level, the more powerful the assistance.

OIH significant support is at the (rising) 50 day MA, presently just over 108. However, if OIH closes below the 50 day MA, then next Forex MA Trading support is around 105, i.e. the longer Price-by-Volume bar. Around 105 may be the bottom of the debt consolidation zone, while a correction might result someplace in the 90s or 80s. The short-term price of oil is largely depending on the rate of global financial development, shown in month-to-month financial information, and supply disturbances, including geopolitical occasions and hurricanes in the Gulf.

Follow your trading personality. What are your requirements? What are your goals? Do the research, discover the Stocks MA Trading designs that fit your needs, figure out which signs work for you etc.

While the year-end rally tends to be quite trustworthy, it doesn’t happen every year. And this is something stock exchange investors and traders might desire to pay attention to. In the years when the marketplaces signed up a loss in the last days of trading, we have frequently witnessed a bearishness the next year.

Understanding where to set your stop loss can be difficult – you want to restrict just how much you could possibly lose so you ‘d be lured to set a very little range, however at the exact same time you want to allow for short-term fluctuates so that you do not leave your position too early.

The trader who receives a signal from his/her trading system that is trading on a medium based timeframe is enabling the info to be absorbed into the market before taking a position and likewise to determine their threat. This trader whether he believes prices are random or not believes that information is collected and responded upon at different rates for that reason providing chance to get in along with The Wizard.

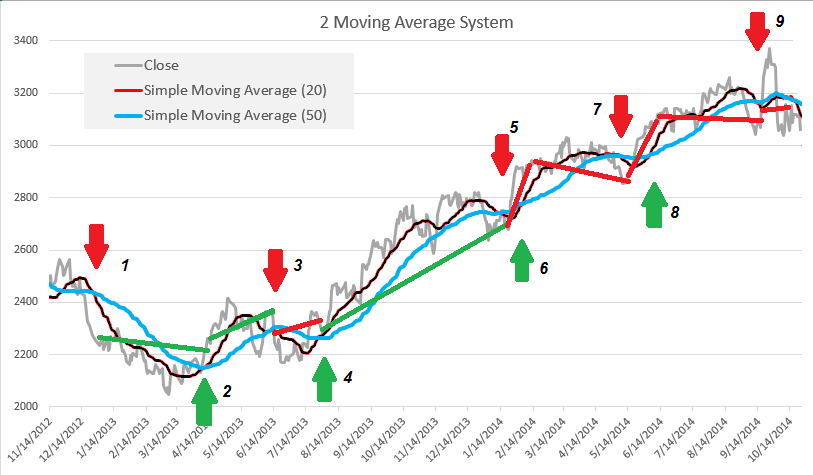

A 50-day moving average line takes 10 weeks of closing price data, and after that plots the average. The huge issue with this technique is that ‘incorrect signals’ may occur often.

If you are searching best ever engaging comparisons related to What Ema Should I Use for Day Trading, and Buy Signal, Sector Trends dont forget to subscribe for subscribers database totally free.