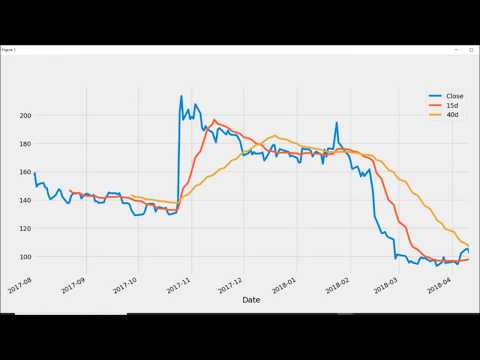

SMA Crossover Strategy in Python Compare Stock Returns and Strategy Returns p.2

Best reviews relevant with Sell Strategy, Trading Tool, Forex Scalping, and What Is Sma In Trading Account, SMA Crossover Strategy in Python Compare Stock Returns and Strategy Returns p.2.

Code Input : http://www.profitaddaweb.com/2018/04/backtest-sma-crossover-strategy-in.html

Open an Online Trading Account to Automate Trading Strategy Visit https://zerodha.com/open-account?c=ZC9000

Subscribe Our YouTube Channel For More Videos : https://www.youtube.com/profitadda

Download our Android App From Google Play Store Please Visit :- https://play.google.com/store/apps/details?id=com.adda.vikash.proda&hl=en

For More Information Please Visit http://www.profitaddaweb.com

For Business or Fresh Queries WhatsApp @ +91-7795780804

For Updates on Telegram Join Our Channel Visit https://t.me/profitaddaweb

Follow us on Facebook :- https://www.facebook.com/profitaddaweb

Follow us on Linkedin :- https://www.linkedin.com/in/profitadda/

What Is Sma In Trading Account, SMA Crossover Strategy in Python Compare Stock Returns and Strategy Returns p.2.

Forex Earnings – Two Easy Indications Anyone Can Use To Improve Trading

Long as the stock holds above that breakout level. It trails the rate action and always lags behind it. They did this by appropriately evaluating the day-to-day price and volume action of the NASDAQ.

SMA Crossover Strategy in Python Compare Stock Returns and Strategy Returns p.2, Search interesting updated videos related to What Is Sma In Trading Account.

Remaining On The Best Side Of The Trend

Just be there in the correct time and with ideal order. To generate income regularly you need to develop a strategy and stay with it. State you wish to trade a per hour basis and you desire to outline an 8 point chart.

The Bollinger Bands were developed by John Bollinger in the late 1980s. Bollinger studied moving averages and try out a new envelope (channel) indication. This study was one of the very first to determine volatility as a dynamic movement. This tool provides a relative meaning of rate highs/lows in regards to upper and lower bands.

The down trend in sugar futures is well established due to the expectations of a big 2013 harvest that need to be led by a record Brazilian harvest. This is news that everybody knows and this fundamental information has actually brought in good traders to the sell side of the market. Technical traders have likewise had an easy go of it considering that what rallies there have been have actually been capped nicely by the 90 day moving average. In reality, the last time the 30-day Moving Average Trader typical crossed under the 90-day moving average remained in August of in 2015. Lastly, technical traders on the brief side have actually collected revenues due to the organized decline of the marketplace so far rather than getting stopped out on any spikes in volatility.

The truth that the BI is assessing such a helpful period implies that it can frequently figure out the predisposition for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears develop their preliminary positions for the day. A relocation far from the BI suggests that a person side is more powerful than the other. A stock moving above the BI implies the prevailing sentiment in the stock is bullish. The manner in which the stock breaks above and trades above the BI will indicate the strength of the bullish belief. The same but opposite analysis applies when a stock moves listed below its BI.

Forex MA Trading She wrote a greater strike rate this time around due to the fact that the pattern appeared to be speeding up and she didn’t want to miss out on out on excessive capital growth if it continued to rally.

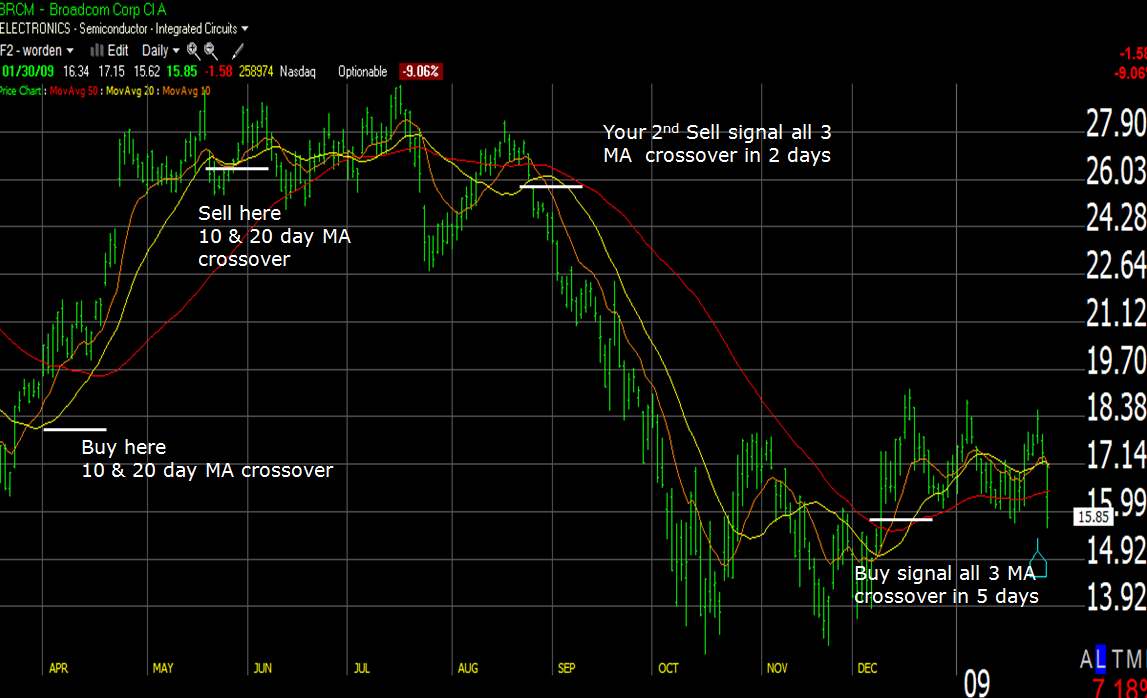

There are numerous strategies and signs to determine the pattern. My favorite ones are the most easy ones. I like to use a moving typical indicator with the big number of averaging durations. Rising Stocks MA Trading indicates the uptrend, falling MA shows the downtrend.

Let’s expect you are in the exact same camp as we are and you believe the long term outlook on gold is very positive. So, each time it dips below a particular worth level, you include more to your portfolio, essentially “purchasing on the dips”. This might be quite various from somebody else who took a look at a roll over as a reason to offer out. Yet, both traders are taking a look at the very same technical levels.

Utilizing the moving averages in your forex trading business would prove to be extremely beneficial. Initially, it is so easy to use. It exists in a chart where all you need to do is to keep an eager eye on the very best entrance and exit points. Thats a sign for you to start purchasing if the MAs are going up. However, if it is decreasing at a continuous rate, then you ought to begin selling. Being able to read the MAs right would surely let you understand where and how you are going to make more money.

To help you determine trends you should also study ‘moving averages’ and ‘swing trading’. For example two fundamental guidelines are ‘don’t buy a stock that is below its 200-day moving average’ and ‘don’t buy a stock if its 5-day moving average is pointing down’. If you do not comprehend what these quotes imply then you need to research study ‘moving averages’. Good luck with your trading.

You require to set really specified set of swing trading guidelines. When you have delighted in share market you should comprehend how it works. You should develop your own system of day trading.

If you are looking most exciting comparisons about What Is Sma In Trading Account, and Forex Beginners – a Simple Scalping Strategy for High Volume Conditions, Successful Trading, Win at Forex dont forget to signup for email list now.