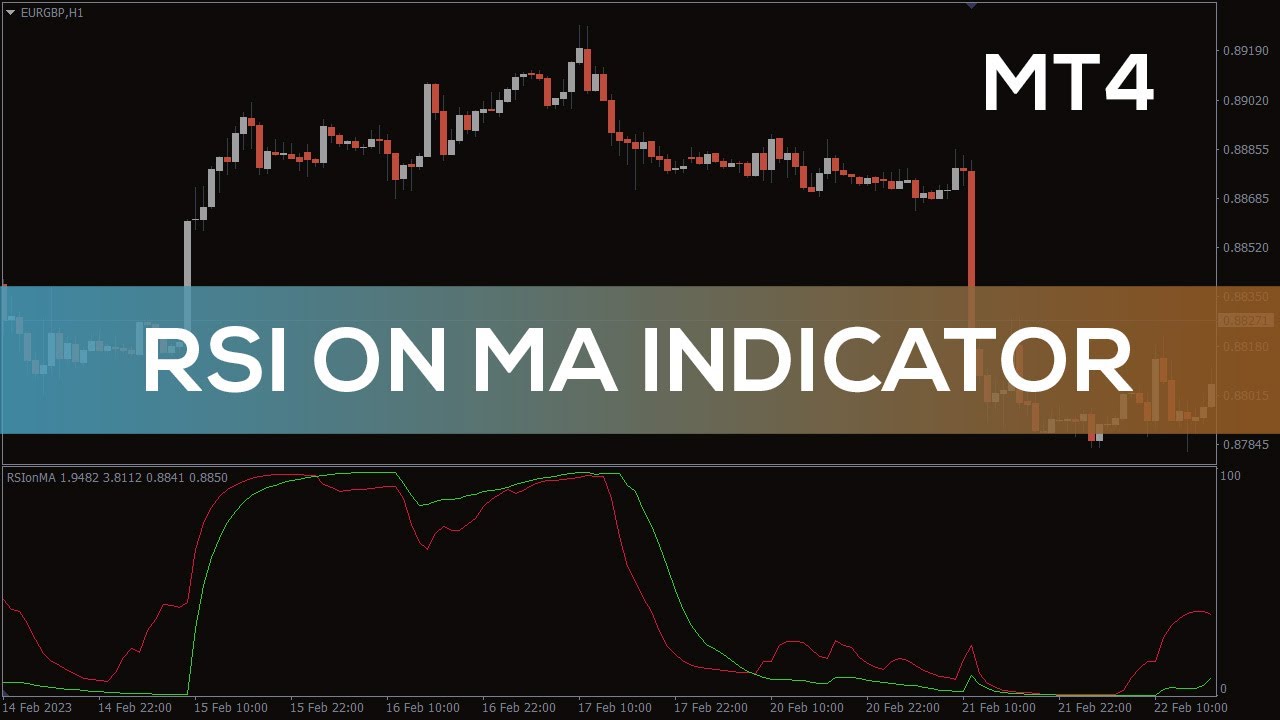

RSI on MA Indicator for MT4 – BEST REVIEW

Popular guide top searched Average Amount, Three Moving Averages, Stock Market Works, What Are the Best Indicators to Use, and Ma Crossover mt4, RSI on MA Indicator for MT4 – BEST REVIEW.

Read more about the FXSSI StopLossClusters Indicator – https://fxssi.com/fxssi-stop-loss-clusters-mt4

FXSSI Sentiment Indicators Pack – https://fxssi.com/

RSI on MA Indicator for MT4 – https://indicatorspot.com/indicator/rsi-on-ma-indicator/ – Download FREE

A technical RSI on MA indicator that detects trend reversals and changes in momentum.

Ma Crossover mt4, RSI on MA Indicator for MT4 – BEST REVIEW.

The Factor Moving Averages Fail

Another forex trader does care too much about getting a return on investment and experiences a loss.

Start by choosing a specific trade that you think is successful, say EUR/USD or GBP/USD.

RSI on MA Indicator for MT4 – BEST REVIEW, Search top replays related to Ma Crossover mt4.

Best Forex Trading System – 5 Proven Ways To Make Simple Money

3) Day trading indicates quick earnings, do not hold stock for more than 25 min. They do not know appropriate trading techniques. This means that you need to understand how to manage the trade before you take an entry.

In my earlier posts, we have learnt indications, chart patterns, finance and other pieces of effective trading. In this short article, let us evaluate those pieces and puzzle them together in order to find conditions we choose for entering a trade.

The downward trend in sugar futures is well established due to the expectations of a big 2013 harvest that ought to be led by a record Brazilian harvest. This is news that everyone understands and this basic information has actually attracted great traders to the sell side of the marketplace. Technical traders have likewise had a simple go of it because what rallies there have actually been have been capped nicely by the 90 day moving average. In truth, the last time the 30-day Moving Average Trader average crossed under the 90-day moving average was in August of in 2015. Finally, technical traders on the short side have actually gathered revenues due to the organized decline of the market hence far instead of getting stopped out on any spikes in volatility.

Nasdaq has actually rallied 310 points in three months, and hit a new four-year high at 2,201 Fri early morning. The economic data suggest market pullbacks will be restricted, although we have actually entered the seasonally weak period of Jul-Aug-Sep after a big run-up. Subsequently, there may be a combination duration rather than a correction over the next couple of months.

The near-term signs on the marketplace have actually damaged on the Dow Jones. The DJIA remained in a bullish trend however it fell below its 20-day average of 11,156. This means that the marketplace might fall if the average can not hold. In addition, the Relative Strength is revealing a loss while the Forex MA Trading is at a moderate sell.

Let us say that we wish to make a brief term trade, in between 1-10 days. Do a screen for Stocks MA Trading in a new up pattern. Raise the chart of the stock you have an interest in and raise the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving average the stock is going to continue up and ought to be purchased. However as quickly as the 9 day crosses over the 4 day it is a sell signal. It is that simple.

Great forex trading and investing involves increasing profits and decreasing probabilities of loss. This is refrained from doing, specifically by newbies in the field. They do not know correct trading methods.

Think about the MA as the very same thing as the cockpit console on your ship. Moving averages can tell you how quick a trend is moving and in what instructions. Nevertheless, you may ask, exactly what is a moving typical sign and how is it computed? The MA is precisely as it sounds. It is approximately a variety of days of the closing price of a currency. Take twenty days of closing costs and determine an average. Next, you will chart the existing rate of the market.

Always be conscious of your emotions and never ever make a trade out of worry or greed. This is harder than it seems. Many amateur traders will take out of a trade based upon what is happening. But I guarantee you this is always bad. To make money consistently you should develop a method and persevere. If this indicates setting stops and targets and leaving the room, so be it! This might be harder to practice than it sounds but unless you get control of your feelings you will never ever be a successful trader.

As a perk, 2 MAs can also work as entry and exit signals. So, when the market is ranging, the finest trading technique is range trading. It can be a 10 day MA, 50 day MA, 100 Day MA or 200 Day MA.

If you are looking more engaging reviews related to Ma Crossover mt4, and Commitment of Traders, Disciplined Trader, Stock Tips you should subscribe for subscribers database totally free.