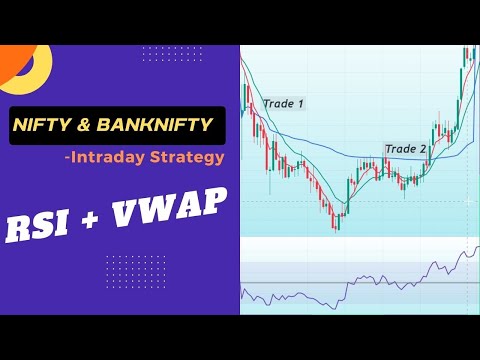

Powerful Intraday Strategy with Proper Entry & Exit ( Nifty & BankNifty ) – VWAP RSI EMA CrossOver

Top complete video related to Forex Beginners – 2 Extremely Popular Indicators and How to Use Them, Forex Investors, Best Forex, Best Forex System, and Best Ma Crossover Settings, Powerful Intraday Strategy with Proper Entry & Exit ( Nifty & BankNifty ) – VWAP RSI EMA CrossOver.

VWAP

* The volume-weighted average price (VWAP) appears as a single line on intraday charts.

* It looks similar to a moving average line, but smoother.

* VWAP represents a view of price action throughout a single day’s trading session.

* Retail and professional traders may use the VWAP to help them determine intraday price trends.

* VWAP typically is most useful to short-term traders.

RSI

The RSI provides technical traders with signals about bullish and bearish price momentum, and it is often plotted beneath the graph of an asset’s price.

Must Watch Videos –

How to Select Stocks For Intraday – https://youtu.be/y9lj6S4wurs

How to trader RSI Divergence – https://youtu.be/Uh0sN-XGMAA

Intraday 5 EMA 20 EMA CrossOver – https://youtu.be/fPchKlBcwQc

3 Minutes Scalping Stratergy – https://youtu.be/nOS8HPvJ6Hg

Telegram : https://t.me/TraderChitra

Facebook : https://www.facebook.com/TraderChitra/

Mobile : 93805 82741

Welcome to Our Channel Trader Chitra

This channel to provide educational videos on Price Action Trading, Stocks, Forex, and Technical Analysis.

Our goal is to provide you all the necessary information related to Stock Market and Share my experience which can help to become Financial Independent. If you want more videos more often please smash the like button, subscribe, and turn on the notifications bell, and share this video across your WhatsApp, Facebook accounts, or Twitter to show your support.

Disclaimer:

Financial trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to trade the financial markets. This YouTube channel is intended for educational purposes only. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this channel. The past performance of any trading system or methodology is not necessarily indicative of future results.

Best Ma Crossover Settings, Powerful Intraday Strategy with Proper Entry & Exit ( Nifty & BankNifty ) – VWAP RSI EMA CrossOver.

How To Quickly Beat The Stock Exchange – Step 1: Follow The Trend

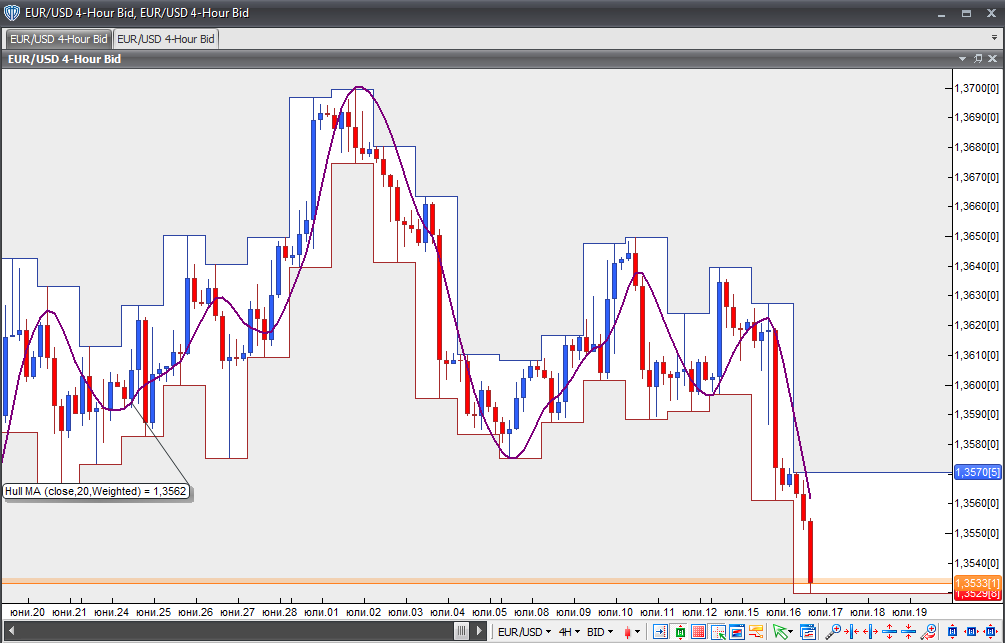

Very first take a look at the last couple of days, then the last few weeks, months and after that year. This tool provides a relative definition of price highs/lows in regards to upper and lower bands.

Powerful Intraday Strategy with Proper Entry & Exit ( Nifty & BankNifty ) – VWAP RSI EMA CrossOver, Play most searched explained videos related to Best Ma Crossover Settings.

The Price Wave – Forecasting With Cycle Analysis

Paul concurred to study tough and to try to overcome his emotions of worry and greed. Another good method to use the sideways market is to take scalping trades. Also active trading can impact your tax rates.

Everybody wishes to discover currency trading, or so it seems from the number of people being drawn into the foreign currency, or forex, craze. However, just like the majority of things, there’s a right way and an incorrect method. And properly has three crucial ingredients.

The DJIA needs to stay its 20-day Moving Average Trader typical if it is going to be feasible. The DJIA needs to get there or else it might go down to 11,000. A rebound can lead to a pivot point more detailed to 11,234.

Leave your trade once the trend is broken! Cut your losses, and let the long trips make up for these little losses. Once the pattern has actually been restored, you can re-enter your trade.

Presuming you did not see any news, you need to put down a Forex MA Trading trade positioning design. For example, if you see that the major pattern is headed up, search for buy signal produced from FX indications, and do not even trade to offer at this duration. This also applies when you see that the major pattern is down, then you understand it is time to purchase.

Taking the high, low, open and close worths of the previous day’s cost action, tactical levels can be identified which Stocks MA Trading or may not have an impact on price action. Pivot point trading puts emphasis on these levels, and uses them to guide entry and exit points for trades.

While the year-end rally tends to be rather reliable, it does not happen every year. And this is something stock exchange financiers and traders might want to take notice of. In the years when the marketplaces signed up a loss in the last days of trading, we have actually frequently seen a bear market the next year.

Stochastics sign has got 2 lines called %K and %D. Both these lines are plotted on the horizontal axis for a provided period. The vertical axis is plotted on a scale from 0% to 100%.

At the day level there are periods likewise that the rate does not largely and periods that the cost change mostly. The risky time durations are when London stock opens ad when USA stock opens. Likewise there are big changes when Berlin stock opens. After every one opens, there are typically large modifications in the rates for a male hours. The most risky time periods is the time at which 2 stocks are overlapped in time.

We do not even put our hopes in the stock we just offered. However as soon as the 9 day crosses over the 4 day it is a sell signal. Buy-and-hold state the advisors who make money from your financial investment purchases though commissions.

If you are finding updated and exciting reviews related to Best Ma Crossover Settings, and Exponential Moving Average Forex Indicator, Bull Market, Make Money in the Market please join for email list now.