20 EMA Trading Strategy (Improved) | Best Intraday Trading Strategy for Bank Nifty @udaymehra

Latest reviews highly rated Forex Trading Softwa, Stock Analysis, Chinese Markets, and What Is Ema Trading, 20 EMA Trading Strategy (Improved) | Best Intraday Trading Strategy for Bank Nifty @udaymehra.

PLATINUM MEMBERSHIP- 🔥

Use below payment link to pay for platinum

https://web.fankonnect.com/g/912

My Mobile App Download Details Below 👇 –

For android: https://play.google.com/store/apps/details?id=co.white.mzewr

or SEARCH ‘nifty prediction uday mehra’

For Apple ios users: https://apps.apple.com/in/app/myinstitute/id1472483563

or Download “My Institute” App and enter org code: mzewr

For web access, in your browser go to

‘https://web.classplusapp.com/login’ & enter code: mzewr followed by your details

#udaymehra #stockmarket #nifty #banknifty

TELEGRAM- https://t.me/udaymehraofficial

My origional telegram link

Or search on telegram “uday mehra 7801886205”

Stay away from all fake channels

Fyers Link to open Demat account

https://open-account.fyers.in/?utm-source=AP-Leads&utm-medium=AP0540

https://paytmmoney.onelink.me/9L59/5bkf6za1

Paytm money Account opening link

TO LEARN STOCK MARKET FROM ME CONTACT ME ON 7801886205 or 7359998456

#stockmarketforbeginners

#sharemarketbasicsforbeginners

#intradaytradingstrategies

#stockmarket

#sharemarket

#intradaytrading

#trading

#intradaytradingforbeginners

#optionstrading

#howtoinvestinsharemarket

#optiontradingstrategies

#bankniftyoptiontradingstrategy

#priceactiontradingstrategies

#swingtrading

#intradaytradingtips

#nifty

#optiontradingforbeginners

#niftyprediction

TOPICS COVERED-

I bring you the most effective and improved Intraday Trading Strategy for Bank Nifty using the 20 Exponential Moving Average (EMA).

Understanding the 20 EMA: We’ll begin with a brief explanation of the 20 Exponential Moving Average and its significance in the context of Bank Nifty intraday trading. You’ll learn how to interpret the EMA to identify trends and potential trade opportunities accurately.

Setting Up Your Trading Platform: We’ll walk you through the process of configuring your trading platform to effectively display the 20 EMA on Bank Nifty charts. Having the right setup is crucial for successful implementation of the strategy.

Identifying Entry and Exit Points: We’ll reveal our proven techniques to spot entry and exit points based on the 20 EMA crossovers and price action. You’ll discover how to avoid false signals and stay focused on high-probability trades.

Risk Management Strategies: Trading involves risk, and we’ll emphasize the importance of managing it effectively. Learn how to set stop-loss levels and position sizing to protect your capital while allowing room for profitable trades to flourish.

Real-Life Trade Examples: To reinforce your understanding, we’ll share real-life trade examples, showing you how the 20 EMA strategy works in actual market conditions. Witness the strategy in action and witness the potential profits it can generate.

Backtesting and Practice: Before implementing any strategy, it’s essential to test it thoroughly. We’ll guide you through backtesting the 20 EMA strategy on historical data and provide tips on how to practice in a risk-free environment.

Remember, successful trading requires discipline, patience, and continuous learning. Our goal is to equip you with the knowledge and tools needed to become a confident and consistent trader in the competitive world of Bank Nifty intraday trading.

Whether you’re a day trader, swing trader, or investor, understanding the 20 EMA Trading Strategy can significantly enhance your trading prowess.

SOME IMPORTANT VIDEO LINKS-

20 EMA Trading Strategy

How to use VWAP

https://youtu.be/FKbKz2LbuvQ

Dow theory special video

Reading candlesticks

Basics of trading and money management free Webinar

https://youtu.be/VGPru0AT-4k

20 EMA Trading Strategy

All about Hedging

Why your analysis go wrong, correct way to do

https://youtu.be/EwSHu3lHpL4

Live trading & learning

https://youtu.be/-bYPj4YjzOo

Welcome to my channel, i am Uday Mehra.

On this channel i post share market analysis video for NIFTY50 , Bank nifty & various stocks. Also i post videos for learning with all practical knowledge i have so that you can learn how to invest and trade in stock market and also you can learn technical analysis basics if you watch all my videos.

DISCLAIMER-

This video is for learning purpose only and their are no buy or sell trade and investment recommendations here. Me and my channel will not be responsible for any profit or loss. Consult your financial advisor before any investment or trade.

I am not a SEBI registered advisor.

Thanks for watching, i hope you liked the video and you can comment your views or any doubts and i will definitely awnser.

Thanks

What Is Ema Trading, 20 EMA Trading Strategy (Improved) | Best Intraday Trading Strategy for Bank Nifty @udaymehra.

More Revenue From Your Trading System

In a varying market, heavy losses will happen. Lots of traders lack the perseverance to see their trade become an earnings after a couple of hours or more. Chart: A chart is a chart of cost over a time period.

20 EMA Trading Strategy (Improved) | Best Intraday Trading Strategy for Bank Nifty @udaymehra, Find popular high definition online streaming videos related to What Is Ema Trading.

What’s The Very Best Day Trading Strategy?

The strongest signal is where the present price goes through both the SMAs at a steep angle. On April 28, the gold-silver ratio had to do with 30, relatively low. I have been trading futures, choices and equities for around 23 years.

You should understand how to chart them if you trade stocks. Some individuals search through charts to find buy or offer signals. I find this inefficient of a stock traders time. You can and require to chart all types of stocks consisting of cent stocks. When to offer or purchase, charting informs you where you are on a stocks price pattern this implies it informs you. There are a lot of excellent business out there, you don’t wish to get captured buying them at their 52 week high and needing to linger while you hope the cost comes back to the price you paid.

When a stock moves in between the assistance level and the resistance level it is stated to be in a pattern and you need to buy it when it reaches the bottom of the Moving Average Trader trend and sell it when it reaches the top. Typically you will be looking for a short-term earnings of around 8-10%. You make 10% earnings and you sell up and go out. You then search for another stock in a similar pattern or you wait on your original stock to fall back to its support level and you buy it back once again.

So this system trading at $1000 per trade has a positive span of $5 per trade when traded over numerous trades. The profit of $5 is 0.5% of the $1000 that is at danger throughout the trade.

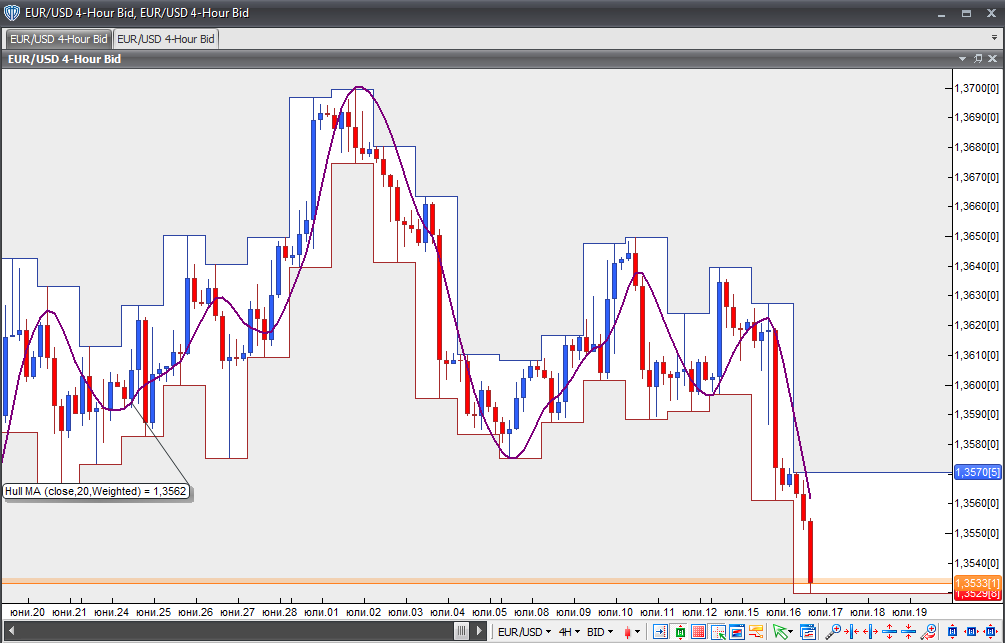

The chart below is a Nasdaq weekly chart. Nasdaq has actually been developing an increasing wedge for about two years. The Forex MA Trading indication has been moving in the opposite direction of the price chart (i.e. unfavorable divergence). The 3 highs in the wedge fit well. However, it’s unpredictable if the third low will also offer a good fit. The wedge is compressing, which must continue to generate volatility. Numerous intermediate-term technical signs, e.g. NYSE Summation Index, NYSE Oscillator MAs, CBOE Put/Call, and so on, suggest the marketplace will be greater at some point within the next couple of months.

Follow your trading personality. What are your requirements? What are your goals? Do the research, discover the Stocks MA Trading designs that fit your requirements, find out which signs work for you and so on.

For each time an article has actually been e-mailed, award it three points. An e-mailed post suggests you have at least strike the interest nerve of some member of your target audience. It might not have been a publisher so the classification isn’t as important as the EzinePublisher link, but it is better than a basic page view, which doesn’t necessarily suggest that somebody read the whole article.

The 2nd action is the “Ready” step. In this step, you may increase your money and gold allowances further. You may also start to move cash into bear ETFs. These funds increase when the market decreases. Funds to consider consist of SH, the inverse of the S&P 500, DOG, the inverse of the Dow Jones Industrial average, and PSQ, the inverse of the NASDAQ index.

There you have the two most vital lessons in Bollinger Bands. The HIG pattern I call riding the wave, and the CIT pattern I call fish lips. Riding the wave can normally be done longer approximately two months, using stops along the way, one does not even really need to see it, obviously one can as they ca-ching in one those safe earnings. The other pattern is fish lips, they are typically held for less than a month, and are exited upon upper band touches, or mare exactly retreats from upper band touches. When the rate touches the upper band and then retreats), (. Fish lips that re formed out of a flat pattern can typically develop into ‘riding the wave,’ and then are held longer.

Nasdaq has been producing an increasing wedge for about two years. They do not know appropriate trading strategies. Now that you’ve tallied the points, what does it indicate? It routes the cost action and always lags behind it.

If you are looking instant exciting comparisons relevant with What Is Ema Trading, and Trading Time, Stock Trading Tip, How to Make Money in Stocks dont forget to list your email address for a valuable complementary news alert service totally free.