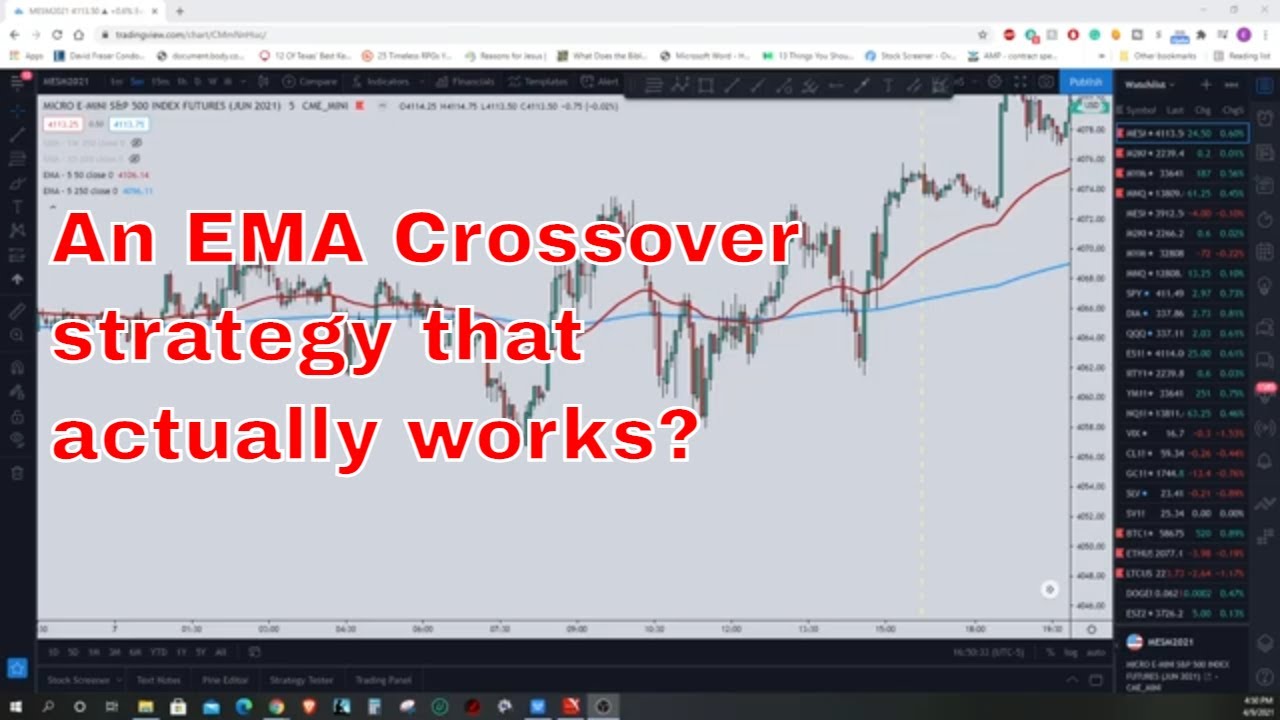

Moving Average Crossover Trading Strategy Using Fibonacci Levels

Top overview top searched Trading Info, Bear Market, Learning Forex, Frequent Trading, and Ma Crossover Strategy, Moving Average Crossover Trading Strategy Using Fibonacci Levels.

In this video, I cover how I trade when I use the EMA Crossover Trading strategy. In most cases, people tell you to go immediately …

Ma Crossover Strategy, Moving Average Crossover Trading Strategy Using Fibonacci Levels.

Financiers Check Out Technical Analysis

In a varying market, heavy losses will take place. Many traders do not have the perseverance to enjoy their trade develop into a revenue after a few hours or more. Chart: A chart is a graph of rate over a duration of time.

Moving Average Crossover Trading Strategy Using Fibonacci Levels, Get most searched full length videos about Ma Crossover Strategy.

What It Takes To Be A Day Trading Expert

You simply need to have persistence and discipline. You should establish your own system of day trading. The bulk of third quarter incomes were reported over the previous two weeks. The other days SMA was approximately the price points 1 – 8.

In my earlier articles, we have actually learnt signs, chart patterns, finance and other pieces of successful trading. In this short article, let us evaluate those pieces and puzzle them together in order to discover conditions we choose for getting in a trade.

When a stock relocations between the assistance level and the resistance level it is stated to be in a pattern and you need to purchase it when it reaches the bottom of the Moving Average Trader pattern and sell it when it reaches the top. Usually you will be trying to find a short-term revenue of around 8-10%. You make 10% profit and you sell up and get out. You then search for another stock in a comparable trend or you await your initial stock to fall back to its assistance level and you buy it back once again.

Accomplishing success in currency trading includes a high level of discipline. It can not be treated as a side organization. It not only needs knowledge about the patterns but likewise about the instructions the trends will move. There are many software application available to understand the trend and follow a system however in fact to attain success in currency trading a trader need to construct their own system for trading and above all to follow it religiously.

Choosing a timespan: If your day trading, purchasing and selling intra day, a 3 year chart will not assist you. For intra day trading you want to use 3,5 and 15 minute charts. Depending upon your longterm investment technique you can look at a 1 year, which I utilize most frequently to a ten years chart. The annual chart offer me an appearance at how the stock is doing now in today’s market. I’ll look longer for historic assistance and resistance points but will Forex MA Trading my buys and sells based upon what I see in front of me in the annual.

Can we purchase before the share price reaches the breakout point? In numerous instances we can, but ONLY if the volume increases. Often you will have a high opening rate, followed by a fast retracement. This will often be followed by a fast upsurge with high volume. This can be a buy signal, once again, we should Stocks MA Trading sure that the volume is strong.

The advantage of a frequent trading method is that if it is a successful trading strategy, it will have a higher return the more times it trades, using a lower utilize. This is mentioning the obvious, but it is typically overlooked when picking a trading strategy. The goal is to make more revenue utilizing the least amount of leverage or threat.

It has been quite a couple of weeks of drawback volatility. The cost has dropped some $70 from the peak of the last run to $990. The green line illustrates the significant fight area for $1,000. While it is $990 rather of $1,000 it does represent that turning point. For that reason we have actually had our 2nd test of the $1,000 according to this chart.

The general guideline in trading with the Stochastics is that when the reading is above 80%, it implies that the marketplace is overbought and is ripe for a downward correction. Likewise when the reading is below 20%, it means that the market is oversold and is going to bounce down quickly!

In a ranging market, heavy losses will happen. Lots of stocks, particularly tech stocks, fell greatly on above average revenues and assistance. 2 bottom lines must be considered for successful trading.

If you are finding unique and entertaining videos about Ma Crossover Strategy, and Forex Tra, Knowing When to Buy and Sell Stocks, Trading Plan, Stock Trading you are requested to signup our email list for free.