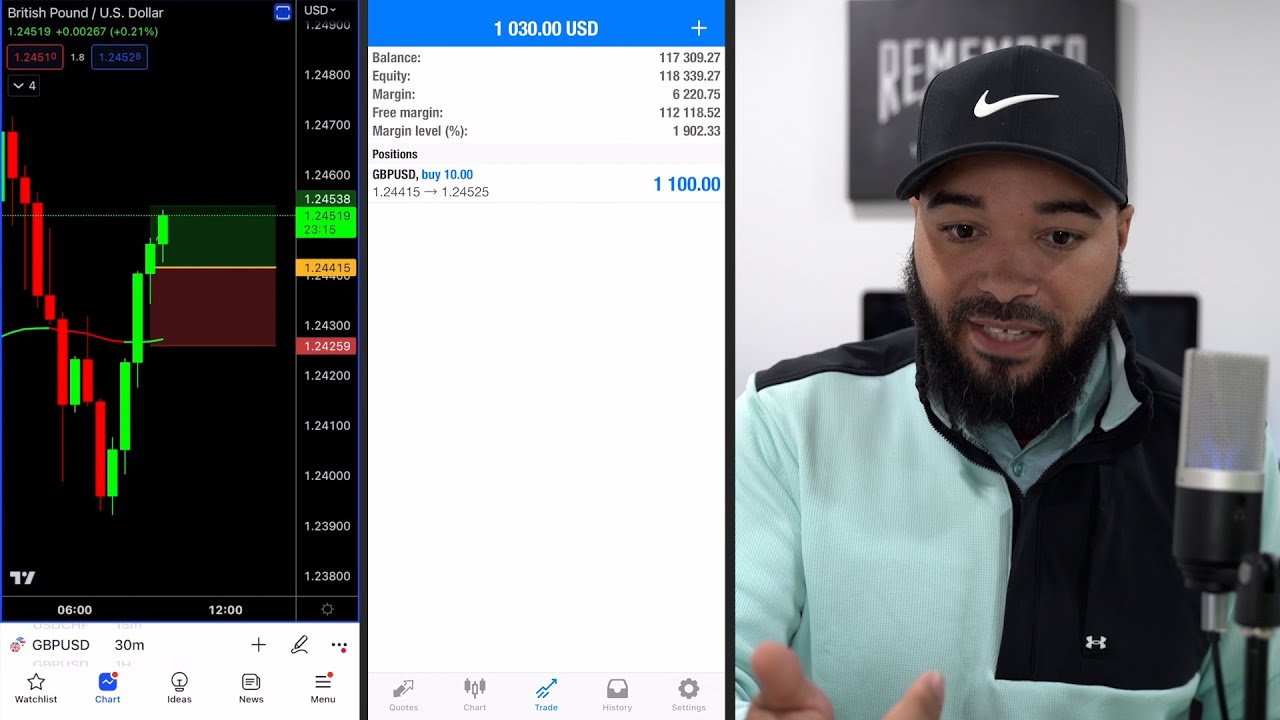

LIVE Trading My 50-SMA Strategy #forex @JayTakeProfits

Best high defination online streaming relevant with Sector Trends, Auto Forex Trading, Forex Trading School, and What Sma Stand For In Trading, LIVE Trading My 50-SMA Strategy #forex @JayTakeProfits.

Get MENTORSHIP by Me https://www.youtube.com/channel/UCNwhUcKPKqSRm7rt8RHXbBQ/join I’m NOT on WHATS APP I’m …

What Sma Stand For In Trading, LIVE Trading My 50-SMA Strategy #forex @JayTakeProfits.

Forex Scalping Trading Systems

You need to always secure your trades with a stop loss. Did you acquire cash in the recent stock bull-run began considering that March of 2009? A Forex trading technique needs 3 main standard bands.

LIVE Trading My 50-SMA Strategy #forex @JayTakeProfits, Find popular high definition online streaming videos relevant with What Sma Stand For In Trading.

One Strategy That Can Bring You Trading Losses

A common forex rate chart can look extremely irregular and forex candlesticks can obscure the pattern further. Those 3 things are the foundation for an excellent trading system. Make certain you end up being one of that minority.

The Bollinger Bands were developed by John Bollinger in the late 1980s. Bollinger studied moving averages and explore a new envelope (channel) sign. This research study was one of the very first to determine volatility as a dynamic movement. This tool supplies a relative meaning of price highs/lows in terms of upper and lower bands.

When a stock moves in between the support level and the resistance level it is stated to be in a trend and you need to buy it when it reaches the bottom of the Moving Average Trader pattern and offer it when it arrives. Usually you will be looking for a short-term revenue of around 8-10%. You make 10% revenue and you sell up and go out. You then try to find another stock in a similar trend or you wait on your original stock to fall back to its support level and you buy it back once again.

Nasdaq has rallied 310 points in 3 months, and hit a brand-new four-year high at 2,201 Fri morning. The economic information suggest market pullbacks will be limited, although we have actually entered the seasonally weak period of Jul-Aug-Sep after a huge run-up. Subsequently, there might be a consolidation period instead of a correction over the next couple of months.

Now when we utilize 3 MAs, the moving average with the least number of durations is identified as fast while the other two are identified as medium and sluggish. So, these three Forex MA Trading can be 5, 10 and 15. The 5 being fast, 10 medium and 15 the sluggish.

Follow your trading character. What are your requirements? What are your objectives? Do the research study, discover the Stocks MA Trading styles that fit your needs, find out which indicators work for you etc.

The benefit of a frequent trading strategy is that if it is a profitable trading method, it will have a greater return the more times it trades, utilizing a lower leverage. This is specifying the obvious, however it is often neglected when selecting a trading technique. The objective is to make more profit utilizing the least quantity of take advantage of or risk.

Since it does not enable for any form of confirmation that the stock’s break above the resistance level will continue, entering the market at this phase is the most aggressive approach. Maybe this strategy ought to be booked for the most promising stocks. Nevertheless it has the benefit of providing, in many scenarios, the cheapest entry point.

Always know your emotions and never ever make a trade out of fear or greed. This is harder than it appears. Most amateur traders will pull out of a trade based upon what is happening. However I guarantee you this is always bad. To make money regularly you need to develop a method and stick with it. So be it if this means setting targets and stops and leaving the space! This might be more difficult to practice than it sounds however unless you get control of your feelings you will never ever be a successful trader.

The gain each day was just 130 pips and the highest loss was a drop of over 170 points. Once the trend is broken, get out of your trade! Cut your losses, and let the long trips offset these little losses.

If you are finding updated and engaging videos about What Sma Stand For In Trading, and Online Day Trading, Stock Trading Tips, Successful Forex Trading dont forget to signup our subscribers database for free.