SMA vs EMA: A Comprehensive Comparison – Strengths and Weaknesses

Trending vids highly rated Forex Trading Software Online, Beginner Trading, 50-Day Moving Average, Forex Website, and Is Ema Better Than Sma, SMA vs EMA: A Comprehensive Comparison – Strengths and Weaknesses.

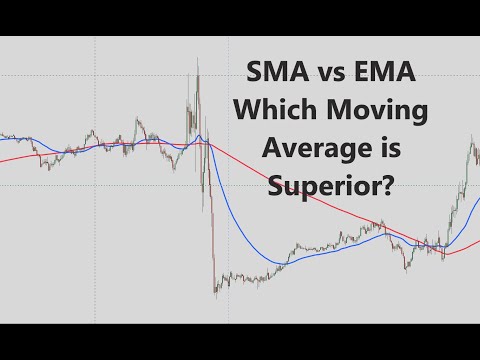

In this video, I cover the strengths and weaknesses between the SMA and EMA. I also cover the most popular trading strategy used with moving averages, the Golden Cross Strategy.

This video goes with this article I wrote: https://evancarthey.com/sma-vs-ema-a-comprehensive-comparison-strengths-and-weaknesses/

Here is the other Moving Average video I mentioned in this video:

When it comes to analyzing financial data, moving averages are one of the most popular tools used by traders. They help to smooth out price fluctuations and identify trends, making it easier to make informed trading decisions. Two of the most commonly used types of moving averages are the simple moving average (SMA) and the exponential moving average (EMA). The SMA vs EMA will be the focus of this article.

The main difference between the two types of moving averages is the way they are calculated. The SMA is calculated by taking the average of a set number of prices over a specific period of time. For example, a 50-day SMA would take the average of the closing prices for the past 50 days. The EMA, on the other hand, gives more weight to recent prices, making it more responsive to changes in the market. This means that the EMA may be more useful for short-term trading, while the SMA may be better suited for longer-term analysis.

While both types of moving averages have their strengths and weaknesses, the choice between the two ultimately depends on the trader’s individual goals and preferences. The SMA is a popular choice for traders who prefer a simple and straightforward approach to analyzing the market. It can be useful for identifying long-term trends and can be less prone to false signals. However, the EMA may be better suited for traders who want to be more responsive to short-term changes in the market. It can be more sensitive to price fluctuations and can help traders identify potential trading opportunities more quickly.

Is Ema Better Than Sma, SMA vs EMA: A Comprehensive Comparison – Strengths and Weaknesses.

Number 1 Loser Indication – Why Trading Moving Averages Fail

A 50-day moving average line takes 10 weeks of closing rate data, and after that plots the average.

However, similar to many things, there’s an incorrect method and a best method.

SMA vs EMA: A Comprehensive Comparison – Strengths and Weaknesses, Find popular updated videos related to Is Ema Better Than Sma.

How To Create Positive Returns Monthly With Forex Trading System?

You simply need to have perseverance and discipline. You should establish your own system of day trading. The bulk of third quarter profits were reported over the previous two weeks. The other days SMA was an average of the cost points 1 – 8.

New traders typically ask how lots of signs do you recommend utilizing at one time? You don’t require to come down with analysis paralysis. You should master just these 2 oscillators the Stochastics and the MACD (Moving Average Convergence Divergence).

Out of all the stock trading suggestions that I have actually been provided over the ears, bone assisted me on a more useful level than these. Moving Average Trader Utilize them and utilize them well.

Peter cautioned him nevertheless, “Remember Paul, not all trades are this simple and end up also, however by trading these kinds of trends on the everyday chart, when the weekly trend is likewise in the very same direction, we have a high possibility of a lucrative result in a big portion of cases.

OIH significant support is at the (increasing) 50 day MA, currently just over 108. However, if OIH closes listed below the 50 day MA, then next Forex MA Trading support is around 105, i.e. the longer Price-by-Volume bar. Around 105 may be the bottom of the consolidation zone, while a correction might result someplace in the 90s or 80s. The short-term price of oil is mostly based on the rate of global economic development, shown in regular monthly economic information, and supply disturbances, including geopolitical occasions and cyclones in the Gulf.

The online Stocks MA Trading platforms provide a great deal of innovative trading tools as the Bolling Bands indicator and the Stochastics. The Bolling Bands is consisting of a moving typical line, the upper standard and lower basic variance. The most utilized moving average is the 21-bar.

The very best way to generate income is purchasing and selling breakouts. , if you integrate them in your forex trading technique you can utilize them to stack up huge gains..

To enter a trade on a Pattern Turnaround, he requires a Trendline break, a Moving Typical crossover, and a swing higher or lower to ready in an uptrend, and a trendline break, a Moving Average crossover and a lower swing low and lower swing high to get in a downtrend.

In this post is illustrated how to trade in a trendy and fading market. This short article has only detailed one method for each market scenario. It is suggested traders utilize more than one strategy when they trade Forex online.

You can and require to chart all kinds of stocks including cent stocks. Trading forex with indications has to do with choosing the most likely trades to profit. But how do you identify whether the pattern is real strong or not?

If you are looking most exciting videos related to Is Ema Better Than Sma, and Trading Days, Buy Weakness please list your email address for subscribers database totally free.