I Tested THIS Simple EMA Crossover Strategy For 100 TRADES.. Here's What I Found

Top videos highly rated Days Moving Average, Simple Moving Average Forex, Market Indicators, Term Trend, and Ema Trading Explained, I Tested THIS Simple EMA Crossover Strategy For 100 TRADES.. Here's What I Found.

In this video, I backtested a simple 10/20 ema crossover strategy (that many beginner traders tend to use) in order to find out if it really works.. the results were quite interesting😅

Reminder of some of the rules:

1. I’m testing this all on EURUSD

2. I’m only using the 15 minute timeframe

3. The data is from August 1st, 2021 and onwards

4. I’m only using the 10 & 20 ema

5. I’m entering one trade at a time

6. Stoplosses are placed 0.5-1 pips past the most recent highs or lows

7. The risk is 1% per trade with a $1000 starting balance

8. The risk to reward ratio is a 1 to 2 (TP is double compared to the SL)

9. I’m only entering a buy or sell after the next 15 minute candle opens, once the emas crossover

10. 100 trades are being tested in total

📈 Live Sessions & Trading Guidance: https://upgrade.chat/mattfxs

📲 Public Telegram: https://t.me/fxs_trading

Follow Me On:

☑️TikTok: https://vm.tiktok.com/ZM8Lrn6bv/

☑️Instagram: https://instagram.com/fxstrading

☑️Twitter: https://twitter.com/matt_fxs

📩Contact: matt@fxstrading.com

Music: ‘Feels Like Winning’ by StreamBeats

****************************************************************************************************

DISCLAIMER: This video is not financial advice, it’s for educational and entertainment purposes only. The information provided is simply based on my own personal opinion or knowledge. I’m not a licensed financial advisor so be sure to speak with your own financial advisor, and to do your own research. Any links provided help support the channel, where I may receive a commission at no additional cost to you. Also, trading or investing carries a large amount of risks with the real potential of losses. Past performances due not guarantee future results. Be careful.⚠️

Ema Trading Explained, I Tested THIS Simple EMA Crossover Strategy For 100 TRADES.. Here's What I Found.

5 Questions For A Winning Trading System

That setup might not occur for XYZ during the rest of the year. Palladium looks to be holding while platinum is anybody’s guess at this point. Naturally, these moving averages are utilized as vibrant assistance and resistance levels.

I Tested THIS Simple EMA Crossover Strategy For 100 TRADES.. Here's What I Found, Search interesting videos relevant with Ema Trading Explained.

Investing & Online Stock Trading – Bear Market Review 1 Year On

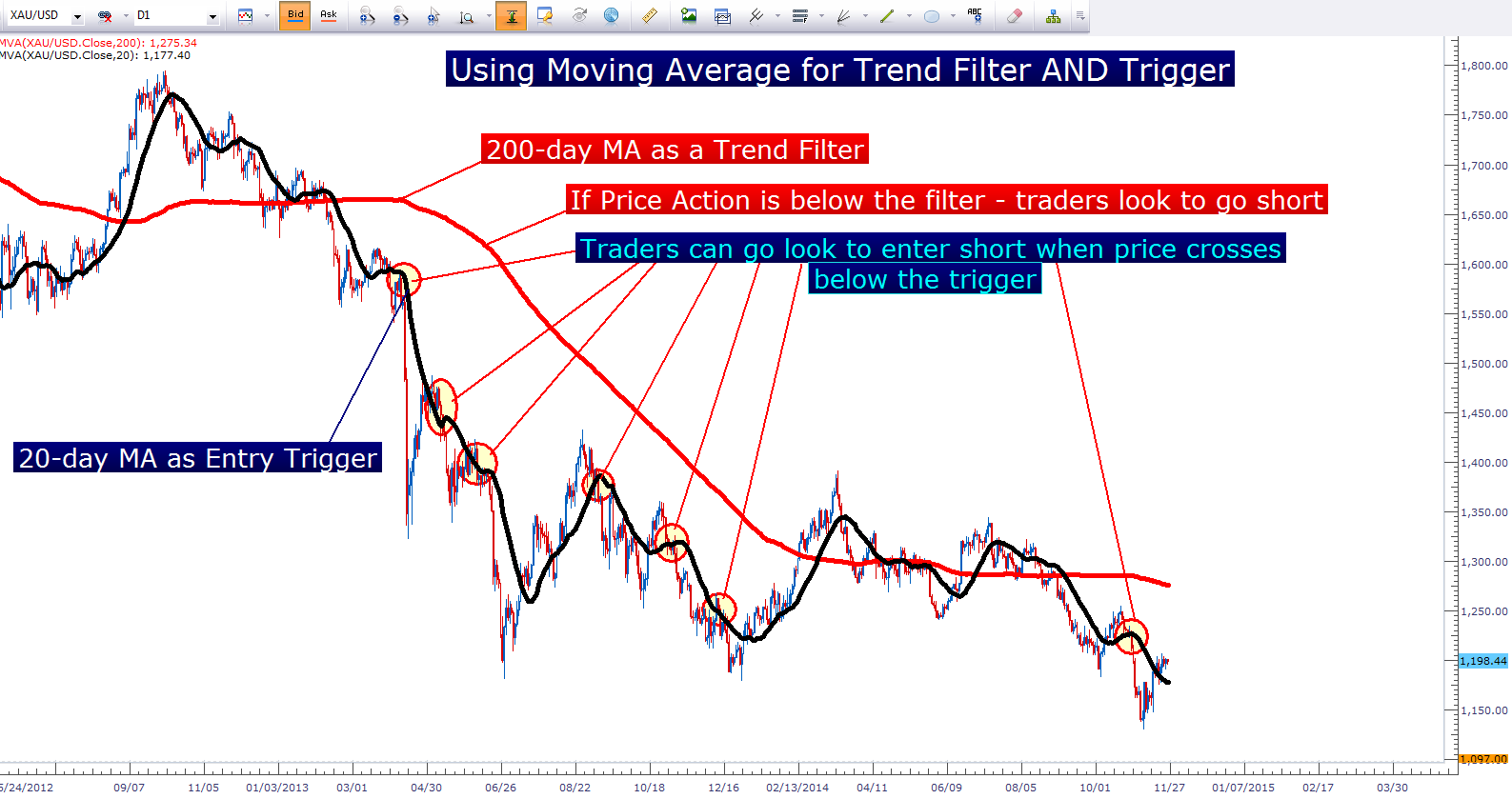

A common forex rate chart can look really irregular and forex candlesticks can obscure the pattern even more. Now, another thing that you should have observed is that all these MAs are the average of past rates.

A ‘moving’ average (MA) is the typical closing price of a specific stock (or index) over the last ‘X’ days. For example, if a stock closed at $21 on Tuesday, at $25 on Wednesday, and at $28 on Thursday, its 3-day MA would be $24.66 (the sum of $21, $25, and $28, divided by 3 days).

This environment would indicate that the currency set’s price is trending up or down and breaking out of its present trading range. This normally happens when there are modifications affecting the currency’s nation. A quick trending day can be seen when the rate of the currency set increases below or above the 21 Exponential Moving Average and after that going back to it. A Moving Average Trader needs to study the basics of the nation before deciding how to trade next.

The most basic application of the BI concept is that when a stock is trading above its Predisposition Indication you should have a bullish predisposition, and when it is trading below its Predisposition Sign you need to have a bearish bias.

The truth that the BI is assessing such a helpful duration implies that it can frequently determine the predisposition for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears develop their preliminary positions for the day. A relocation away from the BI shows that one side is stronger than the other. A stock moving above the BI implies the prevailing belief in the stock is bullish. The Forex MA Trading in which the stock breaks above and trades above the BI will suggest the strength of the bullish belief. When a stock moves below its BI, the same but opposite analysis uses.

Follow your trading character. What are your requirements? What are your objectives? Do the research, find the Stocks MA Trading styles that fit your needs, find out which indications work for you etc.

If you make 4 or more day trades in a rolling five-trading-day duration, you will be considered a pattern day trader no matter you have $25,000 or not. A day trading minimum equity call will be provided on your account needing you to deposit additional funds or securities if your account equity falls listed below $25,000.

For these kind of traders short term momentum trading is the very best forex trading strategy. The goal of this short-term momentum trading method is to hit the profit target as early as possible. When the momentum is on your side, this is achieved by going into the market long or short.

In this article is illustrated how to trade in a fashionable and fading market. This short article has just detailed one technique for each market situation. When they trade Forex online, it is advised traders utilize more than one method.

The gain per day was just 130 pips and the highest loss was a drop of over 170 points. There are an excellent range of forex indicators based on the moving average (MA). Elaborately developed techniques do not always work.

If you are looking instant entertaining comparisons about Ema Trading Explained, and How to Trade Trends, Towards Successful Trading, Online Day Trading, How to Read Stock Charts please subscribe our email list totally free.