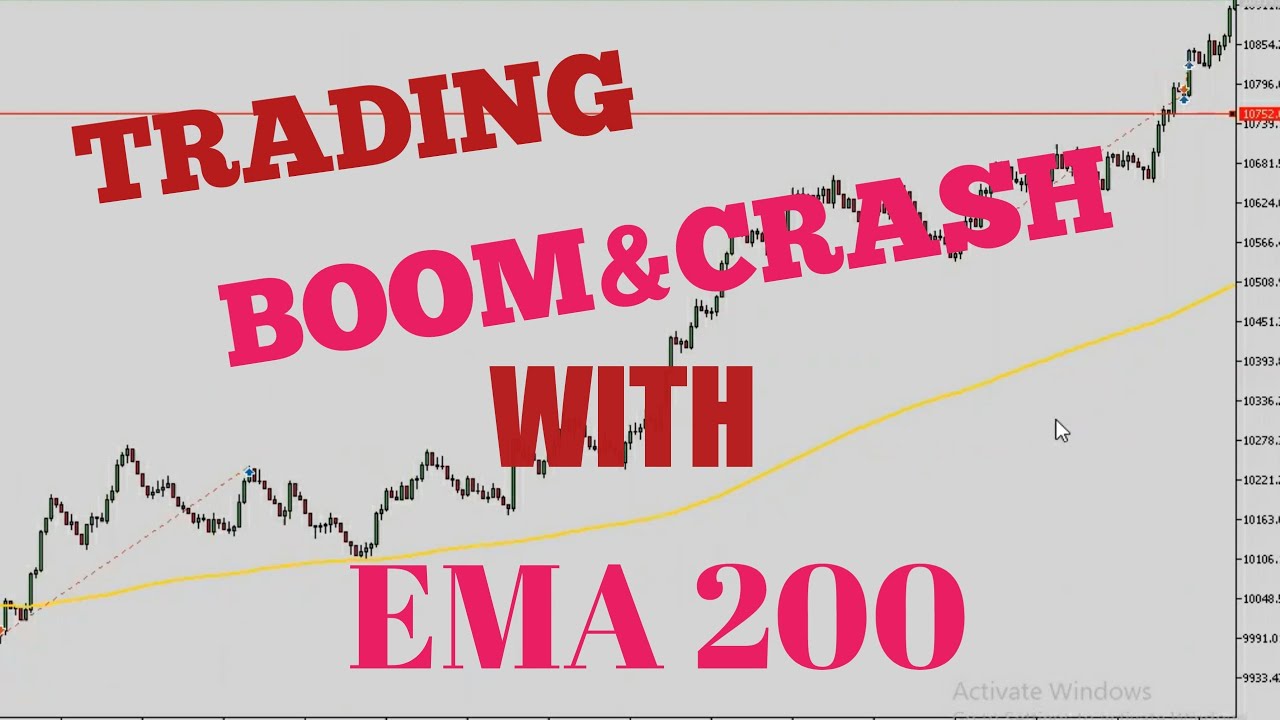

How To Trade Boom And Crash With EMA 200

Top reviews highly rated Trading System, Trend Indicator, Forex Trading Ideas, and How to Trade 200 Ema, How To Trade Boom And Crash With EMA 200.

In this video, we show you how to trade #Boom and #Crash using the exponential moving average 200. Its super easy and simple. Kindly watch the video to the end and follow the instructions.

#Deriv #Binary #V75

How to Trade 200 Ema, How To Trade Boom And Crash With EMA 200.

Investors Check Out Technical Analysis

Naturally, these moving averages are used as vibrant assistance and resistance levels. Elaborately developed strategies do not always work. Let’s begin with a system that has a 50% chance of winning.

How To Trade Boom And Crash With EMA 200, Explore interesting updated videos related to How to Trade 200 Ema.

What It Requires A Day Trading Expert

The first point is the method to be followed while the second pint is the trading time. You’ve most likely lost a lot of trades and even lost a great deal of money with bad trades.

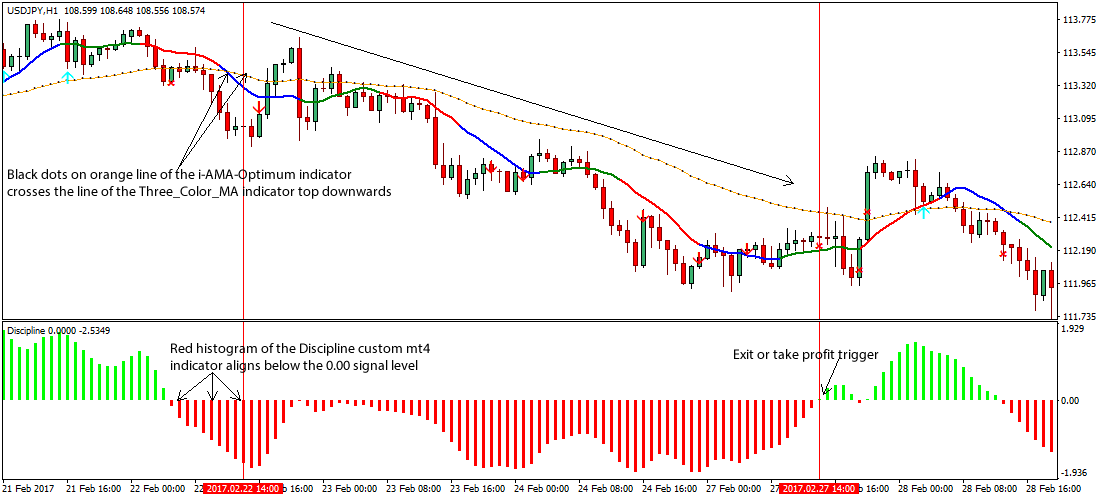

There are a terrific range of forex indications based on the moving average (MA). This is an evaluation on the easy moving average (SMA). The simple moving average is line produced by calculating the average of a set number of duration points.

“Remember this Paul,” Peter Moving Average Trader stated as they studied the long term chart, “Wealth comes from taking a look at the big picture. Many people believe that holding for the long term suggests permanently. I choose to hold things that are increasing in worth.I take my cash and wait up until the trend turns up once again if the trend turns down.

The dictionary quotes an average as “the quotient of any amount divided by the variety of its terms” so if you were exercising a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would include them together and divide them by 10, so the average would be 55.

What does that Forex MA Trading tell you about the instructions it is heading? Is it in an upward or a down trend? Charts of the main index can tell you this by a quick glimpse. If the line is heading downward then it remains in a downward pattern, but with the chaotic nature of the index cost, how do you understand if today’s down is not just a glitch and tomorrow it will return up once again?

Throughout these times, the Stocks MA Trading regularly breaks support and resistance. Obviously, after the break, the prices will usually pullback before continuing on its method.

While the year-end rally tends to be rather trusted, it doesn’t happen every year. And this is something stock market investors and traders may wish to pay attention to. In the years when the markets registered a loss in the last days of trading, we have actually often experienced a bearishness the next year.

It has been rather a couple of weeks of disadvantage volatility. The price has actually dropped some $70 from the peak of the last run to $990. The green line illustrates the significant battle area for $1,000. While it is $990 rather of $1,000 it does represent that turning point. Therefore we have actually had our second test of the $1,000 according to this chart.

Don’t just purchase and hold shares, at the exact same time active trading is not for everybody. When to be in or out of the S&P 500, use the 420 day SMA as a line to decide. Traders can likewise seek to trade short when the market falls below the 420 day SMA.

While it is $990 instead of $1,000 it does represent that milestone. This study was one of the very first to measure volatility as a dynamic motion. The 5 being fast, 10 medium and 15 the sluggish.

If you are searching instant entertaining videos about How to Trade 200 Ema, and Investment Strategy, Forex Trading Techniques, Foreign Currency Trading, Primary Trend you are requested to signup for a valuable complementary news alert service for free.