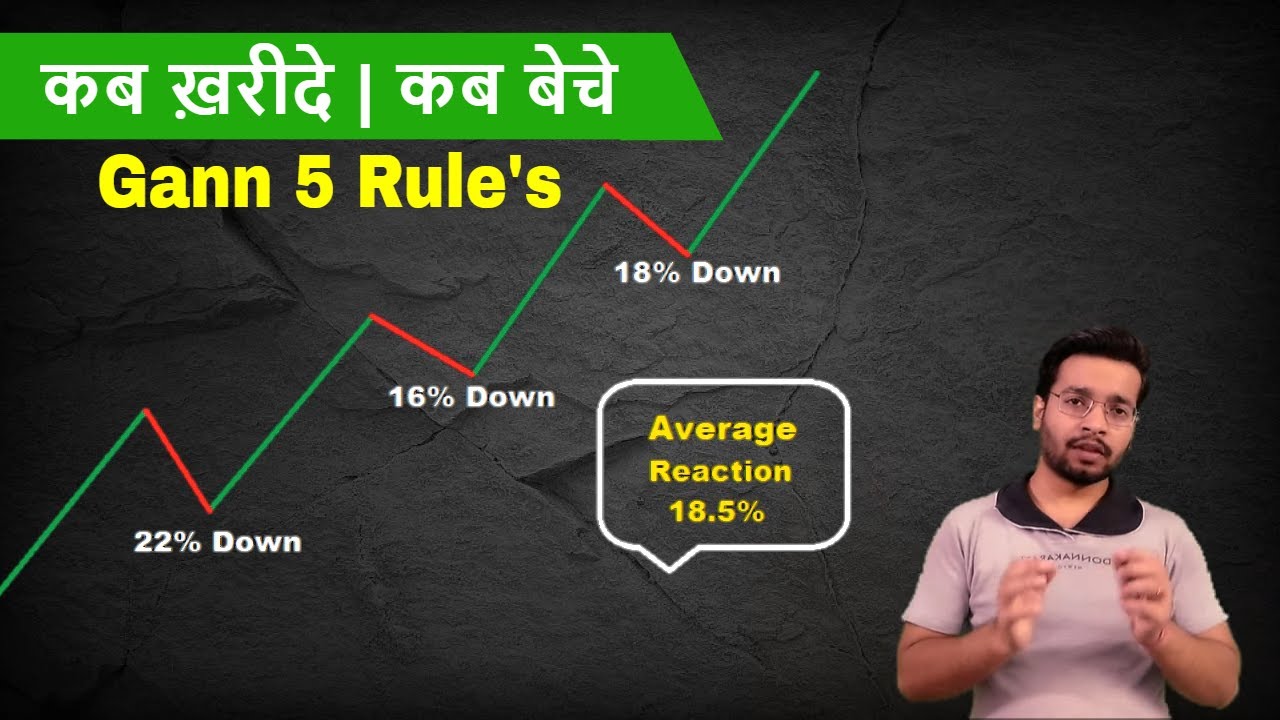

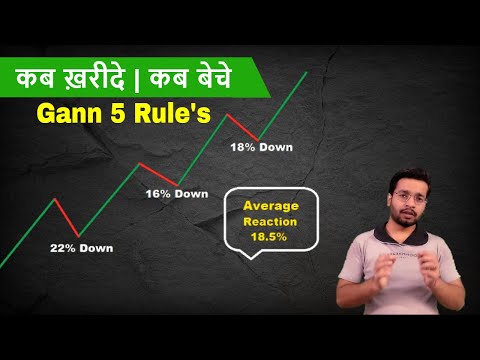

how to identify stock direction | Gann 5 golden rule's | by trading chanakya 🔥🔥🔥

Interesting un-edited videos highly rated Pips Currency Trade, Swing Trading Basics, Trending Market, Trading Without Indicators, and 50 Day Ema Trading Rule, how to identify stock direction | Gann 5 golden rule's | by trading chanakya 🔥🔥🔥.

Hello friends today video concept is gann 5 rule’s for identifying financial market direction.

lowest price video link:- https://youtu.be/PdoLbBKR4Oc

Trading chanakya recommended broker zerodha :-

click for open account – https://zerodha.com/open-account?c=ZMPOOT

#gannrules

#marketdirection

#tradingchanakya

50 Day Ema Trading Rule, how to identify stock direction | Gann 5 golden rule's | by trading chanakya 🔥🔥🔥.

4 Concerns Your Trading Strategy Should Answer

When a pattern remains in movement, we like to track stops behind the 40 day ma. While it is $990 rather of $1,000 it does represent that milestone. There’s plenty out there, however we only suggest one.

how to identify stock direction | Gann 5 golden rule's | by trading chanakya 🔥🔥🔥, Explore top explained videos related to 50 Day Ema Trading Rule.

Should You Follow The Patterns When Forex Trading?

Trading forex with signs has to do with picking the most likely trades to profit. State you want to trade a per hour basis and you wish to outline an 8 point chart. The 5 being quick, 10 medium and 15 the slow.

Everyone wishes to discover currency trading, or so it seems from the number of people being drawn into the foreign currency, or forex, craze. But, just like most things, there’s an ideal method and a wrong way. And properly has 3 essential ingredients.

The time frame is short and is from 2 minutes to 5 minutes. The shortest scalping technique is tape reading where the Moving Average Trader checks out the charts and puts a trade for a brief time period. In this article is the focus on longer trades than the brief tape reading method.

Assistance & Resistance. Support-this term describes the bottom of a stock’s trading variety. It resembles a flooring that a stock cost discovers it tough to permeate through. Resistance-this term describes the top of a stock’s trading range.It’s like a ceiling which a stock’s price doesn’t seem to increase above. When to sell a stock or purchase, assistance and resistance levels are necessary hints as to. Numerous successful traders buy a stock at assistance levels and sell brief stock at resistance. If a stock manages to break through resistance it could go much greater, and if a stock breaks its support it might signify a breakdown of the stock, and it might go down much further.

Market timing is based upon the “reality” that 80% of stocks will follow the direction of the broad market. It is based upon the “truth” that the Forex MA Trading pattern gradually, have actually been doing so considering that the beginning of easily traded markets.

The frequency is very important in option. For instance, offered two trading systems, the very first with a higher revenue factor but a radio frequency, and the second a higher frequency in trades however with a lower profit element. The 2nd system Stocks MA Trading have a lower earnings aspect, but since of its higher frequency in trading and taking little earnings, it can have a higher overall revenue, than the system with the lower frequency and greater earnings aspect on each private trade.

If you make 4 or more day trades in a rolling five-trading-day duration, you will be thought about a pattern day trader no matter you have $25,000 or not. A day trading minimum equity call will be provided on your account requiring you to deposit additional funds or securities if your account equity falls listed below $25,000.

The second step is the “Ready” step. In this action, you may increase your cash and gold allowances further. You might also start to move cash into bear ETFs. When the market goes down, these funds go up. Funds to consider include SH, the inverse of the S&P 500, DOG, the inverse of the Dow Jones Industrial average, and PSQ, the inverse of the NASDAQ index.

Five circulation days during March of 2000 signaled the NASDAQ top. Likewise crucial is the truth that lots of leading stocks were showing top signals at the exact same time. The absolute best stock market operators went mostly, or all in money at this time, and retained their amazing gains from the previous 4 or 5 years. They did this by appropriately evaluating the everyday price and volume action of the NASDAQ. It makes no sense at all to view significant earnings disappear. Once you discover to acknowledge market tops, and take appropriate action, your total trading outcomes will improve dramatically.

A 50-day moving typical line takes 10 weeks of closing price information, and after that plots the average. The big problem with this technique is that ‘false signals’ may occur frequently.

If you are finding exclusive exciting comparisons related to 50 Day Ema Trading Rule, and Buy Breakouts, Foreighn Exchange Market you should list your email address in subscribers database for free.