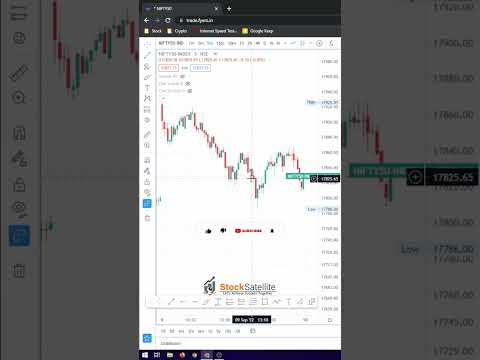

Exponential Moving Average (EMA) | Dynamic Support | Best Length For EMA | 9 EMA | 20 EMA

Latest YouTube videos top searched Forex Trading Software Online, Forex Trading Strategies, Market Bias, Trading Strategy, and How to Use Ema for Trading, Exponential Moving Average (EMA) | Dynamic Support | Best Length For EMA | 9 EMA | 20 EMA.

Open free Demate Account: https://linktr.ee/stocksatellite

Please ❤️Like & 💻Subscribe to Our channel & click the 🔔Bell icon to get new video Updates.

Watch My Other Videos:

**************************************************************

Draw Support & Resistance Like a Pro: https://youtu.be/pncg7cBSZEY

BreakOut & Retest Guide: https://youtu.be/128uuoZk1tw

Doji Candle Explain: https://youtu.be/t4l_ihcP55c

Options Trader Biggest Mistake: https://youtu.be/IGlPepI-oBg

Intraday Strategy For Beginners: https://youtu.be/Bh1i70neM-Y

Trading View Premium Features For Free: https://youtu.be/gVSLhaV7Doc

**************************************************************

✅Follow: @stocksatellite (Instagram)

✅Youtube: Stocksatellite

Disclaimer:

All our posts are for information and educational purposes only.

“Stock Satellite” is not registered under any of the SEBI Regulations

The Posts, References & Analyses shared in it are only meant for educational purposes and do not constitute any Trading or Investment advice. Our posts do not contain any buy/sell recommendations.

We are not responsible for your profit or loss. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any content on this Channel, and cannot be held liable for any Irregularity or Inaccuracy. Our research is solely for educational purposes only. Please do your analysis or consult your financial advisor before investing.

—Avoid HashTags—

exponential moving average

exponential moving averages

exponential moving average explained

exponential moving averages explained

how to calculate exponential moving average

moving average

beginner trading strategies

trading strategies

technical trading

day trading strategies

momentum day trading

how to day trade

charting software

technical analysis

how to trade

stock trading

trading

day trading

stock market

#exponentialmovingaverage #exponentialmovingaveragetradingstrategy #exponentialmovingaverageindicator #exponentialmovingaverage(ema) #exponentialmovingaveragecrossoverstrategy #exponentialmovingaveragestrategy #exponentialmovingaverageforex #exponentialmovingaverageindicatorinzerodha #exponentialmovingaveragesettings #exponentialmovingaverageindicatorinupstox #exponentialmovingaveragesettingsforintraday #exponentialmovingaverageforintraday

#exponentialmovingaverage9and20

#exponentialmovingaverage50and200

#movingaverage #movingaveragetradingstrategy #movingaverageindicator #movingaveragecrossoverstrategy #movingaveragestrategy #movingaveragescalpingstrategy #movingaverageexplained #movingaverageexponentialindicator #movingaverageforex #movingaveragetrading #movingaverageconvergencedivergence #movingaveragemodel #movingaveragecrossover #movingaverageswingtradingstrategy #movingaveragetradingstrategyforex #movingaverageand #movingaverageandmacdtradingstrategy #movingaverageandstochasticstrategy #movingaverageandvwaptradingstrategy #movingaverageandpriceaction #movingaverageandsupertrendstrategy #movingaverageandfibonacci #movingaverageandparabolicsarstrategy #movingaverageandccistrategy #movingaverageandmacdstrategy #movingaverageandawesomeoscillator #movingaverageandema #movingaverageandvolumestrategy #movingaverageandvwap #movingaverageandmacd

#nifty #sensex #banknifty #stockmarket #sharemarket #stocksatellite

How to Use Ema for Trading, Exponential Moving Average (EMA) | Dynamic Support | Best Length For EMA | 9 EMA | 20 EMA.

Forex Trend Following – 2 Tips To Milk The Big Patterns For Larger Profits

That setup might not take place for XYZ during the rest of the year. A duration of 5 in addition to 13 EMA is typically utilized. It is the setup, not the name of the stock that counts. This is to validate that the cost trend holds true.

Exponential Moving Average (EMA) | Dynamic Support | Best Length For EMA | 9 EMA | 20 EMA, Get popular explained videos about How to Use Ema for Trading.

Discover How To Use Moving Typical Effectively To Make Your Trade Decision

Presently, SPX is oversold enough to bounce into the Labor Day vacation. Nasdaq has rallied 310 points in 3 months, and hit a brand-new four-year high at 2,201 Fri early morning. Also active trading can impact your tax rates.

Wouldn’t it be good if you were just in the stock exchange when it was increasing and have whatever transferred to money while it is decreasing? It is called ‘market timing’ and your broker or monetary planner will tell you “it can’t be done”. What that individual just informed you is he does not understand how to do it. He doesn’t understand his job.

Using the exact same 5% stop, our trading system went from losing almost $10,000 to gaining $4635.26 over the very same ten years of information! The efficiency is now a favorable 9.27%. There were 142 successful trades with 198 unprofitable trades with the Moving Average Trader earnings being $175.92 and average loss being $102.76. Now we have a much better trading system!

The most fundamental application of the BI principle is that when a stock is trading above its Predisposition Sign you ought to have a bullish bias, and when it is trading listed below its Bias Indication you ought to have a bearish bias.

OIH major support is at the (increasing) 50 day MA, presently just over 108. However, if OIH closes listed below the 50 day MA, then next Forex MA Trading support is around 105, i.e. the longer Price-by-Volume bar. Around 105 might be the bottom of the consolidation zone, while a correction might result someplace in the 90s or 80s. The short-term rate of oil is mostly based on the rate of international economic growth, shown in regular monthly financial information, and supply disturbances, consisting of geopolitical occasions and cyclones in the Gulf.

Let us say that we wish to make a short term trade, between 1-10 days. Do a screen for Stocks MA Trading in a new up pattern. Raise the chart of the stock you are interested in and raise the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving average the stock is going to continue up and should be purchased. But as quickly as the 9 day crosses over the 4 day it is a sell signal. It is that simple.

During long-term secular bearish market, a buy and hold method hardly ever works. That’s because over that time, the marketplace may lose 80% in worth like it did in Japan in the 90s. However even in that nonreligious bear market, there were substantial cyclical booming market. When it comes to Japan for instance, the greatest rally was an impressive 125% from 2003-2007.

The second step is the “Get Set” action. In this step, you might increase your cash and gold allocations even more. You may also start to move money into bear ETFs. These funds increase when the marketplace decreases. Funds to think about consist of SH, the inverse of the S&P 500, CANINE, the inverse of the Dow Jones Industrial average, and PSQ, the inverse of the NASDAQ index.

18 bar moving typical takes the current session on open high low close and compares that to the open high low close of 18 days back, then smooths the typical and puts it into a line on the chart to provide us a pattern of the present market conditions. Breaks above it are bullish and breaks listed below it are bearish.

The gain daily was only 130 pips and the greatest loss was a drop of over 170 points. Once the trend is broken, get out of your trade! Cut your losses, and let the long trips make up for these small losses.

If you are searching best ever engaging reviews about How to Use Ema for Trading, and Foreighn Exchange Market, Market Analysis please list your email address our a valuable complementary news alert service now.