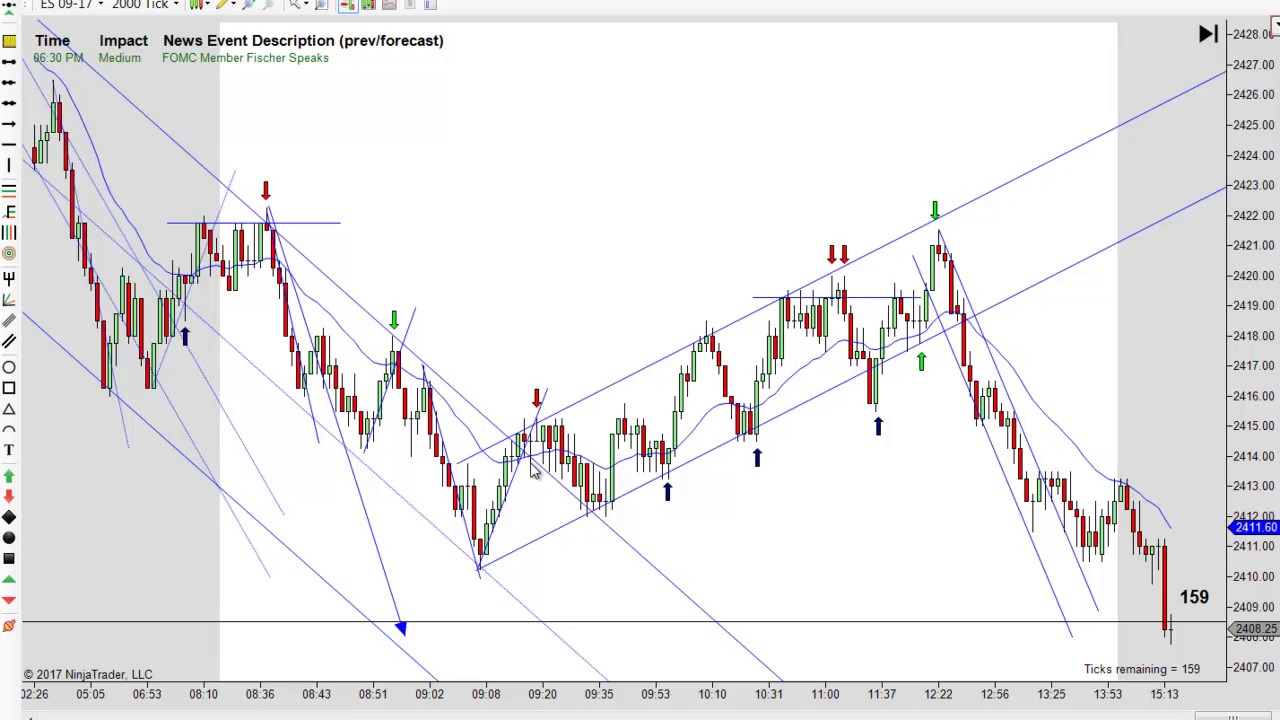

Day Trading Price Action Entry Rules 07-06-2017

Latest clips relevant with Learn About Stock Market, Daily Stock Report, How to Make Money in Stocks, and 50 Day Ema Trading Rules, Day Trading Price Action Entry Rules 07-06-2017.

http://priceactiontradingsystem.com/?s=price+action+rules

The importance of following the rules when day trading price action. Futures, stocks and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than their initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Our full risk disclosure can be found at https://priceactiontradingsystem.com/risk/ .

50 Day Ema Trading Rules, Day Trading Price Action Entry Rules 07-06-2017.

Number 1 Loser Indicator – Why Trading Moving Averages Fail

Complex signs will likely stop working to operate in the long-lasting. Due to the fact that they are lagging indicators. They instantly desert such a trade without awaiting a few hours for it to turn successful.

Day Trading Price Action Entry Rules 07-06-2017, Explore trending replays related to 50 Day Ema Trading Rules.

There Is No Such Thing As “Excellent” Stock

Complex indications will likely stop working to work in the long-lasting. Moving averages are incredibly popular indications in the forex. Delighted trading and never ever stop learning! You should establish your own system of day trading.

Wouldn’t it be great if you were only in the stock market when it was going up and have whatever moved to cash while it is going down? It is called ‘market timing’ and your broker or financial coordinator will tell you “it can’t be done”. What that individual simply told you is he does not understand how to do it. He does not understand his job.

But if you have a couple of bad trades, it can truly sour you on the entire trading video game Moving Average Trader .When you just have to step back and take a look at it, this is. Possibly, you simply need to escape for a day or 2. Unwind, do something various. Your unconscious mind will deal with the problem and when you return, you will have a much better outlook and can spot the trading opportunities quicker than they can come at you.

Nasdaq has rallied 310 points in 3 months, and hit a brand-new four-year high at 2,201 Fri early morning. The financial data recommend market pullbacks will be limited, although we’ve gone into the seasonally weak period of Jul-Aug-Sep after a big run-up. Consequently, there might be a debt consolidation period rather than a correction over the next couple of months.

The truth that the BI is evaluating such an useful period means that it can typically figure out the bias for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears develop their preliminary positions for the day. A move far from the BI shows that one side is stronger than the other. A stock moving above the BI suggests the dominating sentiment in the stock is bullish. The Forex MA Trading in which the stock breaks above and trades above the BI will suggest the strength of the bullish sentiment. When a stock moves below its BI, the opposite but exact same analysis applies.

I also take a look at the Bollinger bands and if the stock is up versus among the bands, there is a likely hood that the pattern Stocks MA Trading be concerning an end. I would not let this prevent me getting in a trade, however I would keep a close search it. Similarly, if the stock is moving up or down and about to strike the 20 or 50 day moving average then this might also stop that directional relocation. What I search for are trades where the DMI’s have actually crossed over, the ADX is moving up through the gap/zone in an upward motion and that the stock has some distance to move previously striking the moving average lines. I have actually found that this system provides a 70%-75% success rate. It’s also an extremely conservative method to utilize the DMI/ADX signs.

Another forex trader does care too much about getting a return on investment and experiences a loss. This trader loses and his wins are on average, much larger than losing. He wins double what was lost when he wins the video game. This reveals a balancing in losing and winning and keeps the investments open to get an earnings at a later time.

The second step is the “Ready” step. In this action, you might increase your cash and gold allowances further. You may likewise start to move cash into bear ETFs. When the market goes down, these funds go up. Funds to consider consist of SH, the inverse of the S&P 500, PET, the inverse of the Dow Jones Industrial average, and PSQ, the inverse of the NASDAQ index.

Integrating these 2 moving averages gives you a good structure for any trading plan. If you await the 10-day EMA to concur with the 200-day SMA, then possibilities are great that you will be able to earn money. Simply utilize good finance, don’t run the risk of too much on each trade, and you must be fine.

This short article has just illustrated one technique for each market circumstance. 2 moving average signs need to be used one fast and another slow. The other days SMA was an average of the rate points 1 – 8.

If you are finding exclusive entertaining reviews about 50 Day Ema Trading Rules, and Stock Analysis, Fading Market, Strategic Investing, Foreign Currency Trading you are requested to subscribe our subscribers database for free.