Best Tradingview Indicators For Day Trading Open Close Trading | Supertrend Indicator Strategy

Latest guide related to Bear Market, Trading Strong Trend, Buying Signals, and Tradingview How To Sma, Best Tradingview Indicators For Day Trading Open Close Trading | Supertrend Indicator Strategy.

Best Tradingview Indicators For Day Trading Open Close Trading | Supertrend Indicator Strategy | Forex Trading Strategies …

Tradingview How To Sma, Best Tradingview Indicators For Day Trading Open Close Trading | Supertrend Indicator Strategy.

When Trading The S & P 500 Mini Futures Contract, How To Identify Trends.

All over the web there are discussions about trading methods – what truly works and what doesn’t. We just want the average to help us find the pattern. They expect that is how rewarding traders make their money.

Best Tradingview Indicators For Day Trading Open Close Trading | Supertrend Indicator Strategy, Search popular updated videos relevant with Tradingview How To Sma.

Day Trading Stock And Forex Markets?

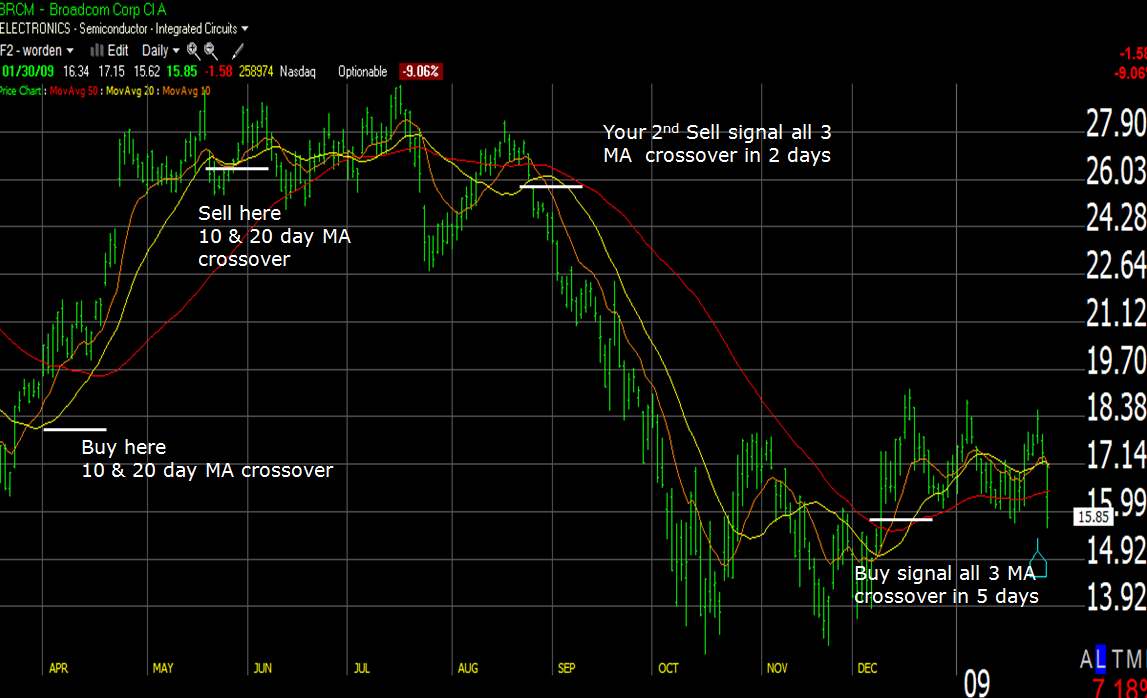

A method that is reasonably popular with traders is the EMA crossover. Comparing the closing price with the MA can help you identify the trend, one of the most crucial things in trading. Oil had its biggest portion drop in three years.

When I first heard of FAP Turbo, I was not thrilled since I have actually lost cash trading forex on my own with a particular robotic and without the right tools and strategies. It was throughout my search for the perfect robotic that I read Marcus B. Leary declaration of it being the most sophisticated live trading forex robot capable of doubling your money every single month. I trusted Marcus and so decided to give it a shot by downloading it for $149. Was I pleased with the outcome? You bet I did. Check out the very best FAP Turbo review listed below prior to you decide to begin online currency trading utilizing this robotic or any other.

When a stock moves in between the support level and the resistance level it is stated to be in a pattern and you require to purchase it when it reaches the bottom of the Moving Average Trader pattern and offer it when it reaches the top. Typically you will be searching for a short-term revenue of around 8-10%. You make 10% profit and you offer up and go out. You then search for another stock in a comparable trend or you wait for your original stock to fall back to its assistance level and you buy it back once again.

There are a couple of possible descriptions for this. The first and most apparent is that I was just setting the stops too close. This might have allowed the random “noise” of the price motions to trigger my stops. Another possibility is that either my broker’s dealing desk or some other heavy player in the market was engaging in “stop hunting”. I have actually composed a more total post on this subject currently, but essentially this involves market players who try to press the rate to a point where they think a great deal of stop loss orders will be activated. They do this so that they can either get in the marketplace at a much better price for themselves or to trigger a cumulative move in a direction that benefits their current positions.

Forex MA Trading She wrote a higher strike price this time around because the trend seemed speeding up and she didn’t want to lose out on too much capital growth if it continued to rally.

During these times, the Stocks MA Trading regularly breaks support and resistance. Of course, after the break, the prices will typically pullback before continuing its way.

Excellent forex trading and investing includes increasing earnings and decreasing possibilities of loss. This is refrained from doing, particularly by newbies in the field. They do not know appropriate trading techniques.

I have discussed this a number of times, however I think it deserves discussing again. The most common moving average is the 200-day SMA (easy moving average). Very put simply, when the market is above the 200-day SMA, traders state that the market is in an uptrend. The market is in a drop when rate is listed below the 200-day SMA.

I know these ideas may sound fundamental. and they are. But you would marvel the number of traders abandon a great trading system due to the fact that they feel they need to be able to trade the system with no idea whatsoever. If you would just discover to sell the best instructions and exit the trade with earnings. your search for a lucrative Forex system would be over.

Shorting isn’t for everybody, however here’s one of my methods for picking stocks to brief. There are a great range of forex signs based on the moving average (MA). This doesn’t have to be scientific discovery for Nobel cost.

If you are searching most engaging comparisons relevant with Tradingview How To Sma, and Counter Trend Trade, Forex Tools, Learning Forex you are requested to subscribe our email alerts service totally free.

![Simple ADX and SMA Indicators Reveal Profitable [Trading Strategy] Simple ADX and SMA Indicators Reveal Profitable [Trading Strategy]](https://MovingAverageTrader.com/wp-content/uploads/Simple-ADX-and-SMA-Indicators-Reveal-Profitable-Trading-Strategy-200x137.jpg)