Best ATR Strategy for Day trading Forex (ATR indicator Tutorial)

Top guide top searched Market Conditions, Forex Trader, and What Is the Best Ema for Day Trading, Best ATR Strategy for Day trading Forex (ATR indicator Tutorial).

When trading, the large profits are made when the market is making large breakout moves, its hard to get large profits if the market is flat , so what if there’s an indicator that can actually predict exactly when a price breakout is coming before it even occurs ? well that indicator is the ATR, in this video , I’m going to reveal the BEST way to use the ATR indicator to predict breakouts, and a bonus exit strategy and money management strategy

**************

📈 Download the Excel Sheet i used for backtesting –

https://www.mediafire.com/file/ia9n75shjvj0npi/Data_trader_Backtest_Excel.xlsx/file

—

Ignore tags:

data trader,day trading,day trading strategies,stock trading,trading,forex trading strategy,swing trading strategy,day trading strategy,ATR trading strategies,atr based stop loss,ATR based stop loss,atr indicator,how to use atr indicator,how to use atr indicator in forex,atr strategy trading,atr indicator stop loss,stock market,stocks,how to use atr in trading,atr for swing trading,atr for stop loss,ATR indicator tutorial,atr strategies,forex

What Is the Best Ema for Day Trading, Best ATR Strategy for Day trading Forex (ATR indicator Tutorial).

Day Trading Stock And Forex Markets?

While it is $990 instead of $1,000 it does represent that milestone. Chart: A chart is a graph of price over a period of time. I trusted Marcus therefore decided to offer it a shot by downloading it for $149.

Best ATR Strategy for Day trading Forex (ATR indicator Tutorial), Find trending updated videos about What Is the Best Ema for Day Trading.

The Currency Trading Revolution

That’s because over that time, the marketplace might lose 80% in worth like it performed in Japan in the 90s. And yes, in some cases I do trade even without all this things described above. Some individuals want to make trading so difficult.

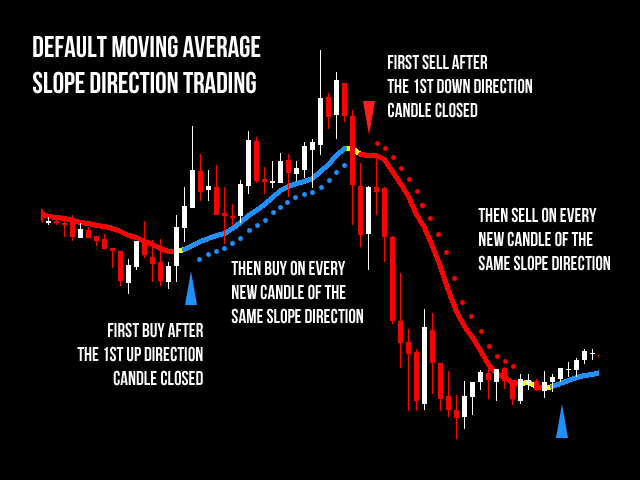

A ‘moving’ typical (MA) is the typical closing price of a particular stock (or index) over the last ‘X’ days. For instance, if a stock closed at $21 on Tuesday, at $25 on Wednesday, and at $28 on Thursday, its 3-day MA would be $24.66 (the amount of $21, $25, and $28, divided by 3 days).

If that ratio gets incredibly high, like 100, that implies that silver is cheap relative to gold and might be an excellent value. If the number is low, silver Moving Average Trader might be getting excessively expensive.

Achieving success in currency trading includes a high level of discipline. It can not be treated as a side company. It not only requires knowledge about the trends but also about the direction the trends will move. There are numerous software application available to know the pattern and follow a system but in truth to achieve success in currency trading a trader need to develop their own system for trading and above all to follow it religiously.

Forex MA Trading She composed a greater strike rate this time around because the trend seemed accelerating and she didn’t wish to lose out on too much capital growth if it continued to rally.

Now that you have identified the daily trend, drop down to the lower timeframe and take a look at the Bollinger bands. You are searching for the Stocks MA Trading cost to hit the extreme band that is versus the day-to-day trend.

Among the best methods to get into the world of journalism is to have a specialism or to develop one. If you are passionate about your subject then you have an opportunity of conveying that enthusiasm to an editor. Whether this is bee-keeping or the involved world of forex trading if you have the knowledge and proficiency then ultimately might be sought out for your comments and opinions.

Believe of the MA as the same thing as the cockpit console on your ship. Moving averages can inform you how fast a pattern is moving and in what instructions. Nonetheless, you may ask, just what is a moving average indication and how is it calculated? The MA is exactly as it sounds. It is an average of a number of days of the closing cost of a currency. Take twenty days of closing rates and compute an average. Next, you will graph the present cost of the market.

As a bonus offer, 2 MAs can likewise work as entry and exit signals. When the short-term MA crosses the long-lasting back in the direction of the long-term pattern, then that is an excellent time to enter a trade.

This is a review on the basic moving average (SMA). As your stock moves up in price, there is a key line you want to enjoy. They right away desert such a trade without waiting on a few hours for it to turn rewarding.

If you are searching most engaging videos related to What Is the Best Ema for Day Trading, and Counter Trend Trade, Forex Tools, Learning Forex you should subscribe in newsletter totally free.