Backtest A Trading Strategy With Tradingview And Run It On Coinrule

Top videos top searched Stock Market Trading, Choosing Forex Indicators, Penny Stocks, and Sma Tradingview, Backtest A Trading Strategy With Tradingview And Run It On Coinrule.

Coinrule is Now Officially Crowdfunding http://Seedrs.com/Coinrule

Coinrule empowers regular traders to compete with professional algorithmic traders and Hedge funds – a smart assistant to build trading strategies without having to program a single line of code

Sign up and get started for free: https://coinrule.io/

Follow on: Twitter: https://twitter.com/CoinRuleHQ

Instagram: https://www.instagram.com/coinrulehq/

FB: https://www.facebook.com/CoinruleHQ/

One of the most common questions we get about coinrule is

what are the returns I can expect on my trading strategies?

Since you can build hundreds of different trading strategies on Coinrule, running on so many different coins, it isn’t straightforward to reply with a quick and unique answer. The good news is that you can backtest some trading strategies using Tradingview to check the historical returns. Tradingview is a powerful tool that most crypto traders use every day.

On Tradingview, you will find the Coinrule account, which we regularly post our trading scripts. We publish automated trading strategies that you can quickly run on your account using Coinrule.

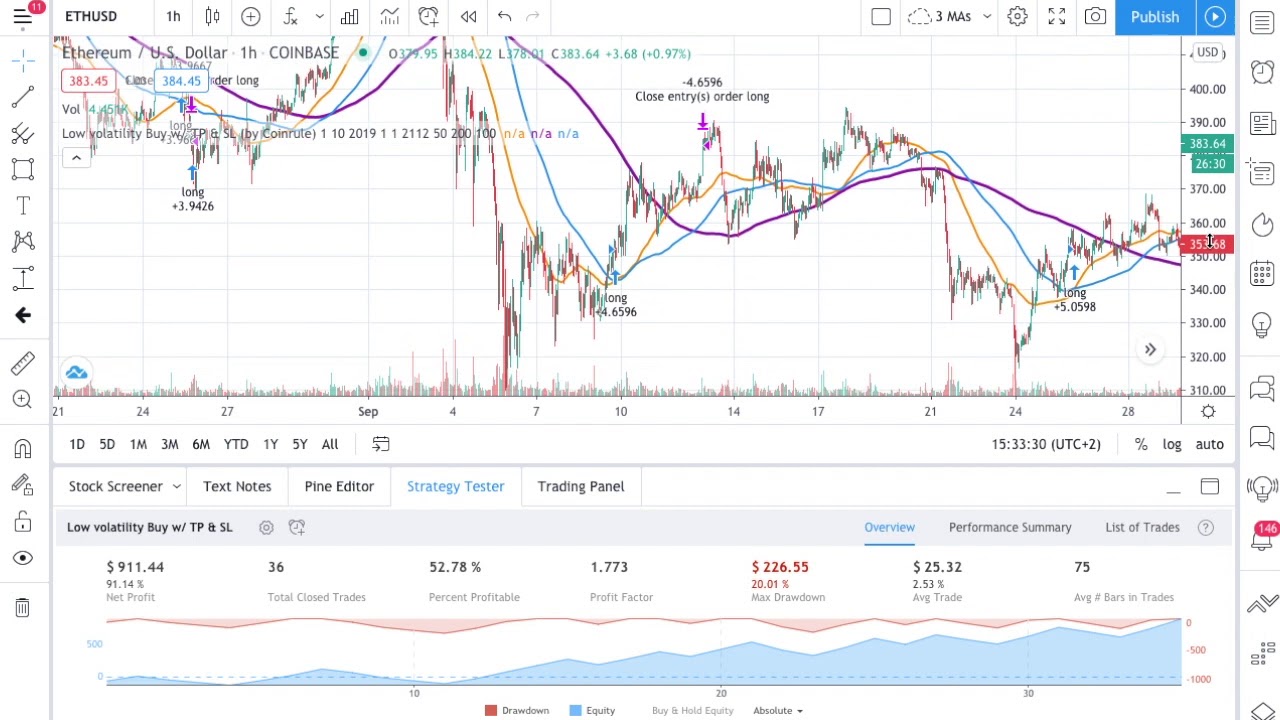

Tradingview shows the net profit that the strategy would have returned, how many trades the strategy open and closed, the percentage of profitability of the strategy, the maximum drawdown of the strategy, and the profit factor. These are more important indicators that will tell if this trading system fits your need or not.

The chart shows precisely when the strategy would have executed. This allows for understanding better how the trading system works.

You can adjust all the relevant parameters to see in real-time how results would have changed based on these changes.

To have more realistic results from the backtest on Tradingview, set up an initial capital aligned to what you expect to invest with this trading system. You can also add a commission on each trade. Some trading strategies may look profitable, but when you account for the fees, then you realize that they’re not that profitable after all.

In a matter of clicks, you can backtest this trading strategy on Tradingview on many coins, experimenting with different setups, such as the triggers for profit and loss. When you are ready, you can set up this trading strategy on Coinrule in just a few steps.

You can decide to run this strategy on the coin that returned the best results from the backtests on Tradingview, or you can let the bot trade all coins available on the market if you feel confident in the setup so that you can catch more opportunities.

Sma Tradingview, Backtest A Trading Strategy With Tradingview And Run It On Coinrule.

Technical Studies Just Inform 1/2 The Story

In a stock everyday cost chart, if 50SMA moves up and crosses 200SMA, then the pattern is up. You would have purchased in June 2003 and remained with the up move until January 2008. A downtrend is shown by lower highs and lower lows.

Backtest A Trading Strategy With Tradingview And Run It On Coinrule, Get most shared replays relevant with Sma Tradingview.

Trading Forex Effectively Is Easier Than You Think

That’s because over that time, the market may lose 80% in value like it carried out in Japan in the 90s. And yes, in some cases I do trade even without all this stuff described above. Some individuals desire to make trading so difficult.

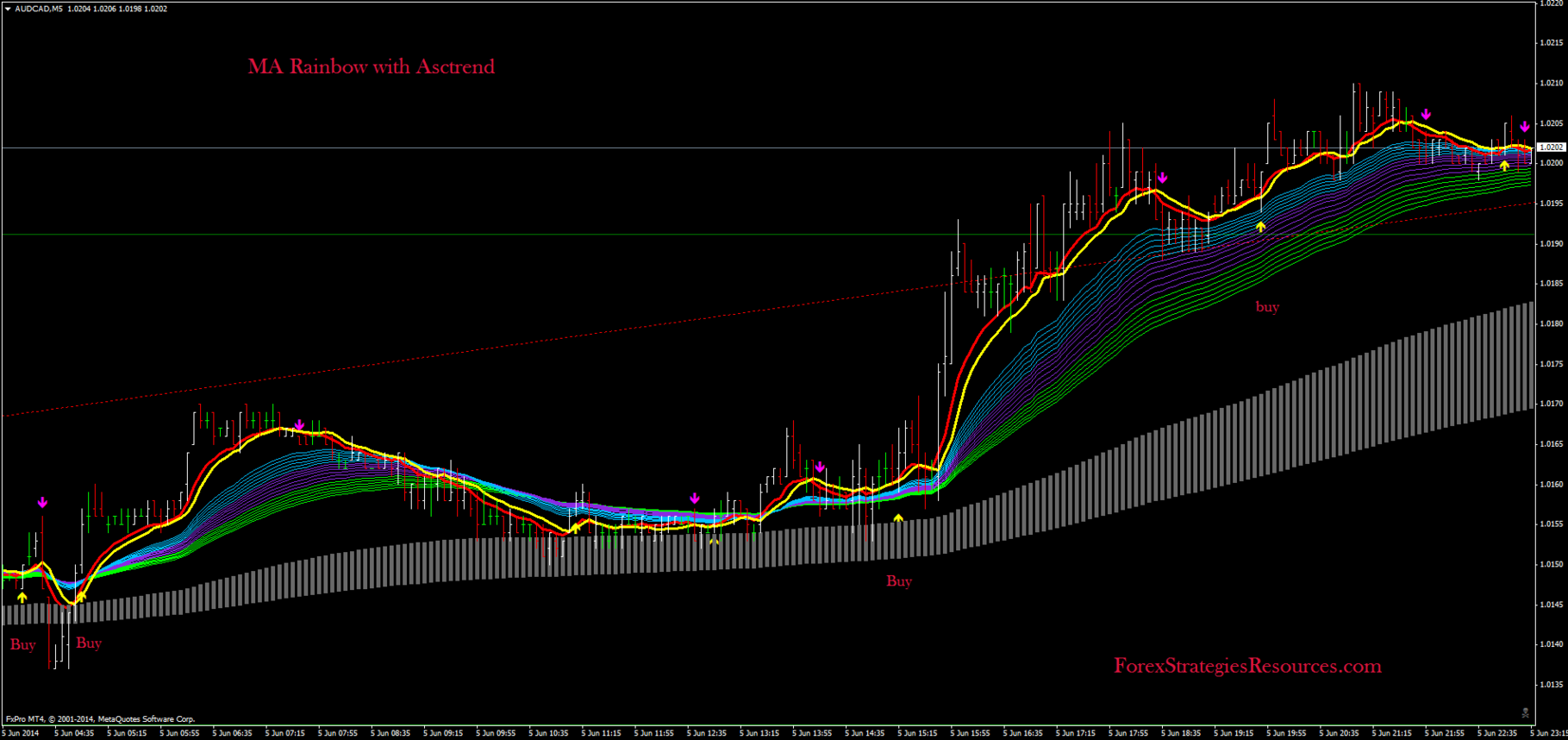

Moving averages are preferred indicators in the forex. A lot of traders utilize them, and some individuals use them solely as their own indicator. However what is the function of moving averages, and how do you really generate income from them?

This environment would show that the currency pair’s rate is trending up or down and breaking out of its current trading variety. This usually takes place when there are changes affecting the currency’s nation. A fast trending day can be seen when the cost of the currency set rises below or above the 21 Exponential Moving Average and then returning to it. A Moving Average Trader should study the fundamentals of the nation before choosing how to trade next.

Technical analysts attempt to spot a trend, and ride that pattern until the pattern has actually confirmed a turnaround. If a great company’s stock remains in a drop according to its chart, a trader or investor utilizing Technical Analysis will not buy the stock up until its trend has actually reversed and it has actually been validated according to other important technical signs.

It’s tempting to begin trading at $10 or $20 a point just to see how much money, albeit make-believe money, you can Forex MA Trading in as brief a time as possible. However that’s an error. Then you ought to treat your $10,000 of make-believe money as if it were real, if you’re to find out how to trade currencies beneficially.

This indicates that you need to know how to manage the trade prior to you take an entry. In a trade management technique, you must have composed out exactly how you will manage the trade after it is entered into the Stocks MA Trading so you know what to do when things turn up. Dominating trade management is really essential for success in trading. This part of the system must include information about how you will react to all type of conditions one you go into the trade.

In addition, if the 5 day moving average is pointing down then stay away, consider an extra product, one where by the 5-day moving average is moving north. And do not purchase a trade stock when it really is down listed below its two-hundred day moving average.

For circumstances, 2 weeks ago JP Morgan Chase cut its projection for fourth quarter growth to just 1.0%, from its already reduced forecast of 2.5% just a few weeks previously. The company also slashed its projection for the first quarter of next year to simply 0.5%. Goldman Sachs cut its forecasts dramatically, to 1% for the 3rd quarter, and 1.5% for the fourth quarter.

Keep in mind, the secret to understanding when to purchase and offer stocks is to be constant in applying your rules and comprehending that they will not work whenever, but it’s a great deal much better than not having any system at all.

A method that is fairly popular with traders is the EMA crossover. Simply divide the daily average Trading Range (ATR) by the share rate to get a percentage. They provide a long ravelled curve of the typical cost.

If you are finding instant entertaining videos relevant with Sma Tradingview, and Forex Trading Software Online, Chinese Growth Stocks, Currency Trading Course, Biotech Stocks you are requested to join in email list totally free.