8-55 EMA Crossover NQ/MNQ Futures Strategy – v2 Update 🤖

Interesting reviews relevant with Stocks Swing in Cycles, Swing Trading Basics, and What Is Ema Crossover, 8-55 EMA Crossover NQ/MNQ Futures Strategy – v2 Update 🤖.

This automated strategy was built from a discretionary strategy by Brett Glover. Don’t miss our interview of Brett and his journey to becoming a full-time futures trader: https://www.youtube.com/watch?v=514gnyuO1TM

Our original published v1 backtest video from December 2022 is here: https://www.youtube.com/watch?v=61mYTkmM8XU

The 8-55 EMA Crossover Strategy trades NQ and MNQ futures on the 5-minute chart using two EMAs (8 and 55) and a higher interval 55 EMA on the 15-minute chart for directional confluence.

It emulates the signal typically found in a motive Elliott Wave by waiting for waves 1 and 2 to establish. The entry signal is generated when:

– The market hours are between 0900 and 1455 (skipping the volatility of the first 30 minutes and avoiding entries in the extended session).

– All EMAs are in a bullish or bearish direction.

– Price has retraced to the 55 EMA within 5 bars of;

– A close above the 8 EMA.

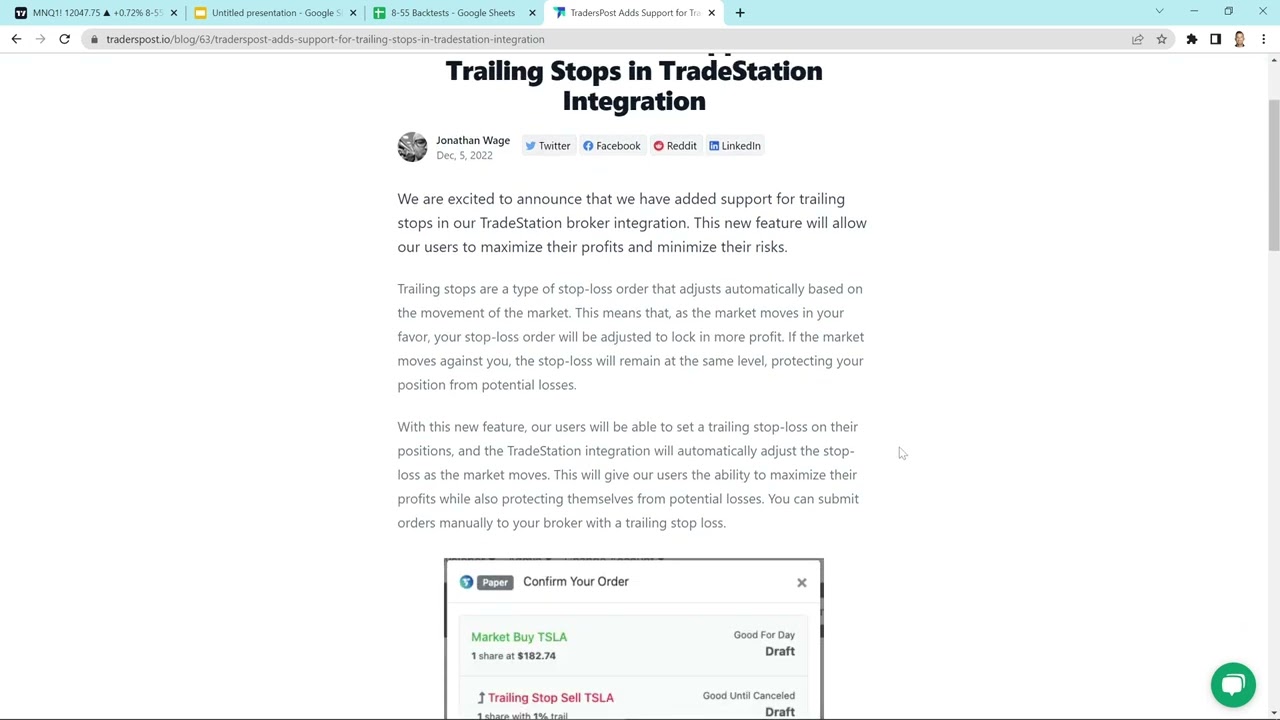

A trailing stop provides the exit signal.

Trades can be long or short or a combination of the two and can have independent trailing stop percentages. And the entire strategy can be automated from TradingView by using TradersPost.

In this update, several changes were made:

– Default settings for strategy

– Commission changes: $0.82 per side

– 0.75% Trailing Stop

– Added Default Contract Quantity

– Previous day volume filter

– Repainting issue fixed on 15 minute 55 EMA

– Retest bars condition fixed. Performance improved

– Yesterday’s low filter for short side

– Built-in TradersPost signal messages (JSON Payload)

– Option to attach a trailing stop with your broker

– Now works on 5 minute, 30 minute and 1 hour

_________

👨💻 Add the strategy to your TradingView account:

https://www.tradingview.com/script/tubAmq4X-8-55-EMA-Crossover-NQ-Futures-Strategy/

or on Github:

https://github.com/TradersPost/pinescript/blob/master/strategies/8-55-EMA-Crossover-NQ-Futures-Strategy.pinescript

_________

✅ Automate Your Strategy and Indicator Signals from TradingView and TrendSpider and try TradersPost free for 30 days.

https://traderspost.io/pricing

_________

💬 Join our Discord Channel for updates on automated trading on TradingView and TrendSpider. Or find us on social.

https://traderspost.io/community

00:00:00 Intro

00:00:13 Strategy Settings Changes

00:01:04 Previous Day Volume Filter

00:02:14 Fixing the Repainting Issue

00:03:19 Entry Condition Update

00:04:12 Short-Side Yesterday’s Low Filter

00:05:18 Automatic TradersPost JSON Message Payload

00:06:07 Attach Broker Trailing Stop

00:07:39 Advantage of Attaching a Trailing Stop

00:08:33 Strategy Settings for Broker Trailing Stops

00:09:24 How Trailing Stops Differ

00:09:50 Using hlc3 Trailing Stop in Strategy

00:10:36 Performance on 5, 30, and 60 Minutes

00:11:17 Walk Forward Results

00:13:00 Staying Long Only

00:13:59 Six Month Long Performance

DISCLAIMER:

Automated trading in the financial markets involves a risk of loss. Content and strategies produced by TradersPost are for informational or educational purposes only and do not constitute trading or investment recommendations or advice.

What Is Ema Crossover, 8-55 EMA Crossover NQ/MNQ Futures Strategy – v2 Update 🤖.

Produce Your Own Forex Trading System In 5 Easy Steps

In a ranging market, heavy losses will occur. Numerous traders do not have the perseverance to enjoy their trade turn into an earnings after a few hours or more. Chart: A chart is a graph of cost over a duration of time.

8-55 EMA Crossover NQ/MNQ Futures Strategy – v2 Update 🤖, Enjoy most searched full length videos relevant with What Is Ema Crossover.

Forex Account Management – How To Protect Your Account From The Dangers You Take

OIH significant support is at the (increasing) 50 day MA, currently just over 108. This system is also understood as the “moving typical crossover” system. What does that market inform you about the direction it is heading?

From time to time the technical indications begin making news. Whether it’s the VIX, or a moving average, somebody gets the story and soon it’s on CNBC or Bloomberg as the news of the day. So, as an investor one has to ask, “are technical indicators truly a factor to purchase or offer?” In some aspects the response is no, given that “investing” is something different from swing trading or day trading.

“Remember this Paul,” Peter Moving Average Trader stated as they studied the long term chart, “Wealth comes from looking at the big picture. Lots of people believe that holding for the long term indicates forever. I prefer to hold things that are increasing in worth.If the pattern denies, I take my cash and wait until the pattern turns up once again.

Buy-and-hold state the experts. Buy-and-hold say the consultants who profit from your investment purchases though commissions. Buy-and-hold state most mutual fund companies who profit from load costs so various in range it would take too much area to note them all here. Buy-and-hold state TV analysts and newsletter publishers who’s clients currently own the stock.

Forex MA Trading She wrote a higher strike cost this time around since the pattern appeared to be accelerating and she didn’t desire to lose out on excessive capital development if it continued to rally.

A Forex trading technique requires three Stocks MA Trading standard bands. These bands are the time frame picked to trade over it, the technical analysis utilized to figure out if there is a rate trend for the currency pair, and the entry and exit points.

The best method to generate income is buying and selling breakouts. , if you integrate them in your forex trading technique you can utilize them to stack up big gains..

NEVER anticipate and attempt beforehand – act on the reality of the modification in momentum and you will have the odds in your favour. Predict and attempt and you are actually simply hoping and thinking and will lose.

Daily Moving Averages: There are lots of moving averages which is just the average cost of a stock over a long period of time, on an annual chart I like to use 50, 100 and 200 day-to-day moving averages. They offer a long ravelled curve of the typical rate. These lines will likewise become assistance and resistance points as a stock trades above or listed below its moving averages.

This is stating the obvious, however it is frequently neglected when choosing a trading strategy. Constantly know your emotions and never make a trade out of fear or greed. Likewise active trading can impact your tax rates.

If you are looking rare and exciting videos relevant with What Is Ema Crossover, and Currency Trading Course, Compare Online Trading, Forex Trading Techniques you are requested to join in newsletter for free.