🔴 Best TradingView Indicator (Algo) Strategy! Day Trading #forex #daytrading #forextrading

Trending overview top searched Trading Stocks, Trade Stocks, Stock Market for Beginners, and Which Sma For Day Trading, 🔴 Best TradingView Indicator (Algo) Strategy! Day Trading #forex #daytrading #forextrading.

Get the same indicator here 👉 https://linktr.ee/millionmoves

Which Sma For Day Trading, 🔴 Best TradingView Indicator (Algo) Strategy! Day Trading #forex #daytrading #forextrading.

3 Things You Require To Understand About Variety Trading

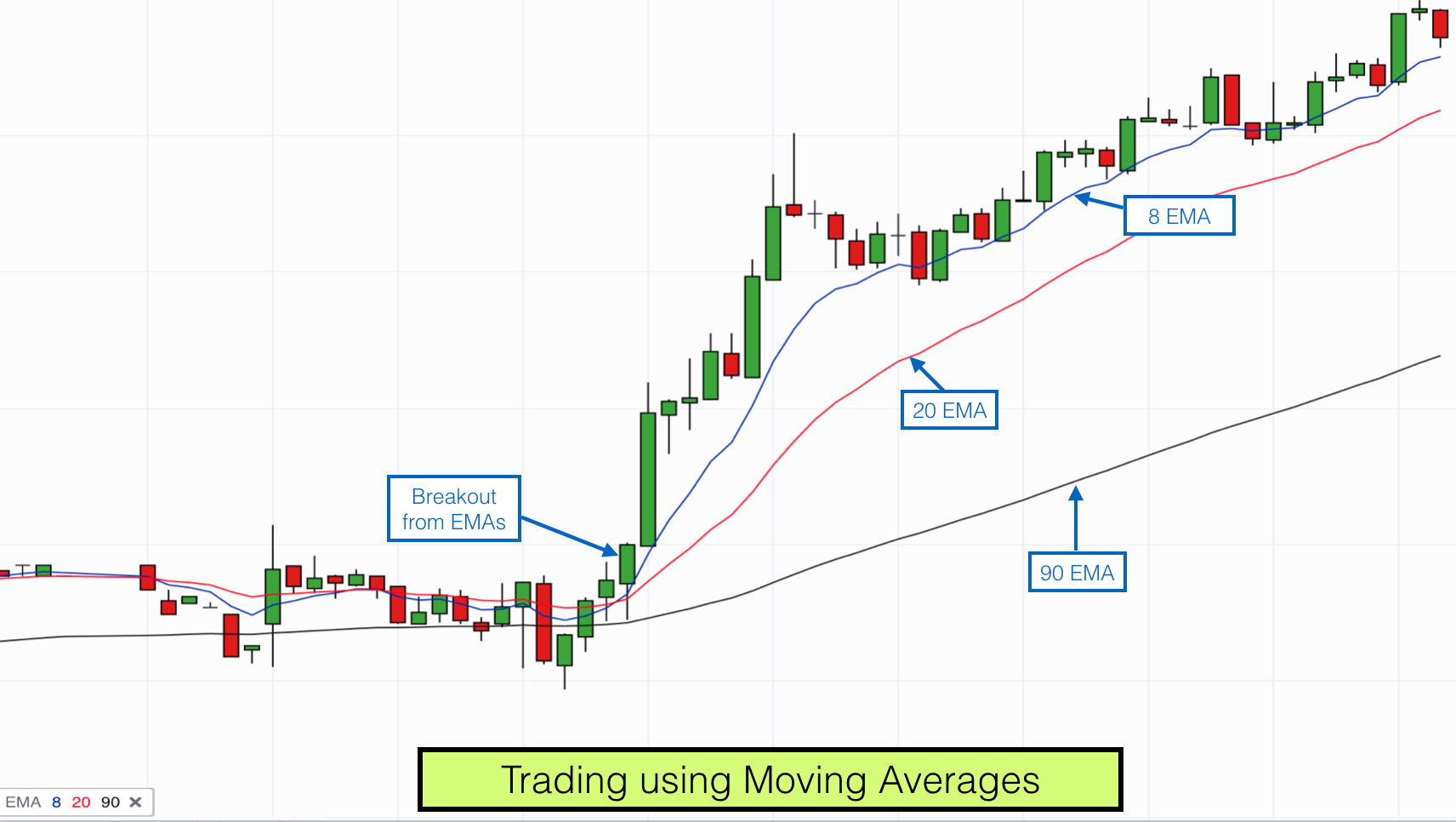

A relocation far from the BI suggests that one side is more powerful than the other. They are extremely useful in showing trends by eliminating price sound. We only desire the average to help us spot the trend.

🔴 Best TradingView Indicator (Algo) Strategy! Day Trading #forex #daytrading #forextrading, Play top replays about Which Sma For Day Trading.

Assistance And Resistance In Cfd Trading

The aim of this short-term momentum trading strategy is to hit the revenue target as early as possible. A Forex trading technique needs 3 main fundamental bands. The most effective indication is the ‘moving average’.

When in a while the technical signs start making news. Whether it’s the VIX, or a moving average, somebody gets the story and quickly it’s on CNBC or Bloomberg as the news of the day. So, as an investor one needs to ask, “are technical indicators actually a reason to sell or buy?” In some respects the answer is no, since “investing” is something different from swing trading or day trading.

At times, the changes can occur abruptly. These down and upward spikes are indicative of major changes within the operation of a company and they trigger Moving Average Trader reactions in stock trading. To be ahead of the game and on top of the scenario, plan ahead for contingency steps in case of spikes.

So this system trading at $1000 per trade has a favorable expectancy of $5 per trade when traded over numerous trades. The profit of $5 is 0.5% of the $1000 that is at risk throughout the trade.

Choosing a timespan: If your day trading, purchasing and offering intra day, a 3 year chart will not help you. For intra day trading you wish to utilize 3,5 and 15 minute charts. Depending on your longterm investment method you can look at a 1 year, which I utilize usually to a 10 year chart. The yearly chart give me a take a look at how the stock is doing now in today’s market. I’ll look longer for historic support and resistance points but will Forex MA Trading my buys and offers based on what I see in front of me in the annual.

Your job is just to find out direction. Once the bands shakes off this signal you must identify instructions since Bollinger bands won’t inform you that. Due to the fact that we had a stopped working greater swing low, we identified Stocks MA Trading instructions. Simply put broken swing low assistance, and after that broken support of our 10 period EMA. Couple that with the expansion of the bands and you wind up with a trade that paid nearly $8,000 dollars with danger kept to an absolute minimum.

Among the finest methods to break into the world of journalism is to have a specialism or to develop one. Then you have a possibility of conveying that interest to an editor, if you are enthusiastic about your subject. If you have the understanding and proficiency then eventually might be looked for out for your opinions and remarks, whether this is bee-keeping or the involved world of forex trading.

For these type of traders short term momentum trading is the best forex trading method. The objective of this short-term momentum trading strategy is to hit the profit target as early as possible. This is attained by entering the market long or short when the momentum is on your side.

The trader who gets a signal from his/her trading system that is trading on a medium based timeframe is allowing the information to be absorbed into the marketplace prior to taking a position and likewise to identify their risk. This trader whether he thinks prices are random or not thinks that details is collected and responded upon at various rates for that reason providing opportunity to get in alongside The Wizard.

It is inevitably utilized in double format, e.g. a 5 day moving average and a 75 day moving average. Five distribution days during March of 2000 signified the NASDAQ top. We only want the average to help us spot the trend.

If you are finding best ever entertaining comparisons relevant with Which Sma For Day Trading, and Forex Autotrading, Bollinger Band Trading, Stock Charting you are requested to list your email address in email subscription DB totally free.