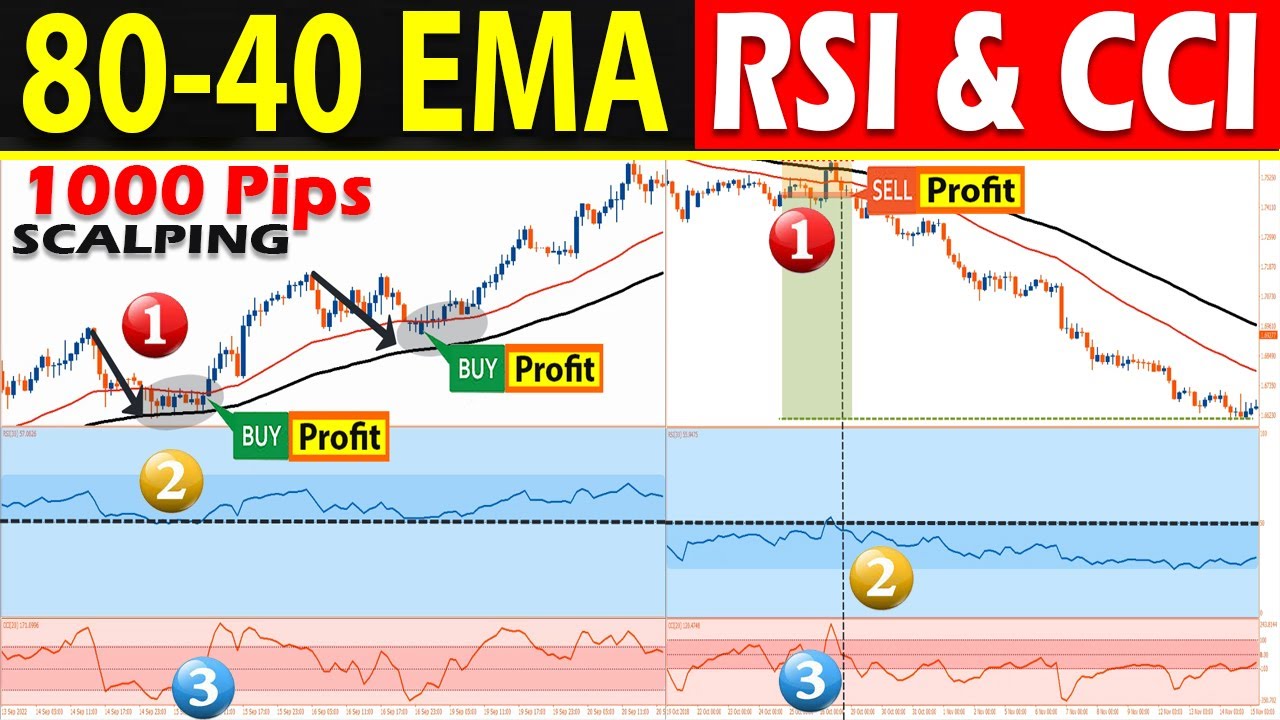

🔴 80-40 EMA SCALPING with CCI & RSI Filter (The Only “TREND TRADING STRATEGY” You Will Ever Need)

New replays highly rated Stock Market Information, Foreign Currency Trading, Megadroid Trading Robot, Forex Beginners – a Simple Scalping Strategy for High Volume Conditions, and How to Use Ema Forex, 🔴 80-40 EMA SCALPING with CCI & RSI Filter (The Only “TREND TRADING STRATEGY” You Will Ever Need).

🔴 *FREE DOWNLOAD TRADING SYSTEMS:*

80-40 EMA SCALPING & SWING TRADING with CCI – RSI Momentum Filter

Forex Middle Point Channel Trading System with RSI Momentum Filter

https://forexwot.com/kst-macd-forex-trading-system.html

Forex & Stock Market “Flat Trend RSI – EMA” Exponential Moving Average Trading Strategy

Stock, Crypto, and Forex Non-Lag MA BBands Stop Trading Strategy [66]

=================================

80-40 EMA SCALPING with CCI & RSI Filter (The Only “TREND TRADING STRATEGY” You Will Ever Need)

How to Use Ema Forex, 🔴 80-40 EMA SCALPING with CCI & RSI Filter (The Only “TREND TRADING STRATEGY” You Will Ever Need).

Investors Explore Technical Analysis

What is suitable for the trending market might not be proper for a variety bound or a consolidating market. Trading in the Forex market has actually ended up being much easier during the last number of years.

🔴 80-40 EMA SCALPING with CCI & RSI Filter (The Only “TREND TRADING STRATEGY” You Will Ever Need), Explore interesting videos related to How to Use Ema Forex.

Different Types Of Day Trading Orders

Rapid MAs weigh more current rates heavier. A 50-day moving average line takes 10 weeks of closing price data, and then plots the average. This trader loses and his wins are on average, much bigger than losing.

Here I am going to show you how to achieve forex trading success with a simple technique which is logical, proven and you can utilize quickly for big profits. Let’s have a look at it.

Nasdaq has actually rallied 310 points in 3 months, and struck a brand-new four-year high at 2,201 Fri Moving Average Trader early morning. The financial data recommend market pullbacks will be restricted, although we have actually gotten in the seasonally weak period of Jul-Aug-Sep after a big run-up. As a result, there may be a consolidation period rather than a correction over the next few months.

This is an excellent question. The response is rather intriguing though. It is simply because everybody is utilizing it, particularly those big banks and organizations. They all use it that way, so it works that method. Really, there are mathematic and statistic theories behind it. Welcome to do more research study on this one if you are interested in it. This short article is for routine readers. So I don’t want to get unfathomable into this.

Forex MA Trading She composed a higher strike price this time around due to the fact that the pattern appeared to be accelerating and she didn’t wish to miss out on out on too much capital growth if it continued to rally.

One of the main indications that can assist you establish the method the index is moving is the Moving Typical (MA). This takes the index price over the last specified variety of averages and days it. With each new day it drops the first cost used in the previous day’s estimation. It’s always good to inspect the MA of numerous durations depending if you are wanting to day trade or invest. If you’re aiming to day trade then a MA over 5, 15, and 30 minutes are a great concept. Then 50, 100, and 200 days may be more what you need, if you’re looking for long term financial investment. For those who have trades lasting a couple of days to a few weeks then periods of 10, 20 and 50 days Stocks MA Trading be more proper.

When figuring out a trade’s appropriateness, the brand-new brief positions will have protective stops placed reasonably close to the market given that risk must constantly be the number one consideration. This week’s action clearly showed that the market has run out of people going to develop new brief positions under 17.55. Markets constantly go to where the action is. The decreasing ranges integrated with this week’s reversal bar lead me to think that the next move is greater.

Consider the MA as the exact same thing as the instrument panel on your ship. Moving averages can tell you how fast a pattern is moving and in what direction. However, you may ask, exactly what is a moving typical indication and how is it computed? The MA is exactly as it sounds. It is an average of a variety of days of the closing rate of a currency. Take twenty days of closing rates and calculate an average. Next, you will chart the current cost of the marketplace.

Do not simply buy and hold shares, at the exact same time active trading is not for everybody. When to be in or out of the S&P 500, use the 420 day SMA as a line to choose. When the market falls below the 420 day SMA, traders can also look to trade brief.

From its opening price on January 3rd 2012 through the closing rate on November 30th, the SPX increased by 12.14%. The vertical axis is outlined on a scale from 0% to 100%. You don’t need to succumb to analysis paralysis.

If you are searching updated and entertaining comparisons relevant with How to Use Ema Forex, and Call Options, Stock Pick, Large Cap Stocks you should subscribe in subscribers database for free.