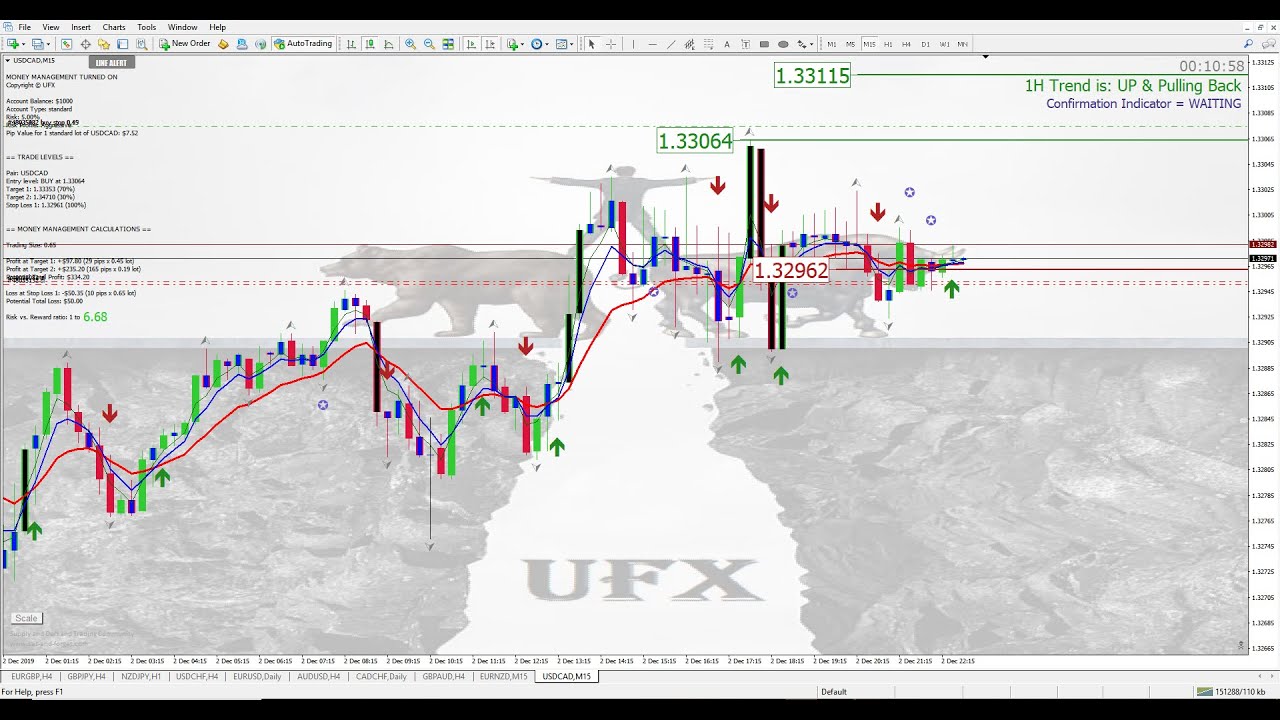

3 EMA Forex Strategy -70/30 Rule Top Down Analysis

Interesting full videos highly rated Trading Strong Trend, Momentum Indicators, and What Is Ema Forex, 3 EMA Forex Strategy -70/30 Rule Top Down Analysis.

http://ufx-trend-scalper.com/Indicators.html

3 EMA Forex Strategy -70/30 Rule Top Down Analysis

Checkout Cool Merch – Coffee Cups, Hoodies, Tees and more

https://teespring.com/stores/ufx

#Forex #3ema #FX

What Is Ema Forex, 3 EMA Forex Strategy -70/30 Rule Top Down Analysis.

Forex Trading Success – A Simple Approach For Substantial Gains

Another restriction with MAs is that they tend to whipsaw a lot in a choppy market. This tool offers a relative definition of rate highs/lows in regards to upper and lower bands. You just have to have perseverance and discipline.

3 EMA Forex Strategy -70/30 Rule Top Down Analysis, Find trending complete videos relevant with What Is Ema Forex.

A Forex Trading System Guide

Moving average is among numerous technical analysis indications. However even in that nonreligious bear market, there were substantial cyclical bull markets. The wedge is compressing, which need to continue to generate volatility.

If you trade stocks, you must understand how to chart them. Some people explore charts to find buy or offer signals. I discover this wasteful of a stock traders time. You can and need to chart all types of stocks including cent stocks. Charting tells you where you are on a stocks rate pattern this indicates it tells you when to sell or purchase. There are plenty of terrific business out there, you do not wish to get captured buying them at their 52 week high and needing to wait around while you hope the cost comes back to the price you paid.

This environment would indicate that the currency set’s price is trending up or down and breaking out of its present trading range. This normally takes place when there are modifications impacting the currency’s country. A fast trending day can be seen when the price of the currency set rises below or above the 21 Exponential Moving Average and after that returning to it. A Moving Average Trader needs to study the principles of the country before deciding how to trade next.

Support & Resistance. Support-this term describes the bottom of a stock’s trading range. It’s like a floor that a stock rate discovers it tough to penetrate through. Resistance-this term explains the top of a stock’s trading range.It’s like a ceiling which a stock’s rate doesn’t appear to rise above. When to sell a stock or buy, support and resistance levels are important clues as to. Numerous effective traders buy a stock at support levels and sell short stock at resistance. If a stock manages to break through resistance it might go much higher, and if a stock breaks its assistance it might signal a breakdown of the stock, and it might go down much further.

It’s tempting to start trading at $10 or $20 a point simply to see how much money, albeit make-believe money, you can Forex MA Trading in as short a time as possible. However that’s a mistake. If you’re to find out how to trade currencies profitably then you need to treat your $10,000 of make-believe cash as if it were real.

There are lots of strategies and indicators to determine the pattern. My favorite ones are the most simple ones. I like to apply a moving average indication with the a great deal of balancing periods. Rising Stocks MA Trading indicates the uptrend, falling MA shows the sag.

You will be considered a pattern day trader no matter you have $25,000 or not if you make 4 or more day trades in a rolling five-trading-day period. A day trading minimum equity call will be provided on your account needing you to deposit extra funds or securities if your account equity falls below $25,000.

Consider the MA as the exact same thing as the cockpit console on your ship. Moving averages can tell you how quick a trend is moving and in what instructions. Nevertheless, you may ask, exactly what is a moving average indicator and how is it determined? The MA is precisely as it sounds. It is approximately a variety of days of the closing rate of a currency. Take twenty days of closing prices and compute an average. Next, you will chart the existing rate of the market.

Private tolerance for threat is a good barometer for picking what share price to brief. If brand-new to shorting, try reducing the quantity of capital typically used to a trade till ending up being more comfortable with the technique.

This does not take place daily, but this occurs pretty typically to mention it. It has been rather a number of weeks of drawback volatility. I do not think this will choice will hold up in time.

If you are finding instant engaging videos relevant with What Is Ema Forex, and Trading Plan, Trading Trends, Forex Profits, Massive Forex please subscribe in email list now.