What are Moving Averages (SMA & EMA) & HOW to use them

Interesting replays highly rated Swing Trading Basics, Exponential Moving, Forex Candlestick, and Sma Vs Ema Swing Trading, What are Moving Averages (SMA & EMA) & HOW to use them.

Brief introduction to how you can understand and utilize simple but more so exponential moving averages for penny stock and …

Sma Vs Ema Swing Trading, What are Moving Averages (SMA & EMA) & HOW to use them.

Trading Forex – Finest Currencies To Trade

What were these basic analysts missing? It makes no sense at all to enjoy major revenues disappear. There are many methods that can be employed to market time, however the simplest is the Moving Average.

What are Moving Averages (SMA & EMA) & HOW to use them, Play more replays relevant with Sma Vs Ema Swing Trading.

Stock Trading Courses – 7 Pointers To Selecting The Best Course!

When trading Forex, one must be mindful because incorrect expectation of price can happen. Attaining success in currency trading involves a high level of discipline. It just may save you a great deal of money.

In less than 4 years, the rate of oil has increased about 300%, or over $50 a barrel. The Light Crude Constant Contract (of oil futures) hit an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Persistently high oil rates will ultimately slow economic growth, which in turn will cause oil prices to fall, ceritus paribus.

3) Day trading implies quick revenue, do not hold stock for more than 25 min. You can constantly sell with earnings if it starts to fall from top, and after that buy it back later if it Moving Average Trader turn out going up again.

So this system trading at $1000 per trade has a favorable expectancy of $5 per trade when traded over numerous trades. The profit of $5 is 0.5% of the $1000 that is at risk during the trade.

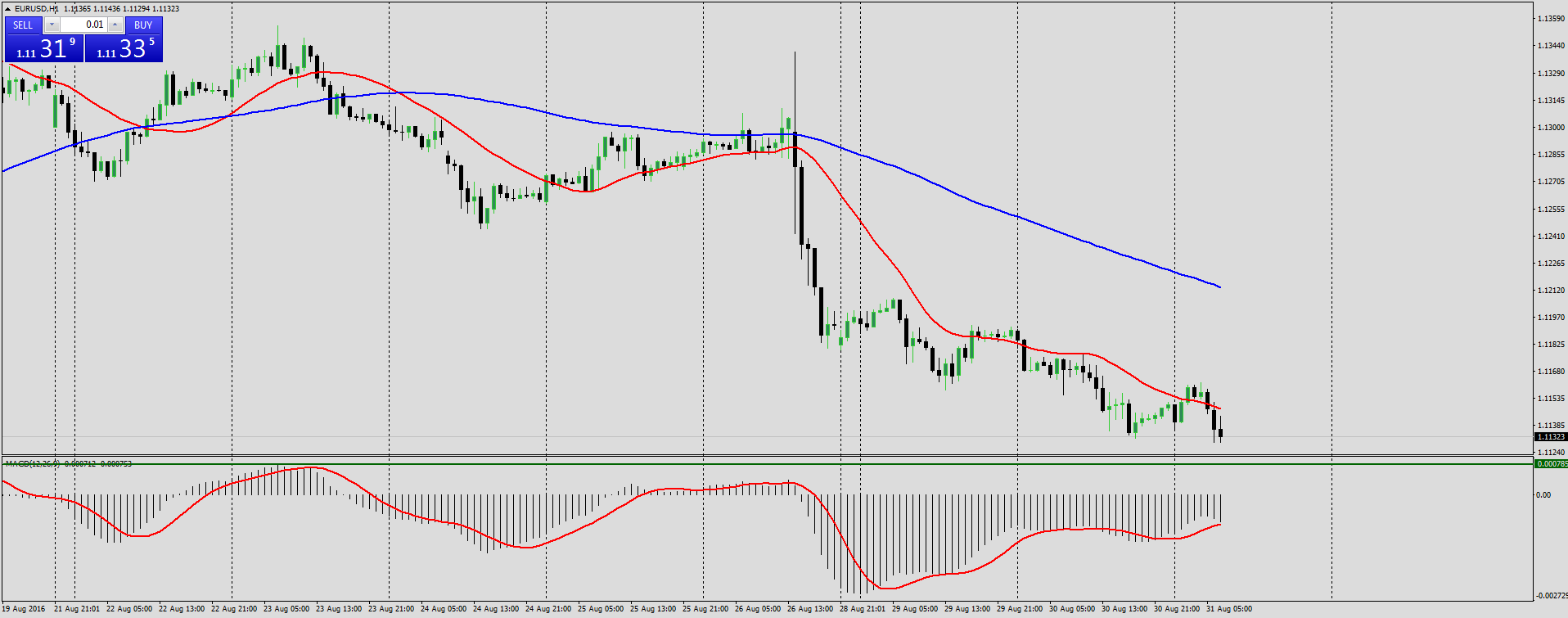

What does that Forex MA Trading inform you about the instructions it is heading? Is it in an upward or a downward trend? Charts of the primary index can inform you this by a fast look. If the line is heading downward then it remains in a downward pattern, however with the chaotic nature of the index price, how do you understand if today’s down is not just a problem and tomorrow it will return up again?

Let us say that we want to make a brief term trade, between 1-10 days. Do a screen for Stocks MA Trading in a new up trend. Bring up the chart of the stock you are interested in and raise the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving typical the stock is going to continue up and ought to be bought. But as quickly as the 9 day crosses over the 4 day it is a sell signal. It is that simple.

The best method to earn money is buying and selling breakouts. If you incorporate them in your forex trading method you can use them to accumulate big gains.

This trading tool works much better on currency set cost history than on stocks. With stocks, cost can gap up or down which causes it to provide incorrect readings. Currency set’s rate action hardly ever spaces.

At the day level there are periods also that the rate does not mostly and durations that the rate change mostly. When London stock opens advertisement when U.S.A. stock opens, the risky time periods are. Likewise there are large modifications when Berlin stock opens. After every one opens, there are frequently big modifications in the rates for a guy hours. The most dangerous period is the time at which 2 stocks are overlapped in time.

This type of day can also occurs on a news day and needs to be approached thoroughly. My favorites are the 20-day and the 50-day moving averages on the S&P 500 index (SPX). In a ranging market, heavy losses will occur.

If you are finding rare and exciting comparisons about Sma Vs Ema Swing Trading, and Primary Trend, Buy Signal, Successful Forex Trading, Forex Education please join for newsletter for free.

![Simple ADX and SMA Indicators Reveal Profitable [Trading Strategy] Simple ADX and SMA Indicators Reveal Profitable [Trading Strategy]](https://MovingAverageTrader.com/wp-content/uploads/Simple-ADX-and-SMA-Indicators-Reveal-Profitable-Trading-Strategy-200x137.jpg)