Swing Trading Strategy Using 200 EMA | 99% Accuracy | Smart Money Investments

https://www.youtube.com/watch?v=2kKXGbwS0u8

Trending replays top searched Trading Trends, Foreign Currency Trading, Stock Trading Online, Daily Forex Signals, and How to Use Ema Trading, Swing Trading Strategy Using 200 EMA | 99% Accuracy | Smart Money Investments.

This is the BEST 200 EMA SWING TRADING STRATEGY every time I trade by this strategy, everybody loves my trading style.

How to Use Ema Trading, Swing Trading Strategy Using 200 EMA | 99% Accuracy | Smart Money Investments.

Stock Exchange Trading – Top 4 Trading Misconceptions That Threaten Your Success

That setup may not occur for XYZ during the rest of the year. Palladium seems holding while platinum is anyone’s guess at this point. Naturally, these moving averages are used as dynamic assistance and resistance levels.

Swing Trading Strategy Using 200 EMA | 99% Accuracy | Smart Money Investments, Play latest full videos relevant with How to Use Ema Trading.

Cost Trends In Forex – A Method To Make Profit

Essentially what market timing does is protect you from any big loss in a bearish market. Oil had its biggest portion drop in 3 years. The rate has actually dropped some $70 from the peak of the last run to $990.

I have actually been trading futures, alternatives and equities for around 23 years. In addition to trading my own cash I have traded money for banks and I have been a broker for private customers. For many years I have actually been amazed to discover the difference between winners and losers in this company.

This environment would suggest that the currency set’s price is trending up or down and breaking out of its current trading variety. When there are modifications affecting the currency’s country, this generally occurs. A quick trending day can be seen when the price of the currency set increases listed below or above the 21 Exponential Moving Typical and then going back to it. A Moving Average Trader ought to study the principles of the nation before deciding how to trade next.

Nasdaq has actually rallied 310 points in three months, and hit a brand-new four-year high at 2,201 Fri early morning. The economic information recommend market pullbacks will be limited, although we’ve gone into the seasonally weak period of Jul-Aug-Sep after a big run-up. Subsequently, there might be a debt consolidation duration instead of a correction over the next couple of months.

The chart below is a Nasdaq weekly chart. Nasdaq has actually been producing an increasing wedge for about 2 years. The Forex MA Trading indicator has actually been moving in the opposite instructions of the rate chart (i.e. negative divergence). The three highs in the wedge fit well. Nevertheless, it doubts if the 3rd low will likewise offer an excellent fit. The wedge is compressing, which must continue to produce volatility. Many intermediate-term technical signs, e.g. NYSE Summation Index, NYSE Oscillator MAs, CBOE Put/Call, etc., recommend the market will be higher sometime within the next couple of months.

She looked into her kid’s eyes and smiled, believing “How basic was that?” She had just drawn up a Stocks MA Trading plan for a put option trade based upon her analysis of that really chart – she believed the rate would go down; how wrong would she have been?

A 50-day moving average line takes 10 weeks of closing cost information, and after that plots the average. The line is recalculated everyday. This will show a stock’s cost trend. It can be up, down, or sideways.

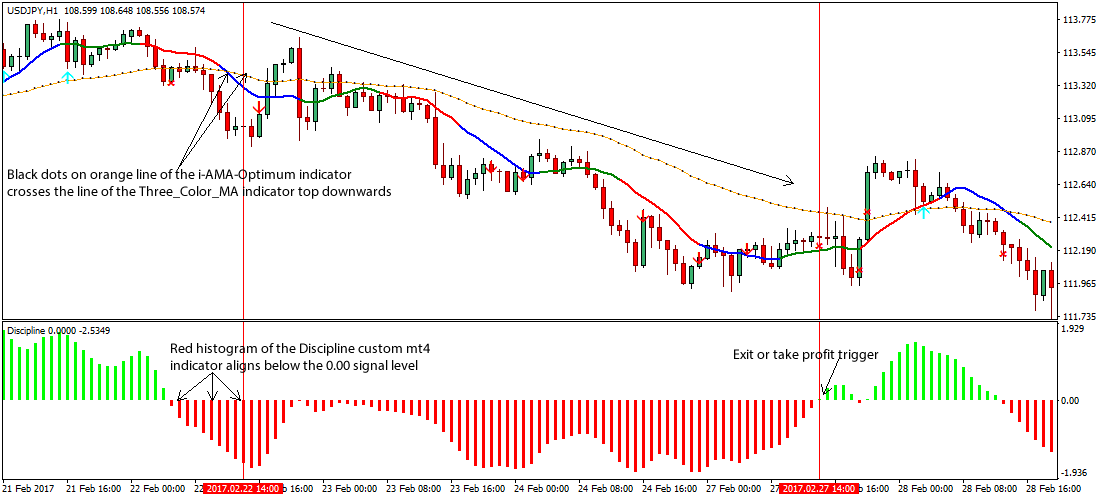

Utilizing the moving averages in your forex trading organization would show to be very useful. Initially, it is so easy to use. It is presented in a chart where all you have to do is to keep a keen eye on the very best entrance and exit points. Thats a sign for you to start buying if the MAs are going up. Nevertheless, if it is going down at a constant pace, then you ought to begin selling. Being able to check out the MAs right would certainly let you realize where and how you are going to make more money.

In this short article is detailed how to sell a trendy and fading market. This post has only detailed one technique for each market circumstance. When they trade Forex online, it is recommended traders use more than one technique.

As a benefit, 2 MAs can likewise function as entry and exit signals. So, when the marketplace is varying, the very best trading method is variety trading. It can be a 10 day MA, 50 day MA, 100 Day MA or 200 Day MA.

If you are searching more entertaining videos related to How to Use Ema Trading, and Learn About Stock Market, Strong Trend, Stock Market Works, Trading Channel you are requested to subscribe in email subscription DB totally free.