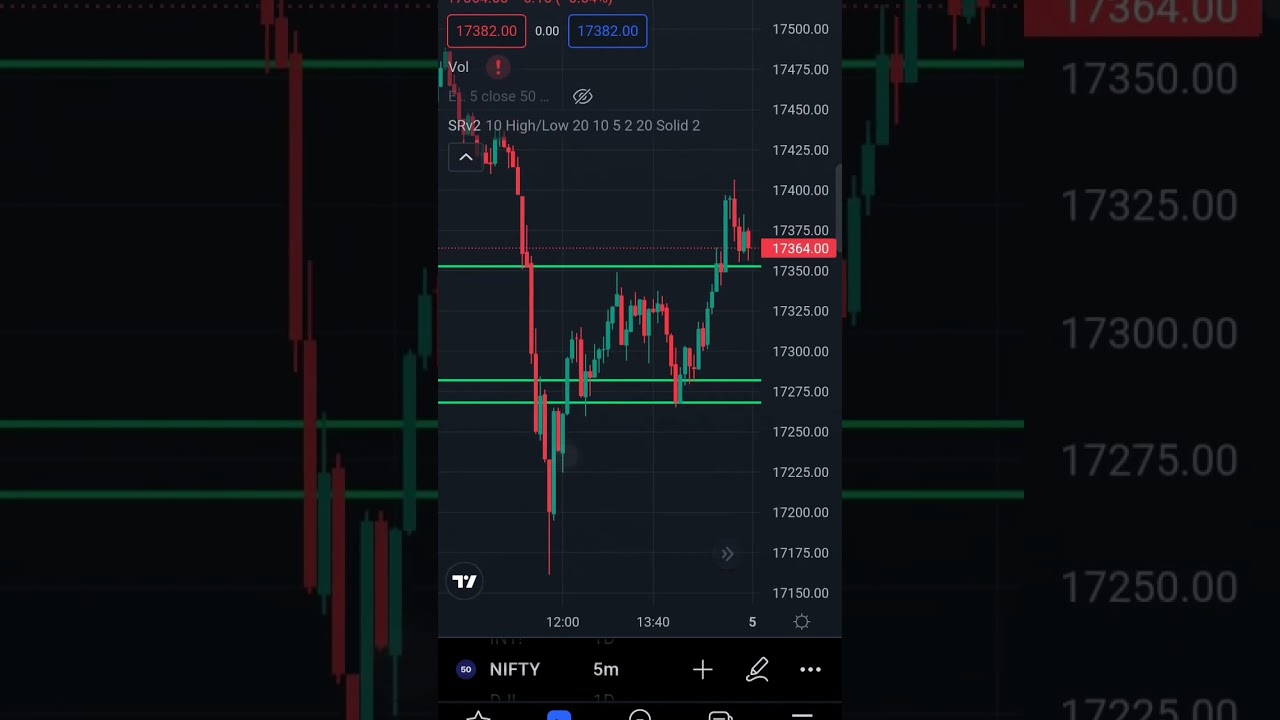

support-Resistance hack 🤑 easy method #sharemarket #buysell #trading #tradingview #indicator

Latest videos about Forex Investors, Moving Average, and How to Add Ema on Tradingview, support-Resistance hack 🤑 easy method #sharemarket #buysell #trading #tradingview #indicator.

support resistance hack

How to Add Ema on Tradingview, support-Resistance hack 🤑 easy method #sharemarket #buysell #trading #tradingview #indicator.

6 Trading Routines To Strive For

The firm likewise slashed its forecast for the first quarter of next year to simply 0.5%. I discover them to be extremely reliable for this function. With stocks, rate can gap up or down which triggers it to give incorrect readings.

support-Resistance hack 🤑 easy method #sharemarket #buysell #trading #tradingview #indicator, Search most shared updated videos about How to Add Ema on Tradingview.

Market Belief Analysis

After all, a lot of indications can lead to decision paralysis. To find a good location for a stop, pretend that you’re thinking about a sell the direction of the stop. A drop is shown by lower highs and lower lows.

A ‘moving’ average (MA) is the typical closing cost of a specific stock (or index) over the last ‘X’ days. For example, if a stock closed at $21 on Tuesday, at $25 on Wednesday, and at $28 on Thursday, its 3-day MA would be $24.66 (the amount of $21, $25, and $28, divided by 3 days).

The time frame is brief and is from 2 minutes to 5 minutes. The fastest scalping technique is tape reading where the Moving Average Trader reads the charts and puts a trade for a short time period. In this article is the focus on longer trades than the brief tape reading method.

This is a great concern. The answer is rather fascinating though. It is simply because everybody is utilizing it, specifically those huge banks and institutions. They all utilize it that way, so it works that way. In fact, there are mathematic and statistic theories behind it. If you are interested in it, welcome to do more research study on this one. This post is for routine readers. So I do not want to get too deep into this.

To make this much easier to comprehend, let’s put some numbers to it. These are simplified examples to highlight the idea and the numbers Forex MA Trading or might not match genuine FX trading strategies.

You have actually probably heard the phrase that “booming Stocks MA Trading climb up a wall of concern” – well there doesn’t appear to be much of a wall of concern left anymore. At least as far as the retail financier is worried.

In addition, if the 5 day moving average is pointing down then remain away, think about an additional product, one where by the 5-day moving average is moving north. And do not buy a trade stock when it really is down below its two-hundred day moving average.

If the price of my stock or ETF falls to the 20-day SMA and closes below it, I like to include a few Put choices– perhaps a third of my position. If the stock then continues down and heads toward the 50-day SMA, I’ll include another 3rd. I’ll add another third if the cost closes below the 50-day SMA.

Long as the stock holds above that breakout level. That provides the stock support at that level. Institutions are huge buyers on breakouts, and they will often step in and purchase stocks at assistance levels to keep the stock moving too.

This research study was among the very first to determine volatility as a vibrant movement. All over the internet there are conversations about trading methods – what truly works and what does not.

If you are finding updated and exciting comparisons relevant with How to Add Ema on Tradingview, and Forex Beginners – a Simple Scalping Strategy for High Volume Conditions, Successful Trading, Win at Forex dont forget to subscribe in email alerts service now.