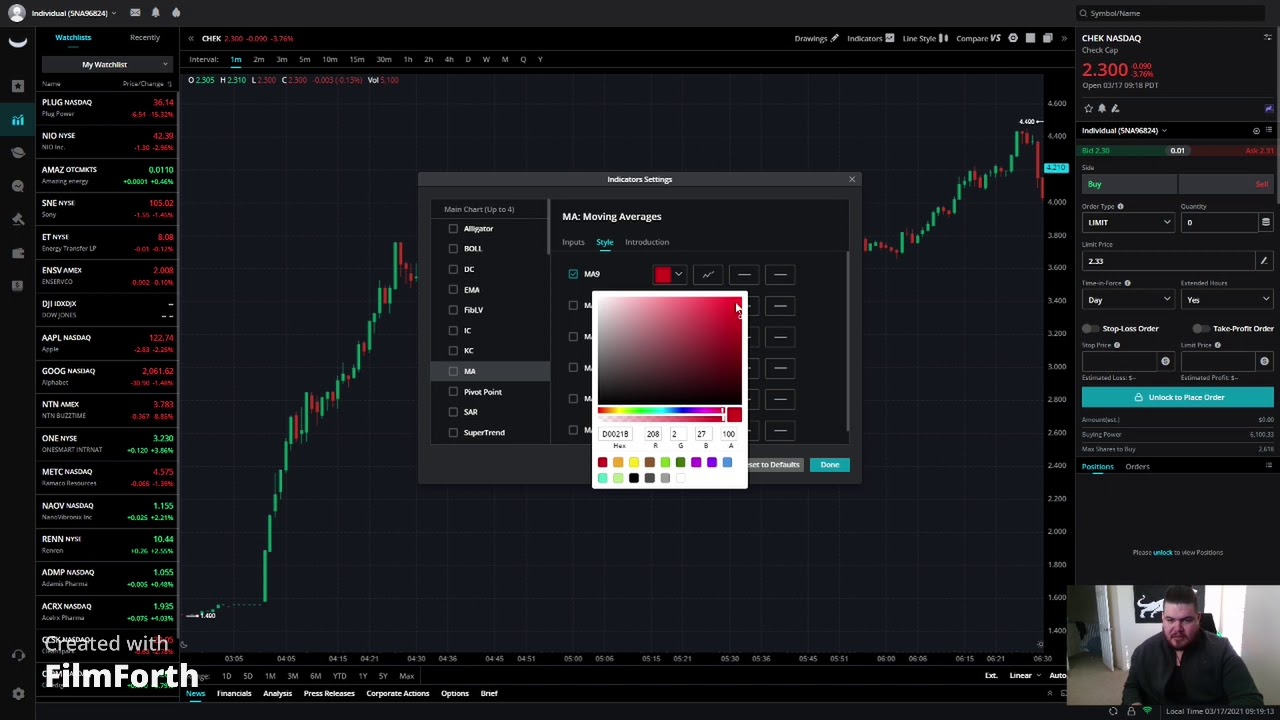

SMA/MA on Webull, its same thing

Latest full videos about Share Market, How to Buy Stocks, Forex Online Trading, Trading Trading Strategies, and What Is Sma In Trading, SMA/MA on Webull, its same thing.

Learning SMA indicator.

Facebook Page: https://www.facebook.com/groups/bullstocks

TikTok

@bull_stocks

@jrockstocks

Check out Webull, its current promotion is:

Sign up and open an account, you can get a free stock valued $2.5-$250

If you make an initial deposit to your account of at least $100, you get two free stocks, each valued $8-$1600.

Remember all has to be done b4 30 days so you can get the promotion.

Get Webull at: https://act.webull.com/ve/3mEXLTEwuPg…

What Is Sma In Trading, SMA/MA on Webull, its same thing.

Create Positive Returns On A Monthly Basis With Forex Trading System

They are assistance, resistance, volume, stochastic and 18 bar moving average. Traders wait till the fast one crosses over or listed below the slower one. The green line portrays the major fight location for $1,000.

SMA/MA on Webull, its same thing, Play most shared complete videos about What Is Sma In Trading.

Forex Scalping Trading Systems

SPX, for instance, normally traded within 1,170 and 1,200, i.e. multi-year assistance at 1,165 and the 200 day MA at 1,200. You simply have to have patience and discipline. Do this three times or more to develop a trend.

If you have been in currency trading for any length of time you have heard the following 2 phrases, “pattern trade” and “counter trend trade.” These 2 approaches of trading have the same validity and require just as much work to master. I like trading counter trend since I have found a system that permits me to discover high frequency trades.

A normal forex rate chart can look extremely erratic and forex candlesticks can obscure the pattern even more. The Moving Average Trader average provides a smoothed graph that is outlined on top of the forex chart, alongside the japanese candlesticks.

Leave your trade once the pattern is broken! Cut your losses, and let the long flights make up for these small losses. Once the pattern has actually been restored, you can re-enter your trade.

Choosing an amount of time: If your day trading, purchasing and selling intra day, a 3 year chart will not help you. For intra day trading you wish to use 3,5 and 15 minute charts. Depending upon your longterm financial investment technique you can look at a 1 year, which I utilize frequently to a 10 year chart. The yearly chart give me a take a look at how the stock is doing now in today’s market. I’ll look longer for historical assistance and resistance points but will Forex MA Trading my buys and sells based upon what I see in front of me in the yearly.

A well implying good friend had discussed an alternatives trading course he had gone to and recommended that trading might be a way for Sidney to Stocks MA Trading above typical returns on her compensation payment money, as interest and dividends would not be able to offer adequate earnings for the family to survive on.

Here is an ideal example of a strategy that is basic, yet clever adequate to ensure you some included wealth. Start by choosing a particular trade that you believe is successful, say EUR/USD or GBP/USD. When done, select two indications: weighted MA and basic MA. It is advised that you use a 20 point weighted moving typical and a 30 point moving average on your 1 hour chart. The next step is to watch out for the signal to sell.

Think of the MA as the same thing as the cockpit console on your ship. Moving averages can tell you how quick a trend is moving and in what direction. Nevertheless, you may ask, exactly what is a moving typical indicator and how is it determined? The MA is precisely as it sounds. It is an average of a number of days of the closing rate of a currency. Take twenty days of closing prices and determine an average. Next, you will chart the current cost of the marketplace.

There you have the two most important lessons in Bollinger Bands. The HIG pattern I call riding the wave, and the CIT pattern I call fish lips. Riding the wave can generally be done longer as much as two months, utilizing stops along the method, one does not even actually need to see it, naturally one can as they ca-ching in one those safe profits. The other pattern is fish lips, they are usually held for less than a month, and are exited upon upper band touches, or mare exactly retreats from upper band touches. When the price touches the upper band and then retreats), (. Fish lips that re formed out of a flat pattern can frequently turn into ‘riding the wave,’ and then are held longer.

When trading Forex, one need to beware due to the fact that incorrect expectation of rate can take place. Utilizing the moving averages in your forex trading organization would prove to be really useful.

If you are finding unique and engaging videos relevant with What Is Sma In Trading, and Oil Stocks, Two Moving Averages, Pips Currency Trade please signup our email list for free.