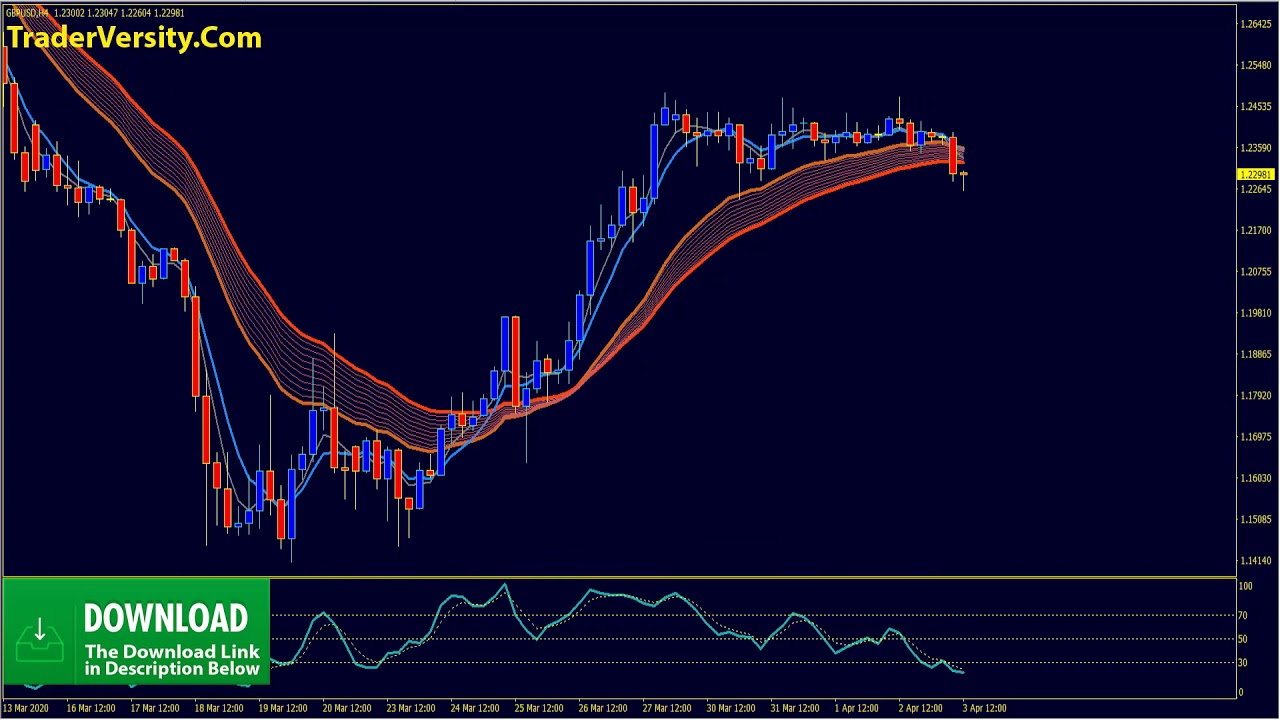

Multi MA OverSold OverBought MT4 Trading with Stochastic Oscillator Filter

Best complete video highly rated Forex Megadroid, 200-Day Moving Average, Ema Indicator, Market Swings, and Ma Crossover mt4, Multi MA OverSold OverBought MT4 Trading with Stochastic Oscillator Filter.

DOWNLOAD TRADING INDICATORS & TEMPLATE:

Multi Moving Average OverBought-OverSold Trading Strategy with Stochastic Oscillator Filter [7638]

SUBSCRIBE: https://www.youtube.com/channel/UCFo1KNyG-0qYKKIV47udmgg?sub_confirmation=1

FACEBOOK: https://web.facebook.com/ForexOnlineTradingClub/

The simplest method for using the Multiple Moving Average indicator is to trade a basic moving average crossover system.

This system would BUY when all of the short-term EMAs cross above all of the long-term EMAs and SELL when the short term EMAs cross below the long-term EMAs.

Ma Crossover mt4, Multi MA OverSold OverBought MT4 Trading with Stochastic Oscillator Filter.

Forex Trading Strategies

A move far from the BI suggests that one side is more powerful than the other. They are extremely helpful in revealing trends by removing price sound. We only desire the average to assist us identify the trend.

Multi MA OverSold OverBought MT4 Trading with Stochastic Oscillator Filter, Play trending full length videos related to Ma Crossover mt4.

Discover How To Use Moving Typical Efficiently To Make Your Trade Decision

The strongest signal is where the existing cost goes through both the SMAs at a steep angle. On April 28, the gold-silver ratio was about 30, relatively low. I have been trading futures, choices and equities for around 23 years.

I have actually been trading futures, options and equities for around 23 years. As well as trading my own cash I have actually traded cash for banks and I have been a broker for personal clients. For many years I have been amazed to find the distinction between winners and losers in this company.

Nevertheless, if there is a breakout through among the outer bands, the rate will tend to continue in the same direction for a while and robustly so if there is a boost Moving Average Trader in volume.

The dictionary prices quote a typical as “the ratio of any sum divided by the number of its terms” so if you were working out a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would add them together and divide them by 10, so the average would be 55.

You require to determine the beginning of the break out that produced the relocation you are going to trade versus. Many people use Assistance and resistance lines to determine these locations. I find them to be very Forex MA Trading effective for this function.

During these times, the Stocks MA Trading regularly breaks assistance and resistance. Naturally, after the break, the rates will typically pullback before advancing its way.

The advantage of a regular trading method is that if it is a rewarding trading method, it will have a greater return the more times it trades, utilizing a lower leverage. This is mentioning the obvious, however it is often ignored when picking a trading method. The objective is to make more revenue using the least amount of leverage or risk.

The second action is the “Get Set” step. In this step, you might increase your money and gold allotments further. You might also begin to move cash into bear ETFs. These funds increase when the market decreases. Funds to consider include SH, the inverse of the S&P 500, PET DOG, the inverse of the Dow Jones Industrial average, and PSQ, the inverse of the NASDAQ index.

Daily Moving Averages: There are many moving averages which is just the average cost of a stock over a long duration of time, on a yearly chart I like to utilize 50, 100 and 200 day-to-day moving averages. They provide a long smoothed out curve of the average cost. These lines will likewise become assistance and resistance points as a stock trades above or below its moving averages.

You just need to have patience and discipline. As your stock goes up in cost, there is a key line you wish to see. Pivot point trading is just one of a toolbox of weapons readily available to Forex market individuals.

If you are searching best ever engaging videos relevant with Ma Crossover mt4, and Currency Trading Course, Compare Online Trading, Forex Trading Techniques you should signup in newsletter now.