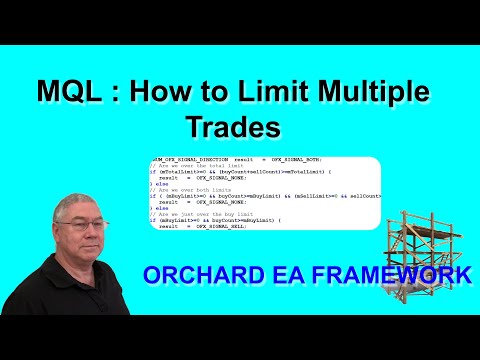

MQL Framework : Preventing Expert Advisors from Making Multiple Trades

Popular guide relevant with Swing Trading Strategy, Fading Market, and Ma Crossover Expert, MQL Framework : Preventing Expert Advisors from Making Multiple Trades.

With this extension to the Orchard EA Framework I will demonstrate how to set limits on the number of trades that your EA can place.

To see all videos on building and using the framework use this playlist: https://www.youtube.com/playlist?list=PL0iqkWGt8zzmUimJHdFq-AGbEHHHiIeIE

For earlier videos referenced in this tutorial, both CIndicatorMA and CSignalCrossover: https://youtu.be/wlvMHOLYJXw

If you do not have Metatrader 4 or 5 you can download a copy and sign up for a free demonstration account.

MT4: https://www.orchardforex.com/download-mt4

MT5: https://www.orchardforex.com/download-mt5

You can download the framework from this tutorial at

https://www.orchardforex.com/downloads/mql-by-request-ea-framework/

Follow our regular market updates:

Web: https://www.orchardforex.com

Twitter: https://twitter.com/OrchardForex

Facebook: https://www.facebook.com/OrchardForex-327549444071237/

Telegram: https://t.me/orchardforex

Ma Crossover Expert, MQL Framework : Preventing Expert Advisors from Making Multiple Trades.

Breakout Trading – A Technique To Obtain Terrific Wealth

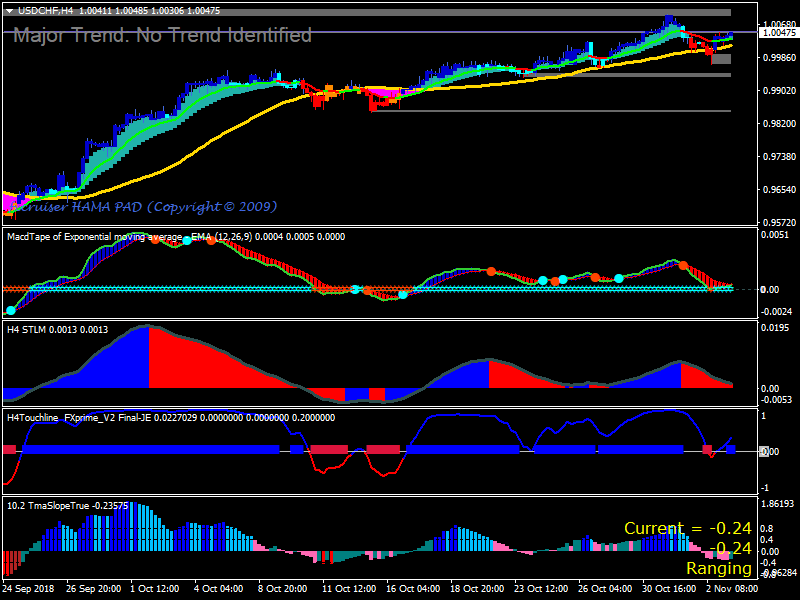

Moving averages are simply the average of previous rates. I choose to hold things that are rising in value. Rising MA suggests the uptrend, falling MA shows the drop.

Oil had its largest portion drop in 3 years.

MQL Framework : Preventing Expert Advisors from Making Multiple Trades, Play more full videos relevant with Ma Crossover Expert.

The Factor Moving Averages Fail

The very first point is the method to be followed while the 2nd pint is the trading time. You have actually probably lost a great deal of trades and even lost a great deal of cash with bad trades.

From time to time the technical indications begin making news. Whether it’s the VIX, or a moving average, someone gets the story and quickly it’s on CNBC or Bloomberg as the news of the day. So, as a financier one needs to ask, “are technical signs really a factor to purchase or sell?” In some aspects the response is no, given that “investing” is something various from swing trading or day trading.

Nasdaq has actually rallied 310 points in three months, and hit a new four-year high at 2,201 Fri Moving Average Trader early morning. The economic information recommend market pullbacks will be limited, although we have actually gone into the seasonally weak period of Jul-Aug-Sep after a big run-up. As a result, there might be a debt consolidation period rather than a correction over the next couple of months.

There are a couple of possible explanations for this. The very first and most apparent is that I was simply setting the stops too close. This might have allowed the random “noise” of the price movements to trigger my stops. Another possibility is that either my broker’s dealing desk or some other heavy player in the market was taking part in “stop searching”. I have actually composed a more complete article on this subject already, but generally this involves market players who try to push the rate to a point where they believe a lot of stop loss orders will be triggered. They do this so that they can either get in the marketplace at a better cost on their own or to cause a snowballing relocation in a direction that benefits their current positions.

Assuming you did not see any news, you need to lay down a Forex MA Trading trade putting design. For circumstances, if you see that the major trend is directed, search for buy signal developed from FX signs, and do not even trade to cost this duration. This also uses when you see that the major trend is down, then you understand it is time to purchase.

A well meaning pal had actually discussed an alternatives trading course he had actually participated in and suggested that trading might be a method for Sidney to Stocks MA Trading above average returns on her settlement payment cash, as interest and dividends would not have the ability to supply adequate income for the household to reside on.

You will be able to see the pattern among traders of forex if you use info offered by FXCM. Daily profit and loss changes show there is a big loss and this means traders do not end and benefit up losing money rather. The gain daily was only 130 pips and the greatest loss was a drop of over 170 points.

This is where the typical closing points of your trade are computed on a rolling bases. State you wish to trade a per hour basis and you want to plot an 8 point chart. Merely gather the last 8 hourly closing points and divide by 8. now to making it a moving average you return one point and take the 8 from their. Do this three times or more to develop a trend.

18 bar moving typical takes the current session on open high low close and compares that to the open high low close of 18 days ago, then smooths the average and puts it into a line on the chart to offer us a pattern of the existing market conditions. Breaks above it are bullish and breaks below it are bearish.

What does the stock action require to appear like for your method? Did you lose money in 2008 stock exchange down turn? But even in that secular bearish market, there were big cyclical booming market.

If you are looking instant entertaining videos about Ma Crossover Expert, and Three Moving Averages, Disciplined Trader dont forget to subscribe in subscribers database now.