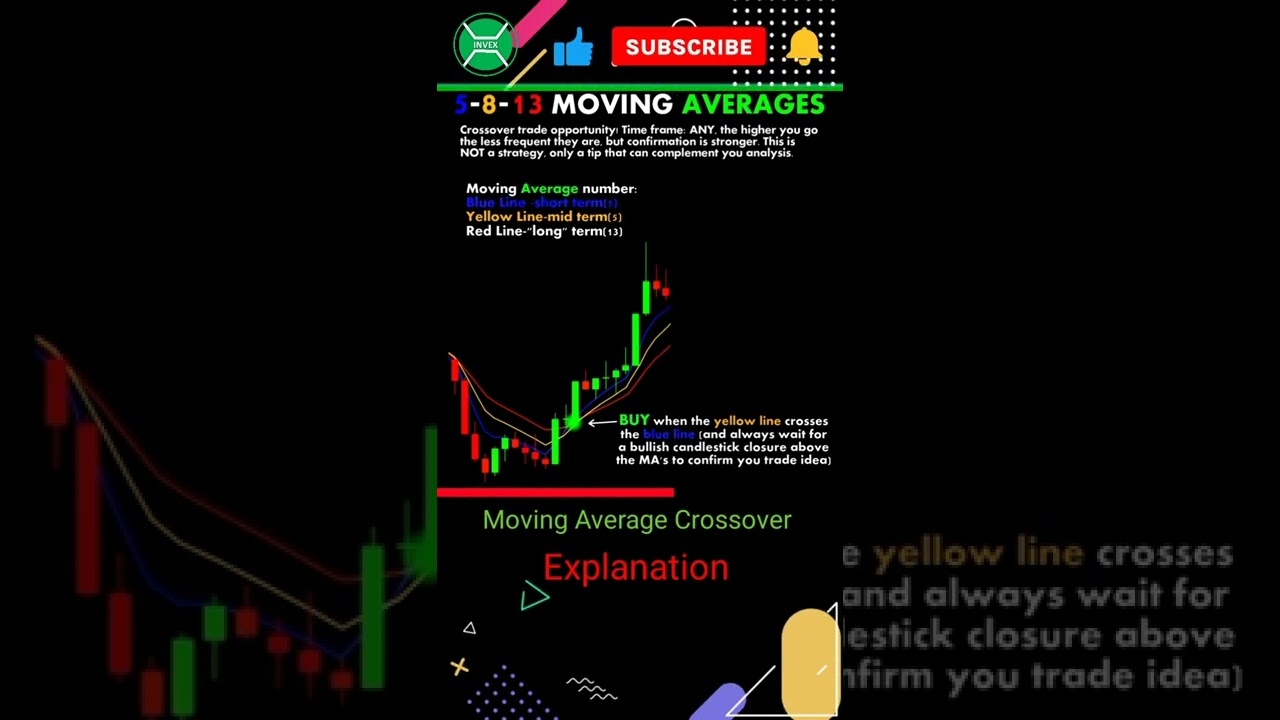

Moving Average Crossover Trading strategy | #stockmarket | #forex | #cryptocurrency | #trading

Latest full videos highly rated Stock Market Information, Foreign Currency Trading, Megadroid Trading Robot, Forex Beginners – a Simple Scalping Strategy for High Volume Conditions, and Ma Crossover Strategy, Moving Average Crossover Trading strategy | #stockmarket | #forex | #cryptocurrency | #trading.

Hi everyone, Welcome to our Community ! ______ About the video:- Moving Average Crossover Trading strategy!!! #chartpatterns …

Ma Crossover Strategy, Moving Average Crossover Trading strategy | #stockmarket | #forex | #cryptocurrency | #trading.

Use The Bias Indicator To Assist You With Your Day Trading

However if you have a couple of bad trades, it can actually sour you on the entire trading video game. This means that you require to understand how to manage the trade before you take an entry.

Moving Average Crossover Trading strategy | #stockmarket | #forex | #cryptocurrency | #trading, Enjoy top videos related to Ma Crossover Strategy.

Forex Account Management – How To Safeguard Your Account From The Threats You Take

Did you gain cash in the recent stock bull-run began because March of 2009? An e-mailed article implies you have at least strike the interest nerve of some member of your target audience.

In less than four years, the cost of oil has increased about 300%, or over $50 a barrel. The Light Crude Constant Agreement (of oil futures) hit an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Persistently high oil prices will ultimately slow economic development, which in turn will trigger oil rates to fall, ceritus paribus.

A common forex rate chart can look very irregular and forex candlesticks can obscure the pattern further. The Moving Average Trader average gives a smoothed graph that is outlined on top of the forex chart, together with the japanese candlesticks.

So this system trading at $1000 per trade has a favorable span of $5 per trade when traded over many trades. The revenue of $5 is 0.5% of the $1000 that is at threat during the trade.

It’s tempting to start trading at $10 or $20 a point simply to see just how much cash, albeit make-believe cash, you can Forex MA Trading in as brief a time as possible. However that’s an error. Then you must treat your $10,000 of make-believe cash as if it were real, if you’re to learn how to trade currencies successfully.

One of the main indications that can help you develop the method the index is moving is the Moving Typical (MA). This takes the index price over the last given number of days and averages it. With each brand-new day it drops the very first rate used in the previous day’s calculation. If you are looking to day trade or invest, it’s constantly excellent to check the MA of numerous periods depending. If you’re looking to day trade then a MA over 5, 15, and 30 minutes are a good concept. Then 50, 100, and 200 days may be more what you need, if you’re looking for long term investment. For those who have trades lasting a couple of days to a couple of weeks then periods of 10, 20 and 50 days Stocks MA Trading be better suited.

Good forex trading and investing involves increasing revenues and decreasing probabilities of loss. This is not done, specifically by newbies in the field. They do not understand appropriate trading strategies.

Stochastics is used to determine whether the marketplace is overbought or oversold. The marketplace is overbought when it reaches the resistance and it is oversold when it reaches the assistance. So when you are trading a range, stochastics is the best indicator to tell you when it is overbought or oversold. It is likewise called a Momentum Indicator!

Now, this extremely important if you alter the number of periods of the basic moving average, you must change the standard deviation of the bands as well. For instance if you increase the duration to 50, increase the standard deviation to two and a half and if you decrease the duration to 10, reduce the basic deviation to one and a half. Periods less than 10 do not seem to work well. 20 or 21 period is the optimum setting.

Keep in mind, the bands inform you where the rate will fall in relative to the 20 day moving average. Ranging methods that the marketplace is moving sideways without any clear trend present in it.

If you are looking instant exciting videos related to Ma Crossover Strategy, and Pivot Point Trading, Forex Online, Forex Scalping you should subscribe our email list now.