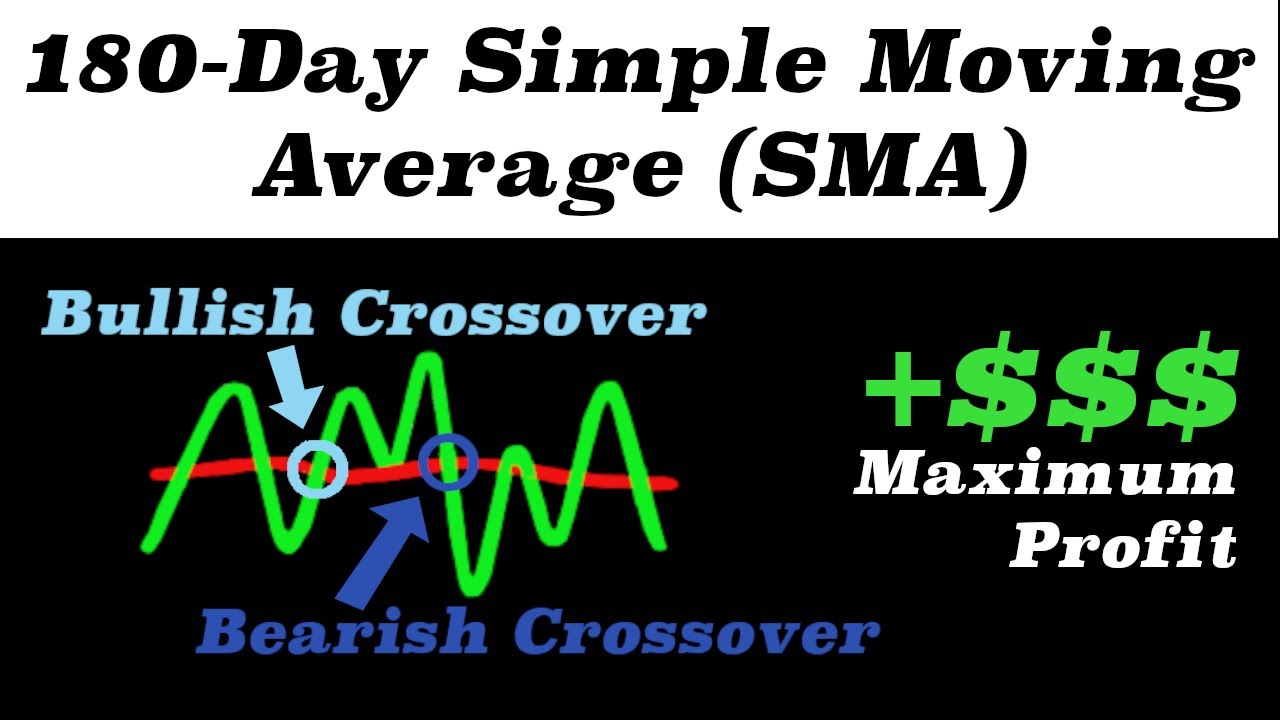

How To Use The SMA (Simple Moving Average) In Stock Trading

Latest YouTube videos about Online Forex Trading, Swing Trading, and What Is Sma In Trading, How To Use The SMA (Simple Moving Average) In Stock Trading.

The basic fundamentals of the SMA (Simple Moving Average). We discuss what crossover represents, the differences between crossing over the line and testing the line as resistance, and how to use the SMA to maximize profits.

Subscribe to Pennant Players for more stock trading lessons. If you have any questions, feel free to comment down below. Stay green!

Disclaimer:

Pennant Players is not a certified financial advisor, and should not serve as such. Anything on this channel should not be seen or taken as financial advice. These videos are solely for entertainment purposes. All trading strategies presented in our videos are based on our opinions and experiences in the stock market.

What Is Sma In Trading, How To Use The SMA (Simple Moving Average) In Stock Trading.

How To Create Favorable Returns Every Month With Forex Trading System?

You do not have to suffer the 40% portfolio losses that many individuals performed in 2008. Moving average is among many technical analysis signs. Excessive in and out trading can be both mentally and economically damaging.

How To Use The SMA (Simple Moving Average) In Stock Trading, Find latest updated videos relevant with What Is Sma In Trading.

Remaining On The Best Side Of The Trend

A method that is reasonably popular with traders is the EMA crossover. Comparing the closing cost with the MA can assist you identify the pattern, one of the most crucial things in trading. Oil had its biggest percentage drop in 3 years.

When you retire, I can’t tell you how much cash you are going to require. If the amount is not enough it is not ‘when’, however ‘if’. You may need to keep working and hope one of those greeter tasks is offered at Wal-Mart.

A typical forex price chart can look very erratic and forex candlesticks can obscure the pattern even more. The Moving Average Trader typical provides a smoothed graph that is outlined on top of the forex chart, along with the japanese candlesticks.

The two charts below are exact same duration daily charts of SPX (S&P 500) and OIH (an oil ETF, which is a basket of oil stocks). Over 15% of SPX are energy & utility stocks. The two charts below show SPX started the recent rally about a month before OIH. Also, the charts imply, non-energy & energy stocks fell over the previous week approximately, while energy & utility stocks stayed high or rose further.

You require to determine the start of the break out that created the move you are going to trade versus. Many people utilize Support and resistance lines to determine these locations. I find them to be very Forex MA Trading reliable for this purpose.

This suggests that you require to understand how to manage the trade prior to you take an entry. In a trade management technique, you should have written out precisely how you will manage the trade after it is participated in the Stocks MA Trading so you understand what to do when things come up. Conquering trade management is really essential for success in trading. This part of the system must consist of details about how you will respond to all kinds of conditions one you go into the trade.

The new short positions will have protective stops put reasonably near the marketplace considering that danger should constantly be the top factor to consider when identifying a trade’s appropriateness. This week’s action plainly showed that the market has run out of people happy to develop brand-new brief positions under 17.55. Markets always go to where the action is. The declining ranges integrated with this week’s reversal bar lead me to believe that the next relocation is greater.

Stochastics indicator has actually got 2 lines known as %K and %D. Both these lines are plotted on the horizontal axis for a given time duration. The vertical axis is plotted on a scale from 0% to 100%.

A method to measure the speed or significance of the move you are going to trade versus. This is the trickiest part of the formula. The most common method is to measure the slope of a MA versus an otherwise longer term trend.

The most used MA figures consist of the 20 Day MA, the 50 Day MA and the 200 Day MA. You’ve probably realized that trading online is not almost as easy as you thought it was. Likewise active trading can impact your tax rates.

If you are finding instant engaging comparisons about What Is Sma In Trading, and Ema Indicator, Basics of Swing Trading please subscribe in email list for free.