WMA VS SMA in a forex market

https://www.youtube.com/watch?v=NI0mnPLbYnk

Popular replays top searched Range Trading, Buying Conditions, Disciplined Trader, Swing Trading for Beginners, and What Is Sma In Trading, WMA VS SMA in a forex market.

Are you looking for an effective way to trade in the Forex market? https://t.me/+4ti823FKA7diOTc0 WMA vs SMA in a Forex market …

What Is Sma In Trading, WMA VS SMA in a forex market.

Mastering Trading Methods – The Key To Forex Day Trading Success

Occasionally the technical signs begin making news. Rather, you must concentrate on 4 to 5 indications to make a trading choice. These kind of traders can’t see their trade breaking them.

WMA VS SMA in a forex market, Play trending videos related to What Is Sma In Trading.

Forex Trading System – Following The Trend

You just have to have perseverance and discipline. You need to develop your own system of day trading. The bulk of 3rd quarter profits were reported over the previous 2 weeks. The other days SMA was an average of the cost points 1 – 8.

Occasionally the technical indications begin making news. Whether it’s the VIX, or a moving average, someone gets the story and quickly it’s on CNBC or Bloomberg as the news of the day. So, as an investor one has to ask, “are technical signs actually a factor to buy or offer?” In some respects the response is no, given that “investing” is something various from swing trading or day trading.

“Remember this Paul,” Peter Moving Average Trader stated as they studied the long term chart, “Wealth originates from looking at the huge image. Numerous people believe that holding for the long term indicates permanently. I prefer to hold things that are increasing in value.If the trend refuses, I take my cash and wait until the pattern shows up again.

The technical analysis should likewise be determined by the Forex trader. This is to forecast the future pattern of the rate. Common indications utilized are the moving averages, MACD, stochastic, RSI, and pivot points. Note that the previous indicators can be used in combination and not only one. This is to validate that the price pattern holds true.

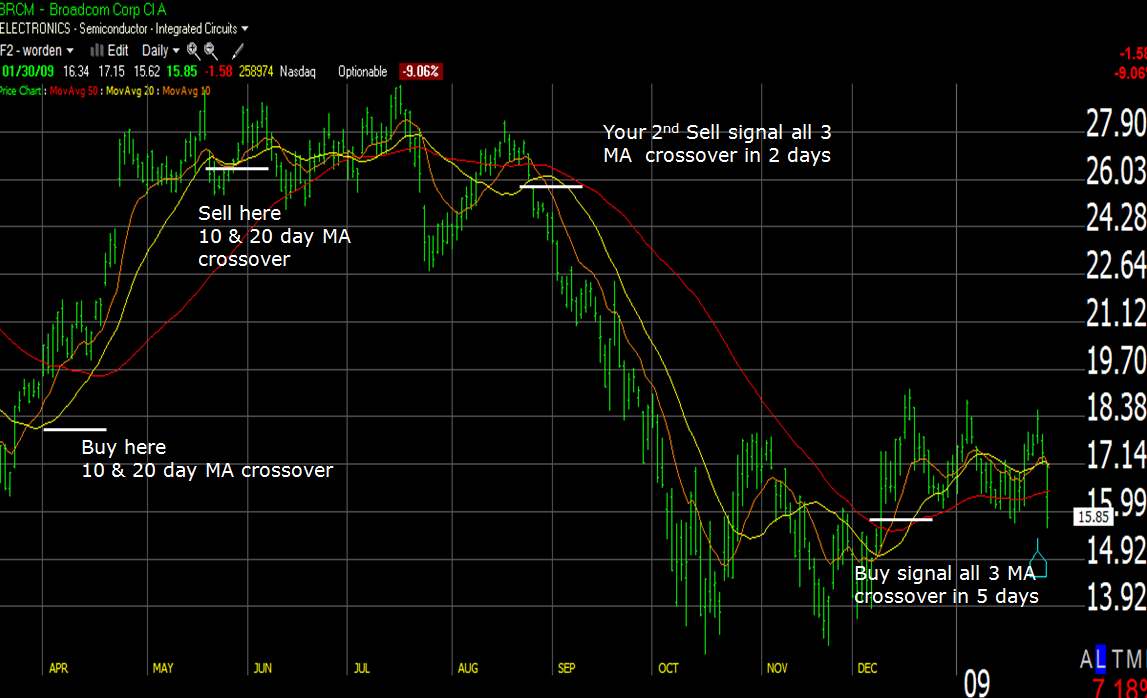

The chart below is a Nasdaq weekly chart. Nasdaq has actually been developing a rising wedge for about two years. The Forex MA Trading sign has actually been relocating the opposite direction of the rate chart (i.e. negative divergence). The 3 highs in the wedge fit well. Nevertheless, it doubts if the third low will also give a great fit. The wedge is compressing, which need to continue to generate volatility. Numerous intermediate-term technical indicators, e.g. NYSE Summation Index, NYSE Oscillator MAs, CBOE Put/Call, and so on, suggest the market will be higher at some point within the next few months.

Follow your trading personality. What are your needs? What are your goals? Do the research, discover the Stocks MA Trading styles that fit your needs, figure out which indications work for you etc.

So, when you utilize MAs, they drag the rate action and whatever trading signals that you get are always late. This is really important to understand. Another constraint with MAs is that they tend to whipsaw a lot in a choppy market. They work well when the marketplace is trending nicely however whipsaw a lot under a market moving sideways. The shorter the time period utilized in an MA, the more whipsaw it will have. Shorter duration MAs move quickly while longer duration MAs move gradually.

Shorting isn’t for everyone, but here’s one of my approaches for picking stocks to brief. Weak point is a stock trading listed below the 200 day moving average – make a list of all stocks that are trading beneath that level.

Daily Moving Averages: There are many moving averages which is simply the typical cost of a stock over an extended period of time, on an annual chart I like to utilize 50, 100 and 200 daily moving averages. They supply a long smoothed out curve of the typical cost. These lines will likewise become assistance and resistance points as a stock trades above or listed below its moving averages.

What does the stock action need to look like for your method? Did you lose money in 2008 stock market down turn? However even because nonreligious bearish market, there were big cyclical bull markets.

If you are looking more exciting reviews relevant with What Is Sma In Trading, and Call Options, Stock Pick, Large Cap Stocks you should list your email address in email list now.