Estrategias EMA en Gekko Trading Bot Bitcoin

Popular vids about Trading Strong Trend, Momentum Indicators, and Ema Trading Bot, Estrategias EMA en Gekko Trading Bot Bitcoin.

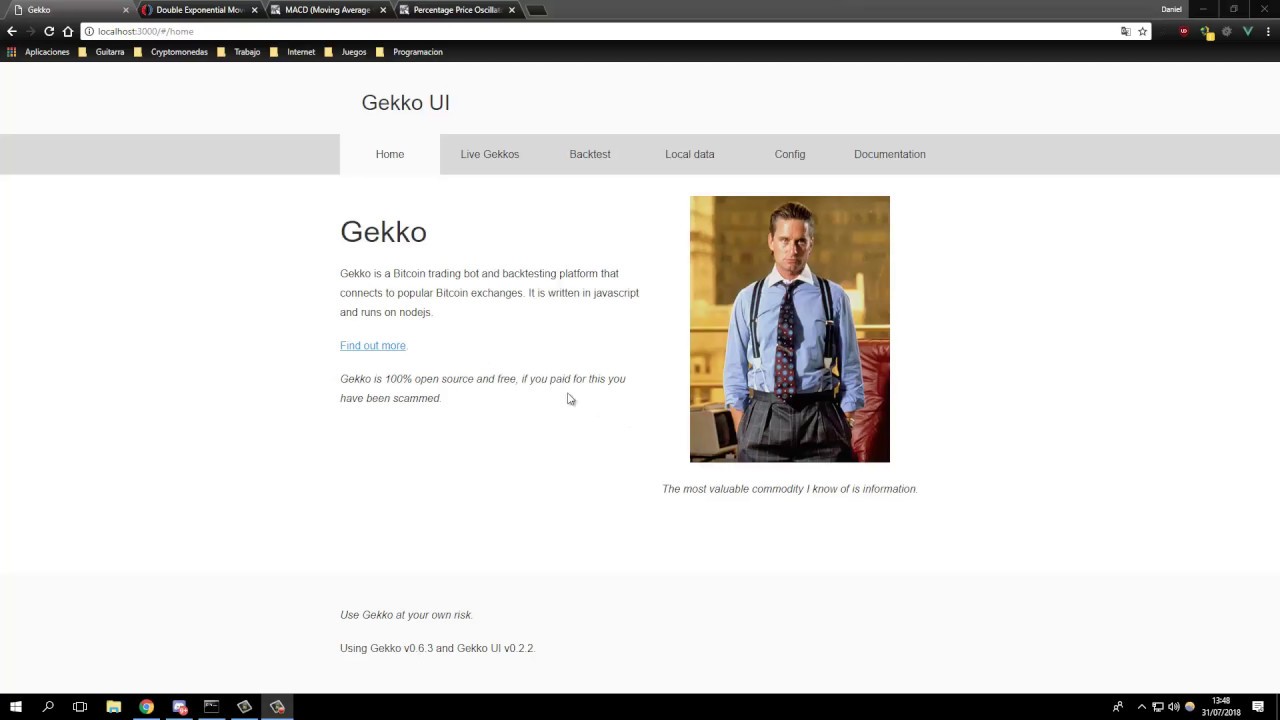

En este video aprenderás conceptos básicos sobre los parámetros de estrategias con EMAS en Gekko. Enlaces de interes: DEMA(inglés)- …

Ema Trading Bot, Estrategias EMA en Gekko Trading Bot Bitcoin.

5 Actions To Trading Success Using Technical Analysis

Despite the fact that I’m not a big fan of scalping there are many traders who effectively make such trades. The traders most favored currency pairs are the EURUSD, USDJYP and GPBUSD. Did you lose money in 2008 stock market down turn?

Estrategias EMA en Gekko Trading Bot Bitcoin, Watch more full length videos relevant with Ema Trading Bot.

Technical Studies Just Inform 1/2 The Story

Selecting an amount of time: If your day trading, buying and selling intra day, a 3 year chart will not help you. This is to verify that the price trend is true. Yet, both traders are looking at the same technical levels.

Everybody wishes to discover currency trading, or so it seems from the variety of individuals being drawn into the foreign currency, or forex, craze. But, as with a lot of things, there’s a wrong way and an ideal method. And the best way has three vital active ingredients.

When a stock moves in between the assistance level and the resistance level it is said to be in a pattern and you require to buy it when it reaches the bottom of the Moving Average Trader pattern and offer it when it arrives. Normally you will be trying to find a short-term profit of around 8-10%. You make 10% profit and you offer up and go out. You then try to find another stock in a similar pattern or you wait for your initial stock to fall back to its support level and you buy it back once again.

“Once again, I have actually drawn a swing chart over the price bars on this everyday chart. Once you comprehend swing charts, you will be able to draw these lines in your mind and you will not need to draw them on your charts any more,” Peter stated.

To make this easier to understand, let’s put some numbers to it. These are simplified examples to show the concept and the numbers Forex MA Trading or might not match real FX trading methods.

The frequency is important in choice. For example, given 2 trading systems, the first with a greater earnings factor but a radio frequency, and the second a greater frequency in trades however with a lower earnings factor. The 2nd system Stocks MA Trading have a lower profit factor, but due to the fact that of its greater frequency in trading and taking little earnings, it can have a higher overall profit, than the system with the lower frequency and higher earnings factor on each specific trade.

The advantage of a frequent trading method is that if it is a lucrative trading technique, it will have a greater return the more times it trades, utilizing a lower leverage. This is specifying the obvious, but it is often overlooked when choosing a trading technique. The objective is to make more revenue using the least quantity of utilize or danger.

Stochastics is utilized to identify whether the market is overbought or oversold. The marketplace is overbought when it reaches the resistance and it is oversold when it reaches the support. So when you are trading a variety, stochastics is the best indication to inform you when it is overbought or oversold. It is likewise called a Momentum Indication!

Constantly be mindful of your feelings and never make a trade out of worry or greed. This is harder than it appears. Most amateur traders will pull out of a trade based on what is taking place. However I guarantee you this is always bad. To make money consistently you must construct a strategy and stick with it. If this suggests setting targets and stops and leaving the room, so be it! This might be more difficult to practice than it sounds but unless you get control of your feelings you will never ever be an effective trader.

It is the setup, not the name of the stock that counts. Start by picking a particular trade that you believe is lucrative, say EUR/USD or GBP/USD. The first point is the strategy to be followed while the second pint is the trading time.

If you are looking exclusive entertaining comparisons related to Ema Trading Bot, and Forex Indicators, Forex Charts, Which Indicators you should subscribe in a valuable complementary news alert service now.