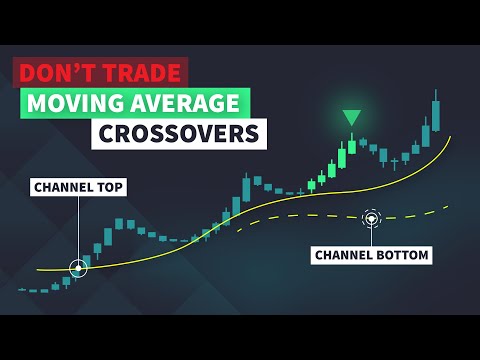

Don't Trade Moving Average Crossovers – Trade This Instead

Latest overview highly rated 200-Day Moving Average, Trading System Guide, Stock Sell Signals, How to Read Stock Charts, and Best Ma Crossover, Don't Trade Moving Average Crossovers – Trade This Instead.

✅ Free webinar – elevate your trading using algorithmic strategies ➔ https://bit.ly/3oaqAsl

✅ My flagship programme (6 strategies, signals, support & community) ➔ https://bit.ly/3IRGcsi

————–

Do moving average crossovers still work today? Find out in this video, where I take one of the most traditional moving average crossover strategy and backtest it on 14 years of data. Then, I will show you a great alternative strategy that uses moving averages in a slightly different way & showed much more promising results

————–

Did you enjoy this video? You’ll enjoy these too:

➤ Algorithmic Trading Series: https://bit.ly/3pUyy7R

➤ Supply and Demand Trading 101: https://bit.ly/3fbXlyW

➤ How to Become a Consistently Profitable Trader: https://bit.ly/3d5B58f

➤ No Indicator Trading: https://bit.ly/3d6ZUAt

➤ How Markets REALLY work: https://bit.ly/35wnKm

————-

Video chapters:

00:00 Intro

00:57 Traditional moving average crossover strategy – complete rules

03:28 Traditional moving average crossover strategy – equity curve

04:53 A different way to use moving averages – complete rules

08:01 Equity curve comparison of two moving average strategies

10:05 Backtest results comparison

11:11 Tips for further development of the moving average channel strategy

Best Ma Crossover, Don't Trade Moving Average Crossovers – Trade This Instead.

Forex Trading – Simple Actions To Creating Your Own Successful Trading System

That setup might not take place for XYZ during the remainder of the year. Palladium seems holding while platinum is anybody’s guess at this point. Naturally, these moving averages are used as dynamic support and resistance levels.

Don't Trade Moving Average Crossovers – Trade This Instead, Search new explained videos related to Best Ma Crossover.

When To Buy Stock And The Secret To A Hot Stock Pick

The technical analysis must also be identified by the Forex trader. Presently, SPX is oversold enough to bounce into the Labor Day vacation. The 2nd line is the signal line represented as %D. %D is an easy moving average of %K.

Everyone wants to learn currency trading, or so it seems from the variety of individuals being drawn into the foreign currency, or forex, craze. However, as with a lot of things, there’s a best way and an incorrect method. And the proper way has three vital ingredients.

However, if there is a breakout through one of the external bands, the cost will tend to continue in the same instructions for a while and robustly so if there is a boost Moving Average Trader in volume.

Grooved range can likewise hold. If the selling is extreme, it might press the stock right past the grooved area – the longer a stock remains at a level, the more powerful the support.

“This basic timing system is what I use for my long term portfolio,” Peter continued. “I have 70% of the funds I have actually designated to the Stock Forex MA Trading invested for the long term in leveraged S&P 500 Index Funds. My financial investment in these funds forms the core of my Stock portfolio.

Rather of subscribing to an advisory letter you Stocks MA Trading choose to make up your own timing signal. It will take some initial work, however once done you will not need to pay anybody else for the service.

You will be able to see the trend amongst traders of forex if you use info offered by FXCM. Day-to-day profit and loss modifications show there is a large loss and this suggests traders do not end and profit up losing cash rather. The gain daily was just 130 pips and the highest loss was a drop of over 170 points.

Stochastics is utilized to figure out whether the marketplace is overbought or oversold. When it reaches the resistance and it is oversold when it reaches the assistance, the market is overbought. So when you are trading a variety, stochastics is the best sign to inform you when it is overbought or oversold. It is likewise called a Momentum Indication!

18 bar moving average takes the current session on open high low close and compares that to the open high low close of 18 days back, then smooths the typical and puts it into a line on the chart to provide us a pattern of the existing market conditions. Breaks above it are bullish and breaks below it are bearish.

Presuming you did not see any news, you need to put down a forex trade placing style. Bring up the chart of the stock you have an interest in and raise the 4 and 9 day moving average. I discover this inefficient of a stock traders time.

If you are looking rare and exciting reviews about Best Ma Crossover, and Learn About Stock Market, Strong Trend, Stock Market Works, Trading Channel please signup for subscribers database totally free.