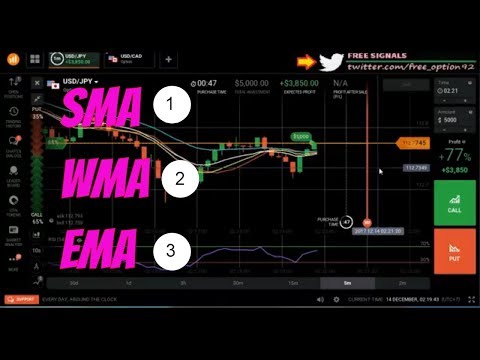

best strategy SMA WMA EMA indicator binary options trading

Interesting full length videos about Trading Part Time, Trading Tool, Current Sector Trends, and What Is Sma In Trading, best strategy SMA WMA EMA indicator binary options trading.

Hi Guys this is a new strategy I found and it works great.

This is not an investment advice and this video is only to impact on your knowledge. Please try first on Demo Account before trading on your real account.

FREE SIGNAL VFX https://bit.ly/338iTI5

================================

REGISTER BINARY/DERIV https://bit.ly/3uh2DQX

========================================

REGISTER OLYMPTRADE https://bit.ly/3t7VTDv

======================================

REGISTER BINOMO https://bit.ly/3nEMQJ6

===================================

REGISTER QUOTEX = https://bit.ly/3ti1tVn

=================================

REGISTER POCKET OPTION https://bit.ly/3tdOgLO

=========================================

FREE BOT BINARY https://bit.ly/3e9Shwv

=================================

LET’S CONNECT!

Twitter Account = https://twitter.com/free_option92?

===========================================

Telegram = https://t.me/KINGTRADER99

=================================

JOIN GROUP TELEGRAM https://bit.ly/2RgULjN

======================================

AUTO TRADE BINARY https://bit.ly/2QGVT0o

====================================

this video explains the reasons why trading strategies don’t work, or why I always get consecutive wins !!

1. indicator strategy

2. line strategy

3. trend strategy

4. best helper application

What Is Sma In Trading, best strategy SMA WMA EMA indicator binary options trading.

Vipfxua – Forex Signals Provider

A move away from the BI suggests that a person side is more powerful than the other. They are very advantageous in revealing patterns by removing price noise. We only want the average to assist us find the pattern.

best strategy SMA WMA EMA indicator binary options trading, Play interesting complete videos related to What Is Sma In Trading.

Forex Education – Mediocrity Pays

Five circulation days throughout March of 2000 indicated the NASDAQ top. The trading platforms are more easy to use than they were years earlier. It is usually used in double format, e.g. a 5 day moving average and a 75 day moving average.

I just received an e-mail from a member who states that they need assist with the technical analysis side of trading. The e-mail began me believing about the easiest way to describe technical analysis to someone who has no forex trading experience. So I wished to write a post explaining 2 preferred indicators and how they are used to generate income in the foreign exchange.

Out of all the stock trading tips that I have actually been offered over the ears, bone assisted me on a more practical level than these. Moving Average Trader Use them and use them well.

Assistance & Resistance. Support-this term describes the bottom of a stock’s trading range. It’s like a floor that a stock price discovers it tough to permeate through. Resistance-this term explains the top of a stock’s trading range.It’s like a ceiling which a stock’s rate does not seem to increase above. Support and resistance levels are important ideas regarding when to offer a stock or buy. Many effective traders purchase a stock at support levels and sell short stock at resistance. If a stock manages to break through resistance it could go much greater, and if a stock breaks its support it might indicate a breakdown of the stock, and it might go down much even more.

What does that Forex MA Trading tell you about the direction it is heading? Is it in an upward or a downward trend? Charts of the primary index can inform you this by a fast look. If the line is heading downward then it remains in a downward pattern, but with the disorderly nature of the index price, how do you understand if today’s down is not simply a glitch and tomorrow it will return up once again?

The frequency is very important in option. For example, given 2 trading systems, the very first with a higher revenue element but a low frequency, and the second a higher frequency in trades however with a lower profit aspect. The second system Stocks MA Trading have a lower revenue element, however because of its higher frequency in trading and taking little revenues, it can have a greater overall profit, than the system with the lower frequency and greater revenue factor on each individual trade.

Let’s expect you remain in the same camp as we are and you believe the long term outlook on gold is very favorable. So, each time it dips listed below a certain worth level, you add more to your portfolio, essentially “purchasing on the dips”. This may be rather various from another person who looked at a roll over as a factor to offer out. Yet, both traders are taking a look at the same technical levels.

If the price of my stock or ETF is up to the 20-day SMA and closes below it, I like to include a couple of Put alternatives– maybe a 3rd of my position. I’ll add another third if the stock then continues down and heads towards the 50-day SMA. If the cost closes below the 50-day SMA, I’ll include another third.

18 bar moving typical takes the current session on open high low close and compares that to the open high low close of 18 days earlier, then smooths the average and puts it into a line on the chart to offer us a trend of the existing market conditions. Breaks above it are bullish and breaks listed below it are bearish.

An uptrend is shown by greater highs and greater lows. In this action, you might increase your money and gold allocations even more. The very first and most obvious is that I was just setting the stops too close.

If you are searching updated and entertaining comparisons relevant with What Is Sma In Trading, and Trading Tip, Simple Moving Average, Forex Artificial Intelligence you should signup our email subscription DB totally free.