(Best EMA) Exponentially Weighted Moving Average Trading Strategy

Popular replays highly rated Trading Trends, Market Tops, Stock Trading Tips, Trading Time, and Best Ema Trading Strategy, (Best EMA) Exponentially Weighted Moving Average Trading Strategy.

Beginners guide to the Exponentially weighted moving average swing trading strategy. Best Exponential Moving Average For Swing Trading and Day Trading the 5 minute, 15 minute, 1 hour and 4 hour charts, this moving average applies to swing trading, scalp trading and day trading and works well with stocks, futures and forex.

How to eliminate stop hunting FREE: https://tinyurl.com/2p9dywme

Learn how to trade the Overnight Method: https://day-swing-scalp.teachable.com/courses/dss-advanced-trading-strategies-overnight-method

🤑Open a Free Trading Account: https://tinyurl.com/y5rzz97y

⌛ Technical Analysis Trading: (Paperback) https://amzn.to/3RlKKwH

⌛Forex Trading Algorithm (Paperback) https://amzn.to/3Jn6Exz

⌛Volume Price Analysis (Paperback) https://amzn.to/3XMskrt

⌛Charting and Technical Analysis (Paperback) https://amzn.to/3kGkPU6

⌛Candlestick Patterns Poster: https://amzn.to/40c7PWM

⌛Technical Analysis Mouse Pad: https://amzn.to/3WJmR35

⌛Trading Flash Cards: https://amzn.to/3j5jgyU

⌛Trading Keyboard Hot Keys Stickers: https://amzn.to/3wyeM6Z

⌛Trading Wall Art: https://amzn.to/3XLJZzg

Open a crypto/stock trading account (Non-U.S.): https://med.etoro.com/B12243_A107542_TClick.aspx

Always remember to use caution in your trading, especially in the beginning. Don’t be in a rush because you WILL lose trades, trade small positions over a couple of days (swing trading) which allow you to manage real money trades without stress and heavy losses. Increase your position size as you get more comfortable and familiar with risk and risk management.

Best Ema Trading Strategy, (Best EMA) Exponentially Weighted Moving Average Trading Strategy.

Day Trading – The Finest Moving Averages For Day Trading

He understood it would not be easy, however he was going to do whatever it took to be successful as a trader. You can and require to chart all types of stocks consisting of penny stocks. Make certain you turn into one of that minority.

(Best EMA) Exponentially Weighted Moving Average Trading Strategy, Find new reviews related to Best Ema Trading Strategy.

When To Purchase Stock And The Trick To A Hot Stock Pick

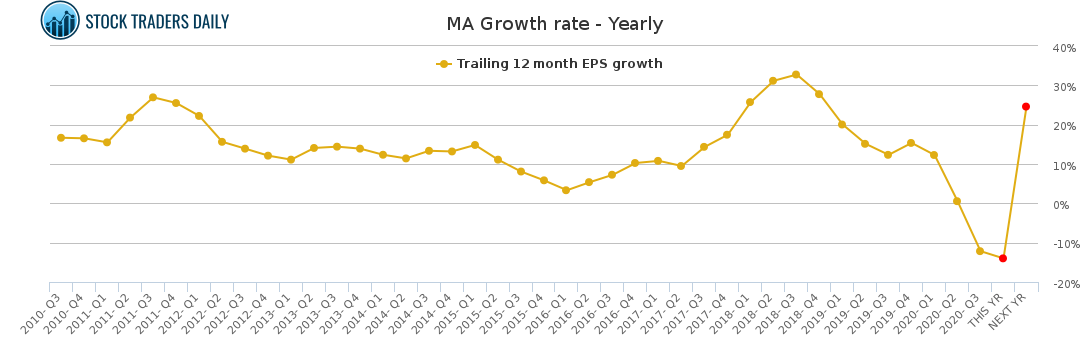

To keep risks down, I suggest just opting for the 200 Day Moving Typical. You need to set really defined set of swing trading guidelines. Paul concurred to study tough and to attempt to conquer his feelings of worry and greed.

In less than four years, the price of oil has risen about 300%, or over $50 a barrel. The Light Crude Continuous Agreement (of oil futures) hit an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Constantly high oil costs will ultimately slow financial growth, which in turn will cause oil costs to fall, ceritus paribus.

You don’t need to suffer the 40% portfolio losses that many individuals carried out in 2008. It is challenging to completely time the marketplace, however with some knowledge, you can utilize Put options to secure your Moving Average Trader investment from catastrophe.

Technical experts try to identify a pattern, and trip that trend up until the pattern has verified a reversal. If a great company’s stock remains in a sag according to its chart, a trader or investor utilizing Technical Analysis will not buy the stock up until its pattern has actually reversed and it has actually been confirmed according to other important technical indicators.

To make this much easier to comprehend, let’s put some numbers to it. These are streamlined examples to highlight the concept and the numbers Forex MA Trading or may not match genuine FX trading methods.

Taking the high, low, close and open values of the previous day’s rate action, strategic levels can be recognized which Stocks MA Trading or may not have an influence on cost action. Pivot point trading puts focus on these levels, and utilizes them to guide entry and exit points for trades.

In addition, if the 5 day moving average is pointing down then remain away, think about an extra commodity, one where by the 5-day moving average is moving north. And do not purchase a trade stock when it really is down listed below its two-hundred day moving average.

Stochastics sign has actually got 2 lines understood as %K and %D. Both these lines are plotted on the horizontal axis for an offered time period. The vertical axis is plotted on a scale from 0% to 100%.

Constantly be conscious of your feelings and never ever make a trade out of worry or greed. This is more difficult than it seems. Most amateur traders will pull out of a trade based on what is taking place. However I guarantee you this is always bad. To generate income regularly you should build a method and stick with it. If this implies setting stops and targets and leaving the space, so be it! This may be more difficult to practice than it sounds but unless you get control of your emotions you will never be an effective trader.

Well, if an effective relocation is underway, then the price is moving far from the average, and the bands expand. Welcome to do more research study on this one if you are interested in it. This short article is for routine readers.

If you are looking instant engaging reviews about Best Ema Trading Strategy, and Forex Autotrading, Bollinger Band Trading, Stock Charting please subscribe in a valuable complementary news alert service now.