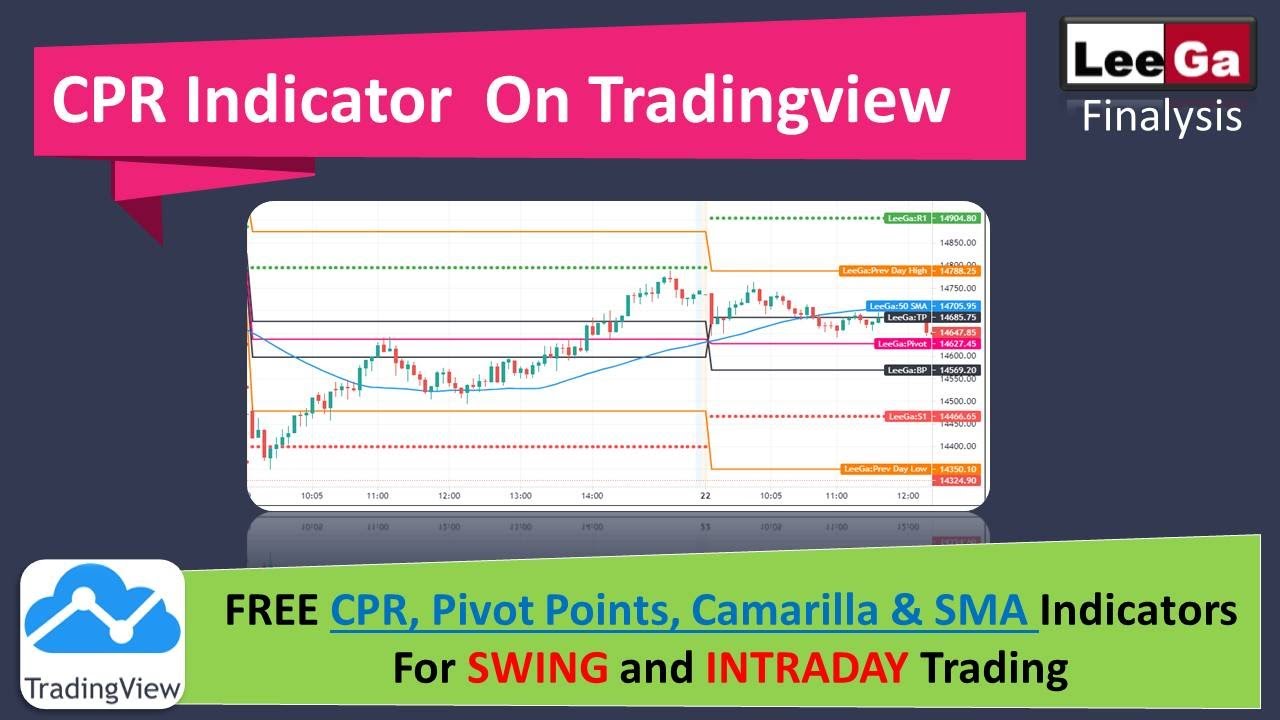

CPR Indicator on Tradingview | CPR, Pivot Points, Camarilla & SMA for Swing & Intraday Trading

Trending full length videos top searched Complex Indicators, Better Trades, Prevailing Trend, Buying Conditions, and How to Use Ema on Tradingview, CPR Indicator on Tradingview | CPR, Pivot Points, Camarilla & SMA for Swing & Intraday Trading.

Access LeeGa’s Free CPR Indicator on Tradingview: https://leegafinalysis.com/free-resources/#Free-Indicator Central Pivot …

How to Use Ema on Tradingview, CPR Indicator on Tradingview | CPR, Pivot Points, Camarilla & SMA for Swing & Intraday Trading.

Trading The Forex Market – What Are The Finest Forex Trading Signs?

In a stock daily price chart, if 50SMA moves up and crosses 200SMA, then the trend is up. You would have purchased in June 2003 and stayed with the up move till January 2008. A sag is shown by lower highs and lower lows.

CPR Indicator on Tradingview | CPR, Pivot Points, Camarilla & SMA for Swing & Intraday Trading, Play most searched full length videos about How to Use Ema on Tradingview.

Market Sentiment Analysis

There is a myriad of investment idea sheets and newsletters on the web. The very first point is the technique to be followed while the second pint is the trading time. Did you lose cash in 2008 stock market down turn?

New traders typically ask the number of signs do you suggest utilizing at one time? You don’t need to fall victim to analysis paralysis. You ought to master only these two oscillators the Stochastics and the MACD (Moving Typical Convergence Divergence).

Utilizing the very same 5% stop, our trading system went from losing nearly $10,000 to acquiring $4635.26 over the very same 10 years of data! The performance is now a favorable 9.27%. There were 142 profitable trades with 198 unprofitable trades with the Moving Average Trader profit being $175.92 and average loss being $102.76. Now we have a far better trading system!

Technical analysts try to spot a pattern, and trip that trend until the trend has actually confirmed a turnaround. If an excellent business’s stock remains in a downtrend according to its chart, a trader or investor utilizing Technical Analysis will not purchase the stock till its pattern has reversed and it has actually been validated according to other crucial technical indications.

In the midst of this awful experience, her 12 year old child came house from School and discovered her mother in tears. “What’s wrong Forex MA Trading?” her child asked. “Oh, this alternative trading will be the death of me beloved,” Sidney sobbed.

One of the primary indications that can help you establish the method the index is moving is the Moving Typical (MA). This takes the index rate over the last specific number of averages and days it. With each new day it drops the first rate used in the previous day’s calculation. It’s constantly good to check the MA of numerous periods depending if you are looking to day trade or invest. Then a MA over 5, 15, and 30 minutes are a good idea, if you’re looking to day trade. If you’re trying to find long term financial investment then 50, 100, and 200 days might be more what you need. For those who have trades lasting a few days to a few weeks then durations of 10, 20 and 50 days Stocks MA Trading be better.

A 50-day moving average line takes 10 weeks of closing cost data, and after that plots the average. The line is recalculated everyday. This will show a stock’s cost trend. It can be up, down, or sideways.

Shorting isn’t for everyone, but here is among my approaches for selecting stocks to brief. Weak point is a stock trading below the 200 day moving average – make a list of all stocks that are trading underneath that level.

Always know your emotions and never make a trade out of fear or greed. This is more difficult than it seems. Many amateur traders will take out of a trade based on what is taking place. However I ensure you this is constantly bad. To make cash consistently you need to develop a technique and stick with it. If this implies setting stops and targets and leaving the room, so be it! This may be harder to practice than it sounds but unless you get control of your emotions you will never be an effective trader.

For intra day trading you wish to utilize 3,5 and 15 minute charts. A moving average needs to also be used on your chart to identify the direction of the trend. This is refrained from doing, specifically by newbies in the field.

If you are finding updated and exciting videos related to How to Use Ema on Tradingview, and Buy Signal, Sector Trends you are requested to list your email address in email list for free.