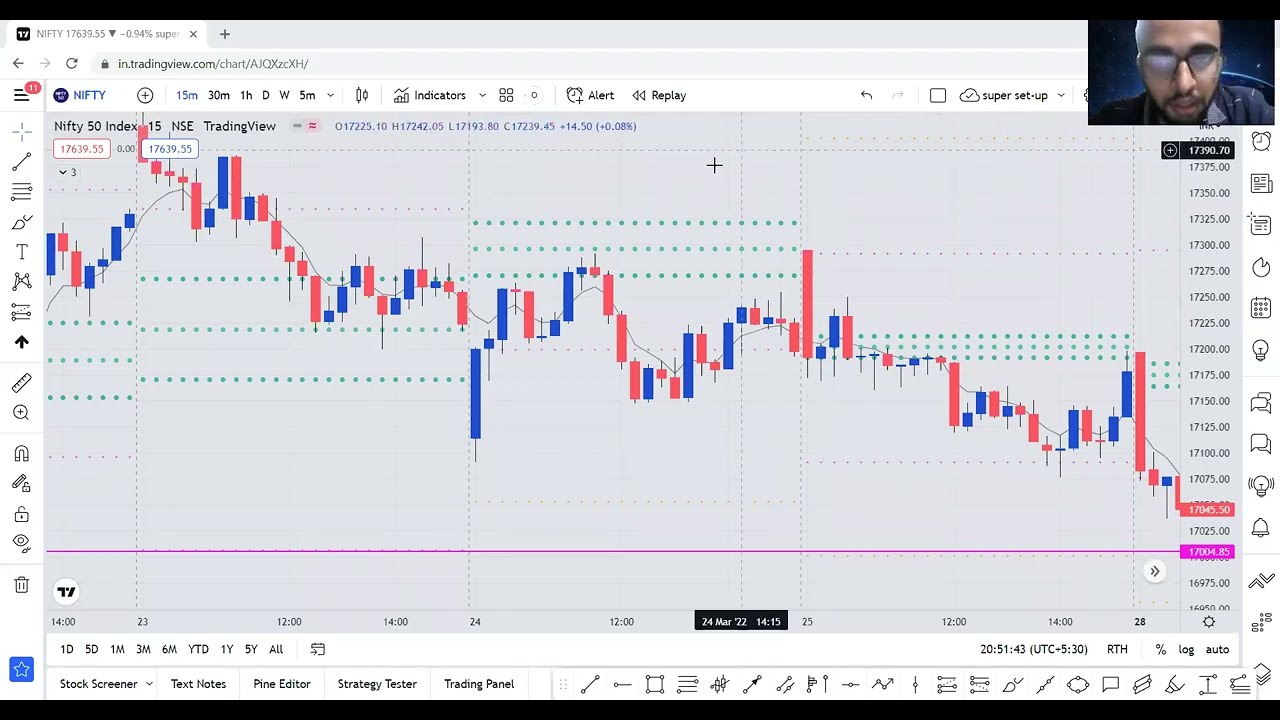

5EMA + CPR : Mean Reversion System : Option writing #powerofstocksreview #powerofstocks

Top videos relevant with Stock Trading Tips, Trading Time, Option Trading, and 5 Ema Trading System, 5EMA + CPR : Mean Reversion System : Option writing #powerofstocksreview #powerofstocks.

This is my intraday trading system for Mean reversion. I have designed this system after a lot of effort and study. Generally, this system gives a high risk to reward trades and the accuracy of this system is 50%.

I learned the concept of 5EMA and mean reversion from @powerofstocks in traders carnival 2021.

I hope it helps you.

5 Ema Trading System, 5EMA + CPR : Mean Reversion System : Option writing #powerofstocksreview #powerofstocks.

Forex Megadroid – Is This Forex Trading Robotic Actually The Very Best Of The Very Best?

5 distribution days throughout March of 2000 indicated the NASDAQ top. We might not always have the ability to buy the very same stock back whenever we want to get another 10%. It is the setup, not the name of the stock that counts.

5EMA + CPR : Mean Reversion System : Option writing #powerofstocksreview #powerofstocks, Get popular replays about 5 Ema Trading System.

Top 3 Reasons That Trading With Signs Is Overrated

The software the traders utilize at the online trading platforms is more easy to use than it was years ago. It’s not clear which companies will be affected by this decree but Goldcorp and DeBeers have mining projects there.

If you trade stocks, you must understand how to chart them. Some people explore charts to find buy or sell signals. I find this inefficient of a stock traders time. You can and need to chart all types of stocks including cent stocks. When to offer or buy, charting tells you where you are on a stocks price pattern this means it informs you. There are plenty of great companies out there, you do not want to get caught purchasing them at their 52 week high and having to wait around while you hope the rate comes back to the price you paid.

Technical analysis can be extremely beneficial for Moving Average Trader to time our entries and exits of the trade. It shouldn’t be used alone due to the fact that it can be puzzling details if not utilized correctly.

The technical analysis must likewise be identified by the Forex trader. This is to predict the future trend of the rate. Common indicators used are the moving averages, MACD, stochastic, RSI, and pivot points. Note that the previous indicators can be used in combination and not just one. This is to confirm that the rate pattern is real.

Market timing is based on the “reality” that 80% of stocks will follow the instructions of the broad market. It is based on the “reality” that the Forex MA Trading trend with time, have been doing so because the beginning of easily traded markets.

She checked out her young child’s eyes and smiled, believing “How simple was that?” She had just composed out a Stocks MA Trading strategy for a put option trade based on her analysis of that really chart – she believed the cost would go down; how wrong would she have been?

The new brief positions will have protective stops put fairly close to the market since risk must always be the top consideration when figuring out a trade’s suitability. This week’s action clearly revealed that the market has lacked individuals happy to produce new brief positions under 17.55. Markets constantly run to where the action is. The declining ranges integrated with this week’s turnaround bar lead me to believe that the next relocation is greater.

As soon as the buzz settles and the CME finishes its margin boost on Monday, we should see silver prices stabilize. From my point of view, I see $33 as a level I might meticulously start to buy. I think support will be around $29 up until the Fed chooses it’s time to cool inflation if silver breaks below that level.

To help you recognize patterns you must also study ‘moving averages’ and ‘swing trading’. For example two standard guidelines are ‘don’t purchase a stock that is listed below its 200-day moving typical’ and ‘do not buy a stock if its 5-day moving average is pointing down’. If you do not comprehend what these quotes imply then you require to research ‘moving averages’. All the best with your trading.

As a perk, 2 MAs can likewise work as entry and exit signals. So, when the marketplace is varying, the best trading technique is range trading. It can be a 10 day MA, 50 day MA, 100 Day MA or 200 Day MA.

If you are searching best ever entertaining reviews related to 5 Ema Trading System, and Trading Channel, Forex Online Trading, Trading Forex With Indicators, Forex Trading – a Simple 1-2-3 Step Process for Using Moving Averages to Find the Trend you should join our subscribers database totally free.