Why Moving Average Crossover Strategies Don't Work (Answer Transaction Costs)

Top high defination online streaming relevant with Days Moving Average, Simple Moving Average Forex, Market Indicators, Term Trend, and Ma Crossover Strategy, Why Moving Average Crossover Strategies Don't Work (Answer Transaction Costs).

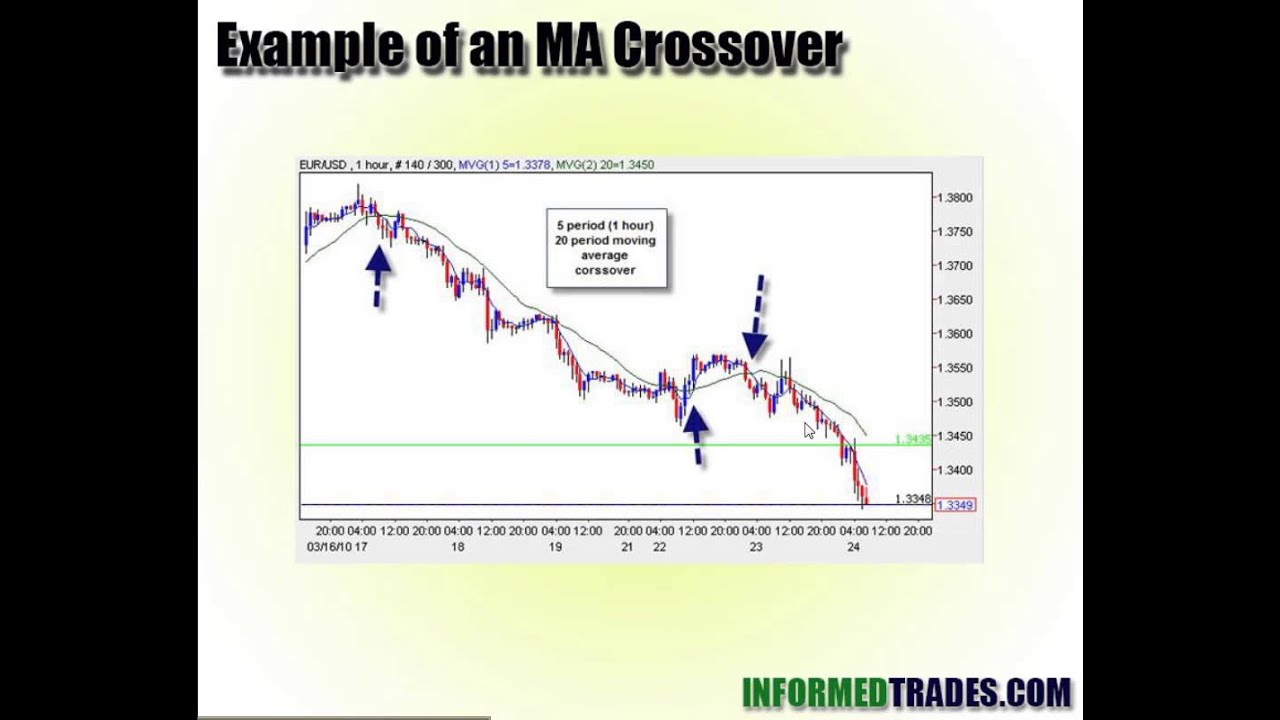

In this video we discuss why conventional moving average crossover strategies don’t work — and what can be done to make them work.

Join us in the discussion on InformedTrades:

Donate to InformedTrades — because it helps us do an even better job of helping traders learn: http://www.informedtrades.com/trades.php?page=donate

Ma Crossover Strategy, Why Moving Average Crossover Strategies Don't Work (Answer Transaction Costs).

Practical Tips In Emini Trading

The outcome of this will provide you the everyday interest turnover for either the debit or credit range. Ensure you end up being one of that minority. With persistence however, you will start to “get it” and discover the ropes.

Why Moving Average Crossover Strategies Don't Work (Answer Transaction Costs), Search trending reviews related to Ma Crossover Strategy.

Number 1 Loser Indication – Why Trading Moving Averages Fail

Simply exist in the ideal time and with best order. To generate income consistently you must build a method and stick with it. State you want to trade a per hour basis and you wish to plot an 8 point chart.

After the last couple of years of broad swings in the stock exchange, oil, gold, etc, an easy investment strategy that works is at the top of lots of financiers’ desire list. Many retired people have actually seen 20 to 40 percent losses in their retirement funds. The ideal financial investment strategy would keep portfolios invested during all major up market moves and be on the sidelines during major down moves. Any strategy utilized need to likewise avoid over trading. Too much in and out trading can be both psychologically and economically damaging. The understanding and use of basic moving averages will accomplish this.

If it is going to be viable, the DJIA has to stick around its 20-day Moving Average Trader typical. The DJIA has to arrive or else it might decrease to 11,000. A rebound can result in a pivot point better to 11,234.

The two charts listed below are very same period daily charts of SPX (S&P 500) and OIH (an oil ETF, which is a basket of oil stocks). Over 15% of SPX are energy & energy stocks. The 2 charts below show SPX started the recent rally about a month before OIH. Also, the charts imply, non-energy & utility stocks fell over the previous week or so, while energy & energy stocks stayed high or rose further.

Selecting an amount of time: If your day trading, buying and selling intra day, a 3 year chart will not help you. For intra day trading you want to utilize 3,5 and 15 minute charts. Depending on your longterm investment method you can look at a 1 year, which I use most frequently to a 10 year chart. The yearly chart offer me a take a look at how the stock is doing now in today’s market. I’ll look longer for historical support and resistance points however will Forex MA Trading my buys and sells based on what I see in front of me in the yearly.

One of the primary indicators that can help you establish the method the index is moving is the Moving Typical (MA). This takes the index cost over the last given variety of averages and days it. With each brand-new day it drops the first cost utilized in the previous day’s estimation. If you are looking to day trade or invest, it’s constantly excellent to check the MA of a number of periods depending. Then a MA over 5, 15, and 30 minutes are a good concept, if you’re looking to day trade. If you’re looking for long term financial investment then 50, 100, and 200 days might be more what you require. For those who have trades lasting a couple of days to a few weeks then periods of 10, 20 and 50 days Stocks MA Trading be better suited.

For each time a short article has been e-mailed, award it 3 points. An e-mailed article suggests you have at least strike the interest nerve of some member of your target market. It may not have been a publisher so the category isn’t as valuable as the EzinePublisher link, but it is more valuable than a basic page view, which does not always indicate that somebody checked out the entire short article.

Shorting isn’t for everyone, however here’s one of my techniques for picking stocks to short. Weak point is a stock trading below the 200 day moving average – make a list of all stocks that are trading underneath that level.

At the day level there are durations likewise that the rate doesn’t largely and durations that the price change mostly. The risky time periods are when London stock opens ad when U.S.A. stock opens. Likewise there are large changes when Berlin stock opens. After each one opens, there are typically big modifications in the prices for a male hours. The most risky period is the time at which 2 stocks are overlapped in time.

A technique that is fairly popular with traders is the EMA crossover. Simply divide the everyday average Trading Range (ATR) by the share price to get a portion. They provide a long ravelled curve of the average cost.

If you are finding most engaging videos relevant with Ma Crossover Strategy, and Bear Markets, Global Market Divergences, Forex Strategy, Penny Stock dont forget to list your email address in email list for free.