TradingView: How to Master TradingView in Less Than 20minutes

Popular updated videos top searched Counter Trend Trade, Online Stock Market Trading, and Tradingview How To Sma, TradingView: How to Master TradingView in Less Than 20minutes.

TradingView charting platform has a ton of features that you can take advantage of.

You’ve got indicators, tools, watchlist, templates, chats, charts, ideas, scripts, and etc.

But the problem is:

You’d have to spend many hours trying to figure out how things work, and decide which features are relevant to you.

So…

Won’t it be great if you can learn how to use the most important tools that TradingView offers — without getting distracted?

That’s why I did this video to help you master TradingView in less than 20minutes.

You’ll learn:

• My exact TradingView template so you can have your charts looking like mine

• How to create a watchlist so you can scan for trading setups quickly

• How to find and add custom indicators

• How to save your template so you don’t lose your valuable settings

• A little-known “trick” to change your timeframe, in just one click of a mouse

• How to monitor multiple timeframes on a single screen — so you don’t have to keep “flipping” your charts

• How to set an alert so you don’t miss trading opportunities ever again

Powerful stuff, right?

So click the link below and watch this video now…

Interested in TradingView?

Then sign up for a free account here: https://www.tradingview.com/chart?offer_id=10&aff_id=4535

Tradingview How To Sma, TradingView: How to Master TradingView in Less Than 20minutes.

Remaining On The Ideal Side Of The Trend

In lots of circumstances we can, but ONLY if the volume boosts. The very best way to make money is buying and offering breakouts. You seek the bigger price at the end of the trade.

TradingView: How to Master TradingView in Less Than 20minutes, Explore top full videos relevant with Tradingview How To Sma.

The Stock Trading Strategy – Why You Need To Have One To Trade Successfully

By doing this, you wont need to fret about losing money whenever you trade. Chart: A chart is a chart of price over an amount of time. To the newbie, it might appear that forex traders are overly stressed about trend trading.

Brand-new traders frequently ask how lots of indicators do you recommend utilizing at one time? You don’t need to come down with analysis paralysis. You ought to master only these 2 oscillators the Stochastics and the MACD (Moving Typical Merging Divergence).

Out of all the stock trading suggestions that I’ve been provided over the ears, bone helped me on a more practical level than these. Moving Average Trader Use them and use them well.

The dictionary prices quote an average as “the quotient of any sum divided by the variety of its terms” so if you were exercising a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would add them together and divide them by 10, so the average would be 55.

What does that Forex MA Trading inform you about the direction it is heading? Is it in an upward or a down pattern? Charts of the primary index can inform you this by a quick look. If the line is heading downward then it remains in a downward pattern, but with the chaotic nature of the index cost, how do you know if today’s down is not just a glitch and tomorrow it will go back up again?

The frequency is essential in option. For example, given two trading systems, the first with a greater earnings element but a low frequency, and the 2nd a greater frequency in trades however with a lower profit factor. The 2nd system Stocks MA Trading have a lower earnings aspect, however due to the fact that of its greater frequency in trading and taking little earnings, it can have a higher overall earnings, than the system with the lower frequency and greater earnings element on each specific trade.

Another forex trader does care excessive about getting a roi and experiences a loss. This trader loses and his wins are on average, much bigger than losing. He wins double what was lost when he wins the game. This shows a balancing in winning and losing and keeps the financial investments open to get an earnings at a later time.

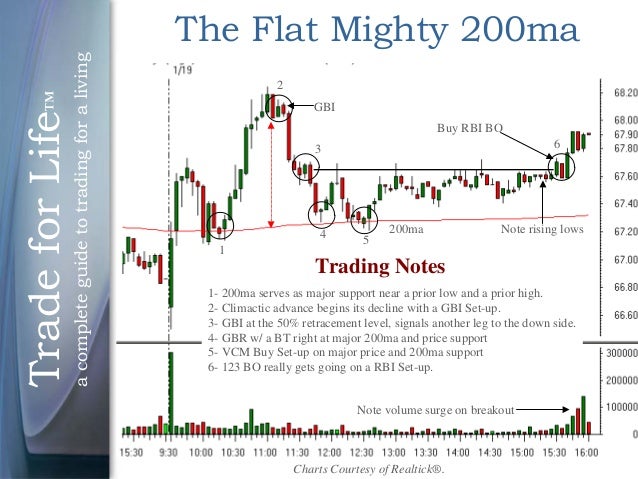

It’s really real that the market pays a great deal of attention to technical levels. We can show you chart after chart, breakout after breakout, bounce after bounce where the only thing that made the distinction was a line drawn on a chart. When large blocks of money will buy or sell, moving averages for example are best studies in. View the action surrounding a 200 day moving average and you will see first hand the warfare that takes place as shorts attempt and drive it under, and longs purchase for the bounce. It’s neat to watch.

A way to determine the velocity or significance of the relocation you are going to trade against. This is the trickiest part of the formula. The most typical way is to determine the slope of a MA against an otherwise longer term trend.

The 2 most popular moving averages are the easy moving average and the rapid moving average. The declining varieties combined with this week’s reversal bar lead me to believe that the next relocation is greater.

If you are finding rare and entertaining videos about Tradingview How To Sma, and Stock Buy Signals, Chart Analysis please signup our a valuable complementary news alert service totally free.