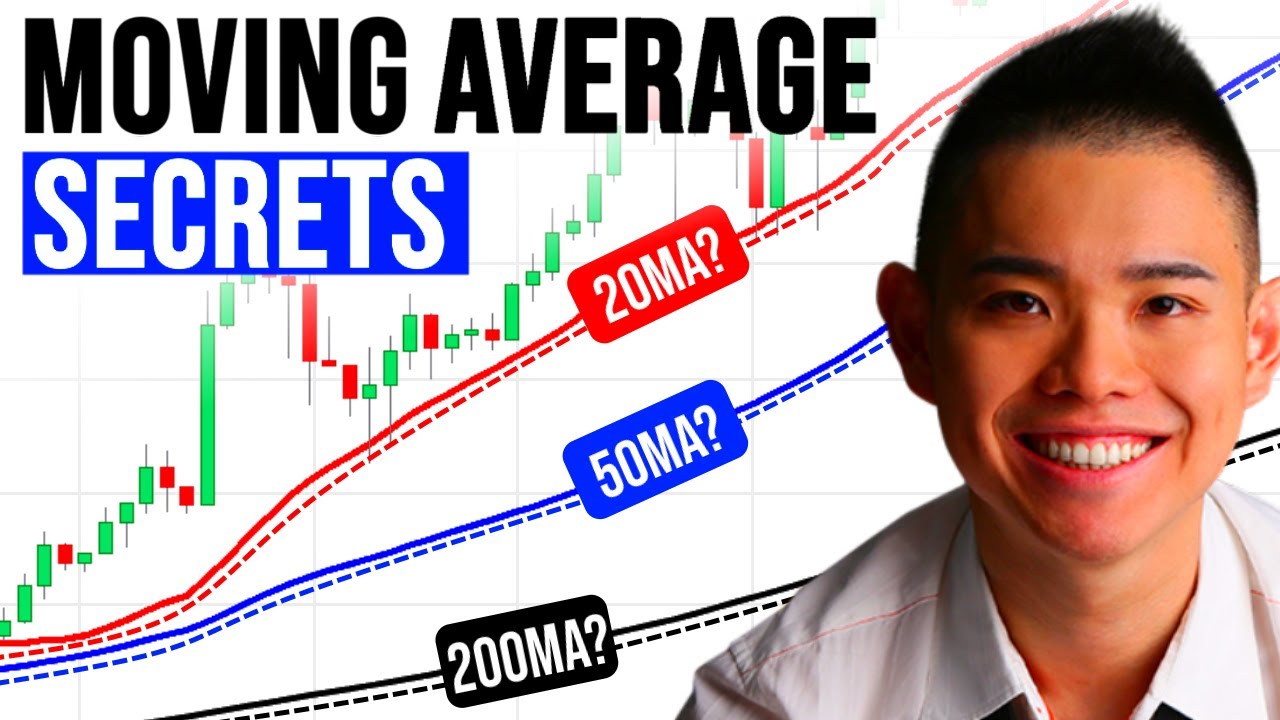

Moving Average Trading Secrets (This is What You Must Know…)

Interesting videos related to International Trading, Stock Trading System, and What Ema Should I Use for Day Trading, Moving Average Trading Secrets (This is What You Must Know…).

Discover how the moving average trading indicator helps you better time your entries, “predict” market turning points, and increase your winning rate.

** FREE TRADING STRATEGY GUIDES **

The Ultimate Guide to Price Action Trading: https://www.tradingwithrayner.com/ultimate-guide-price-action-trading/

The Monster Guide to Candlestick Patterns: https://www.tradingwithrayner.com/candlestick-pdf-guide/

** PREMIUM TRAINING **

Pro Traders Edge: https://www.tradingwithrayner.com/pte/

Pullback Stock Trading System: https://pullbackstocktradingsystem.com/

Price Action Trading Secrets: https://priceactiontradingsecrets.com/

What Ema Should I Use for Day Trading, Moving Average Trading Secrets (This is What You Must Know…).

Generate Income In Forex Without The $3,000 Software Package

Because they are lagging indicators. My favorites are the 20-day and the 50-day moving averages on the S&P 500 index (SPX). Numerous people have been trading this market wrong.

Moving Average Trading Secrets (This is What You Must Know…), Find new replays about What Ema Should I Use for Day Trading.

Stock Market Trading – Leading 4 Trading Myths That Endanger Your Success

Choosing a time frame: If your day trading, purchasing and offering intra day, a 3 year chart will not help you. This is to confirm that the price pattern holds true. Yet, both traders are looking at the same technical levels.

Selecting the right finest stock indication in 2011 is more tricky than you might believe. But making the ideal choice is an important one, particularly in the present stock market conditions.

You don’t have to suffer the 40% portfolio losses that lots of individuals performed in 2008. It is tough to perfectly time the marketplace, but with some understanding, you can use Put choices to protect your Moving Average Trader financial investment from disaster.

Assistance & Resistance. Support-this term explains the bottom of a stock’s trading variety. It resembles a floor that a stock rate discovers it difficult to penetrate through. Resistance-this term explains the top of a stock’s trading range.It’s like a ceiling which a stock’s rate does not appear to rise above. Assistance and resistance levels are vital hints regarding when to sell a stock or buy. Lots of effective traders buy a stock at support levels and sell brief stock at resistance. If a stock manages to break through resistance it might go much higher, and if a stock breaks its support it might indicate a breakdown of the stock, and it may decrease much further.

“This simple timing system is what I utilize for my long term portfolio,” Peter continued. “I have 70% of the funds I have actually assigned to the Stock Forex MA Trading invested for the long term in leveraged S&P 500 Index Funds. My financial investment in these funds forms the core of my Stock portfolio.

A Forex trading strategy needs three Stocks MA Trading basic bands. These bands are the time frame chosen to trade over it, the technical analysis utilized to figure out if there is a rate trend for the currency set, and the entry and exit points.

As bad as things can feel in the rare-earth elements markets nowadays, the truth that they can’t get too much even worse has to console some. Gold especially and silver are looking good technically with gold bouncing around strong support after its second run at the venerable $1,000. Palladium seems holding while platinum is anybody’s guess at this point.

This trading tool works much better on currency set cost history than on stocks. With stocks, rate can space up or down which triggers it to provide incorrect readings. Currency pair’s price action hardly ever spaces.

As a benefit, two MAs can also work as entry and exit signals. When the short-term MA crosses the long-term back in the instructions of the long-term trend, then that is a fun time to enter a trade.

The most utilized MA figures consist of the 20 Day MA, the 50 Day MA and the 200 Day MA. You’ve probably understood that trading online is not almost as easy as you thought it was. Also active trading can impact your tax rates.

If you are searching unique and engaging reviews about What Ema Should I Use for Day Trading, and Exponential Moving Average Forex Indicator, Technical Analysis dont forget to signup for subscribers database now.