#Moving #Average Price #Crossover Alert #Indicator for #MetaTrader

Interesting YouTube videos related to Counter Trend, Forex Beginners – a Simple Scalping Strategy for High Volume Conditions, and Ma Crossover Alert, #Moving #Average Price #Crossover Alert #Indicator for #MetaTrader.

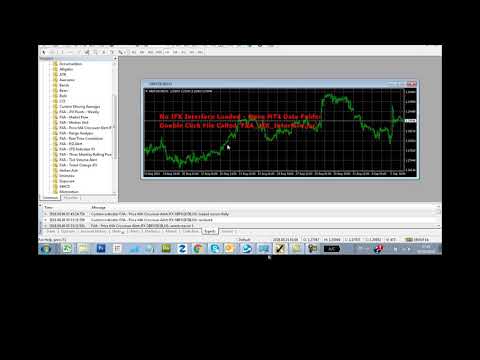

http://www.fxalgotrader.com

FX AlgoTrader installation video for #Moving #Average #Price #Crossover #Alert indicator.

#moving #average #crossover #indicator #metatrader

Ma Crossover Alert, #Moving #Average Price #Crossover Alert #Indicator for #MetaTrader.

Biggest Forex Day Trading Strategy

Any strategy utilized need to also avoid over trading. The 30-minute BI is strictly the high and the low of the first thirty minutes of trading. Intricately created methods do not always work.

#Moving #Average Price #Crossover Alert #Indicator for #MetaTrader, Enjoy latest updated videos relevant with Ma Crossover Alert.

Trading Trends – Knowing When To Get In And Exit

Varying ways that the marketplace is moving sideways without any clear pattern present in it. So this system trading at $1000 per trade has a positive span of $5 per trade when traded over lots of trades.

In less than 4 years, the rate of oil has actually increased about 300%, or over $50 a barrel. The Light Crude Continuous Agreement (of oil futures) hit an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Persistently high oil costs will eventually slow financial development, which in turn will trigger oil prices to fall, ceritus paribus.

A normal forex cost chart can look very irregular and forex candlesticks can obscure the pattern even more. The Moving Average Trader typical gives a smoothed chart that is plotted on top of the forex chart, along with the japanese candlesticks.

So this system trading at $1000 per trade has a positive span of $5 per trade when traded over many trades. The profit of $5 is 0.5% of the $1000 that is at risk throughout the trade.

To make this much easier to comprehend, let’s put some numbers to it. These are streamlined examples to illustrate the principle and the numbers Forex MA Trading or might not match genuine FX trading strategies.

Taking the high, low, open and close worths of the previous day’s price action, strategic levels can be determined which Stocks MA Trading or may not have an impact on price action. Pivot point trading puts emphasis on these levels, and uses them to direct entry and exit points for trades.

You will be able to see the trend amongst traders of forex if you utilize details provided by FXCM. Everyday profit and loss modifications show there is a large loss and this means traders do not end and profit up losing cash instead. The gain daily was just 130 pips and the highest loss was a drop of over 170 points.

Shorting isn’t for everyone, but here’s one of my methods for selecting stocks to brief. Weakness is a stock trading listed below the 200 day moving average – make a list of all stocks that are trading below that level.

Combining these 2 moving averages gives you a great structure for any trading strategy. Opportunities are excellent that you will be able to make money if you wait for the 10-day EMA to agree with the 200-day SMA. Simply utilize great finance, don’t run the risk of too much on each trade, and you ought to be fine.

So, when the market is ranging, the best trading strategy is range trading. 3) Day trading means quick earnings, do not hold stock for more than 25 minutes. You must establish your own system of day trading.

If you are looking instant exciting videos about Ma Crossover Alert, and Trend Analysis, Share Market, Forex Trends you should subscribe in email subscription DB for free.