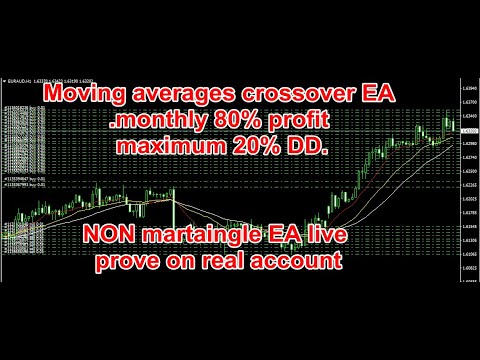

Moving Average Crossover EA Monthly 80% Profit Maximum 20% DD 2020

Top vids top searched Forex Online Trading, Best Forex Technical Analysis, Forex Trading Robot, Forex Market, and Ma Crossover Expert, Moving Average Crossover EA Monthly 80% Profit Maximum 20% DD 2020.

… its very simple EA just run on single chart you don’t need to do any thing its full auto NON martingale EA, working on moving average crossover for more detail …

Ma Crossover Expert, Moving Average Crossover EA Monthly 80% Profit Maximum 20% DD 2020.

Learn How To Use Moving Average Efficiently To Make Your Trade Decision

Pivot point trading assists psychologically in establishing the buy zone and the sell zone. There are different patterns that represent tops, bottoms and turnarounds. What does that market inform you about the instructions it is heading?

Moving Average Crossover EA Monthly 80% Profit Maximum 20% DD 2020, Explore top high definition online streaming videos relevant with Ma Crossover Expert.

Forex Killer – Andreas Kirchberger’s Approach For More Winning Trades

Support and resistance are levels that the market reaches before it reverses. You make 10% revenue and you sell up and go out. I choose to hold things that are increasing in worth. Ensure you become one of that minority.

There are a terrific range of forex signs based upon the moving average (MA). This is an evaluation on the basic moving average (SMA). The basic moving average is line produced by calculating the average of a set number of duration points.

Out of all the stock trading suggestions that I have actually been offered over the ears, bone assisted me on a more useful level than these. Moving Average Trader Use them and utilize them well.

The dictionary prices estimate an average as “the quotient of any sum divided by the variety of its terms” so if you were exercising a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would add them together and divide them by 10, so the average would be 55.

Now when we use three MAs, the moving average with the least variety of periods is characterized as quick while the other two are characterized as medium and slow. So, these three Forex MA Trading can be 5, 10 and 15. The 5 being fast, 10 medium and 15 the sluggish.

The frequency is very important in choice. For example, offered two trading systems, the first with a higher profit aspect but a low frequency, and the second a greater frequency in trades but with a lower earnings aspect. The second system Stocks MA Trading have a lower earnings factor, however due to the fact that of its higher frequency in trading and taking little profits, it can have a greater total revenue, than the system with the lower frequency and greater revenue element on each private trade.

Let’s suppose you are in the same camp as we are and you believe the long term outlook on gold is really positive. So, each time it dips below a certain value level, you include more to your portfolio, generally “buying on the dips”. This might be quite various from somebody else who took a look at a roll over as a reason to offer out. Yet, both traders are looking at the very same technical levels.

I have mentioned this a number of times, but I believe it is worth mentioning once again. The most typical moving average is the 200-day SMA (simple moving average). Really merely put, when the market is above the 200-day SMA, traders state that the market remains in an uptrend. The market is in a downtrend when price is below the 200-day SMA.

The general rule in trading with the Stochastics is that when the reading is above 80%, it implies that the marketplace is overbought and is ripe for a downward correction. Likewise when the reading is below 20%, it suggests that the marketplace is oversold and is going to bounce down quickly!

Another example of an easy timing system might be revealed as follows. Draw the line to recognize the assistance and resistance levels. The first and most obvious is that I was just setting the stops too close.

If you are looking rare and exciting videos about Ma Crossover Expert, and Forex Market, Trend Lines dont forget to join our email subscription DB totally free.