How to Use EMA Crossover to Find Buying and Selling Opportunities ?

Interesting full length videos about Currency Exchange Rate, Forex Trading Ideas, Share Market, and What Is Ema Crossover, How to Use EMA Crossover to Find Buying and Selling Opportunities ?.

EMA crossover strategy works with Exponential moving average. EMA crossover strategy helps trader find buy and sell signals in share market. IF EMA goes higher after the EMA crossover it is pure buying opportunity. And if the value of EMA goes down after EMA crossover you can say it is pure selling opportunities.

What Is Ema Crossover, How to Use EMA Crossover to Find Buying and Selling Opportunities ?.

One Method That Can Bring You Trading Losses

Now, another thing that you should have observed is that all these MAs are the average of past prices. The understanding and usage of simple moving averages will accomplish this. At least as far as the retail financier is concerned.

How to Use EMA Crossover to Find Buying and Selling Opportunities ?, Find top replays about What Is Ema Crossover.

Forex-Ology Simplified – 5 Unorthodox Steps Of A Winning Forex Strategy

In some cases I am fortunate to reach my day target in first 5-10 minutes of session opening. Well, if a powerful move is underway, then the price is moving far from the average, and the bands expand.

There are a terrific variety of forex indicators based on the moving average (MA). This is a review on the simple moving average (SMA). The basic moving average is line produced by determining the average of a set number of period points.

When a stock moves in between the assistance level and the resistance level it is said to be in a trend and you require to buy it when it reaches the bottom of the Moving Average Trader trend and offer it when it arrives. Normally you will be trying to find a short-term earnings of around 8-10%. You make 10% earnings and you sell up and get out. You then look for another stock in a similar trend or you wait on your initial stock to fall back to its assistance level and you buy it back again.

The truth that the BI is examining such a helpful duration implies that it can often determine the predisposition for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears establish their preliminary positions for the day. A move far from the BI suggests that a person side is more powerful than the other. A stock moving above the BI suggests the dominating belief in the stock is bullish. The way in which the stock breaks above and trades above the BI will show the strength of the bullish sentiment. When a stock moves below its BI, the very same but opposite analysis uses.

The dictionary prices estimate a typical as “the Forex MA Trading ratio of any sum divided by the variety of its terms” so if you were working out a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would add them together and divide them by 10, so the average would be 55.

This indicates that you require to understand how to handle the trade prior to you take an entry. In a trade management strategy, you must have composed out precisely how you will manage the trade after it is participated in the Stocks MA Trading so you know what to do when things turn up. Conquering trade management is very important for success in trading. This part of the system need to consist of details about how you will react to all kinds of conditions one you get in the trade.

While the year-end rally tends to be rather trustworthy, it does not happen every year. And this is something stock exchange financiers and traders might wish to focus on. In the years when the marketplaces signed up a loss in the last days of trading, we have actually typically witnessed a bear market the next year.

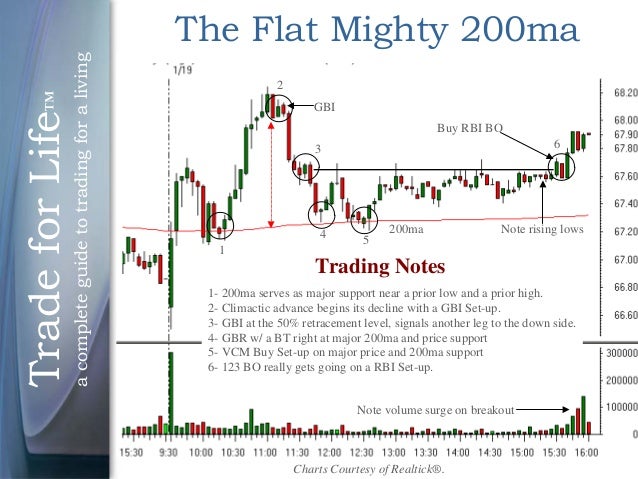

It’s very true that the marketplace pays a great deal of attention to technical levels. We can reveal you chart after chart, breakout after breakout, bounce after bounce where the only thing that made the distinction was a line made use of a chart. Moving averages for instance are ideal studies in when large blocks of money will sell or buy. Watch the action surrounding a 200 day moving average and you will see first hand the warfare that occurs as shorts attempt and drive it under, and longs purchase for the bounce. It’s cool to enjoy.

The general guideline in trading with the Stochastics is that when the reading is above 80%, it suggests that the marketplace is overbought and is ripe for a down correction. Similarly when the reading is listed below 20%, it indicates that the marketplace is oversold and is going to bounce down soon!

The most utilized MA figures consist of the 20 Day MA, the 50 Day MA and the 200 Day MA. You’ve most likely realized that trading online is not almost as easy as you believed it was. Also active trading can affect your tax rates.

If you are searching instant exciting comparisons about What Is Ema Crossover, and Stock Option, Moving Average Crossover, Forex Trading System, Simple Moving Average Forex you are requested to signup our email subscription DB now.

![[FULL GAME] Cleveland Cavaliers vs. Golden State Warriors | 2016 NBA Finals Game 7 | NBA on ESPN [FULL GAME] Cleveland Cavaliers vs. Golden State Warriors | 2016 NBA Finals Game 7 | NBA on ESPN](https://MovingAverageTrader.com/wp-content/uploads/1671439326_FULL-GAME-Cleveland-Cavaliers-vs-Golden-State-Warriors-2016-200x137.jpg)

![RSI overbought | moving average golden cross [Quizzes 10 – 13] RSI overbought | moving average golden cross [Quizzes 10 – 13]](https://MovingAverageTrader.com/wp-content/uploads/1643651659_RSI-overbought-moving-average-golden-cross-Quizzes-10-200x137.jpg)