How To Use ATR In Intraday Trading|Best Moving Average Crossover Forex Trading Strategies

Interesting YouTube videos highly rated Best Moving Averages, Best Forex Technical Analysis, Best Forex, and Ma Crossover Expert, How To Use ATR In Intraday Trading|Best Moving Average Crossover Forex Trading Strategies.

How To Use ATR In Intraday Trading|Best Moving Average Crossover Forex Trading Strategies

ATR indicator specification

Simply put, the ATR indicator measures the volatility of price changes in any security or market. In this regard, ATR is a global indicator. Indicators work in the stock market, commodity market, forex market and so on.

ATR indicator

The ATR indicator measures the volatility in the pips. This is a great way to read the market volatility. Just knowing the last day or the last hour’s volatility does not provide us with enough data to be able to make an informed decision. This is why the ATR indicator determines and plans to average a certain number of sessions.

By default, the ATR indicator is set to 14. So, if you’re on the daily chart, the ATR indicator fluctuates on average over the last 14 days. Will display from top to bottom. Conversely, if you’re on the 1h chart, the ATR indicator will show average volatility over the last 14 hours.

Explain the average correct range

The ATR Indicator The ATR Indicator will display the value of the volatility in the upper right corner of the window.

The best average range to trade is Period 10. With extensive research by our team at Trading Strategy Guides, 10 sessions or 10 periods are the best numbers for measuring volatility.

When trying to understand average trades, they often use the first technical indicator traders on the go. However, it is noteworthy that these averages are often related to highly qualified traders, who have experience and knowledge of many additional tools. This highlights the importance that they can play in the realm of average technical analysis, while spectrum traders use them on a regular basis.

Moving average crossover types

Dynamic averages can be used in many tactics, from providing support and resistance to identifying possible turning points around this over. Each trader will have his or her own average, yet it is worth considering two groups of the average: the long term and the short term.

Long-term moving average

Long-term averages (such as 50, 100 and 200) are moving slowly, providing lower sensitivity to short-term costs compared to their short-term counterparts. This long-term average will generally provide less signal to any method of use, yet the relative efficiency may also increase the importance of these signals. Due to the slow nature of these moving averages, there is a risk that the signals may lag relatively behind the short-term average.

Short-term moving average

In contrast, short-term moving averages (such as 5, 10, 20, and 50) can provide a trader with more active indicators, with recent price action increasing significantly. The signals are very constant, with the average response rate which means that the signals can be longer than the average over the long run. However, there may be a large number of false signals with high signals and response motion.

When using a moving average crossover strategy, the key is to look at a shorter, more reactive average as a guide to how the market can turn. It is worth noting that a crossover strategy is generally more effective within a trending market, with the expectation that a short-term product may be expected to signal a buy and sell.

When it comes to choosing which dynamic averages to use, traders will undoubtedly want to find a magic number that will somehow provide a consistent trading strategy that others do not have. However, it is not the case that a more ambiguous combination is the best approach, therefore reducing the self-fulfilling element of this trading strategy.

Welcome Friends to ‘s Biggest Technical Analysis Youtube Channel

Our Dream is to make you an Expert in Trading any Market, be it Commodity or Forex Trading. We plan to achieve that by:

By providing you A-Z of Technical Analysis and Fundamental Analysis training,

By Giving you tools, Strategies and Indicators to know the markets better,

By Providing you a Demo trading platform free of cost to test the waters

By Providing you Free Honest Product reviews related to Trading.

Our Channel has Videos basic videos from what is Technical Analysis to advanced concepts like Trading Divergences, we have training videos in Trading Psychology, Money Management

Wishing you all the very best.

……………………………………………..

forex trading strategies

best forex trading platform

forex trading for beginners

forex trading tutorial

what is forex trading and how does it work

forex trading reviews

forex market live

forex trading wik

forex moving average strategy pdf

200 day moving average strategy

20 period moving average strategy

3 moving average crossover strategy

profitable moving average forex strategies

moving average example

best moving average setting for h1

moving average indicator

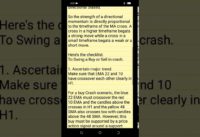

atr trading strategy pdf

how to use atr in intraday trading

best atr multiplier stop loss

atr bands

atr trailing stop

how to use atr for stop loss

Ma Crossover Expert, How To Use ATR In Intraday Trading|Best Moving Average Crossover Forex Trading Strategies.

Forex Exchange – How To Anticipate Cost Movements

As you can plainly see, understanding stock seasonality can include tremendous revenue to any trader’s account.

You will often see price respecting these lines and after that blowing right through them.

How To Use ATR In Intraday Trading|Best Moving Average Crossover Forex Trading Strategies, Enjoy popular reviews related to Ma Crossover Expert.

What’s The Very Best Day Trading Technique?

The greatest signal is where the present price goes through both the SMAs at a steep angle. On April 28, the gold-silver ratio was about 30, relatively low. I have actually been trading futures, choices and equities for around 23 years.

.jpg)

A ‘moving’ typical (MA) is the typical closing price of a certain stock (or index) over the last ‘X’ days. For instance, if a stock closed at $21 on Tuesday, at $25 on Wednesday, and at $28 on Thursday, its 3-day MA would be $24.66 (the amount of $21, $25, and $28, divided by 3 days).

The down trend in sugar futures is well founded due to the expectations of a big 2013 harvest that should be led by a record Brazilian harvest. This is news that everybody knows and this basic details has actually drawn in good traders to the sell side of the marketplace. Technical traders have also had a simple go of it since what rallies there have been have been topped perfectly by the 90 day moving average. In reality, the last time the 30-day Moving Average Trader typical crossed under the 90-day moving average remained in August of in 2015. Finally, technical traders on the brief side have collected earnings due to the organized decrease of the marketplace hence far rather than getting stopped out on any spikes in volatility.

Peter warned him however, “Remember Paul, not all trades are this easy and turn out as well, but by trading these types of patterns on the everyday chart, when the weekly trend is also in the same direction, we have a high possibility of a lucrative result in a large portion of cases.

It’s tempting to start trading at $10 or $20 a point just to see how much money, albeit make-believe money, you can Forex MA Trading in as brief a time as possible. However that’s a mistake. Then you should treat your $10,000 of make-believe cash as if it were genuine, if you’re to find out how to trade currencies beneficially.

Now that you have actually identified the everyday pattern, fall to the lower timeframe and take a look at the Bollinger bands. You are searching for the Stocks MA Trading price to hit the extreme band that protests the daily pattern.

In addition, if the five day moving average is pointing down then keep away, think about an extra commodity, one where by the 5-day moving average is moving north. And do not buy a trade stock when it really is down below its two-hundred day moving average.

This trading tool works better on currency pair rate history than on stocks. With stocks, price can space up or down which triggers it to offer incorrect readings. Currency pair’s cost action hardly ever spaces.

In this post is illustrated how to sell a fading and trendy market. This short article has just detailed one method for each market scenario. It is advised traders use more than one strategy when they trade Forex online.

With each brand-new day it drops the first price utilized in the previous day’s computation. When trading Forex, one should take care since incorrect expectation of price can take place.

If you are looking exclusive entertaining reviews relevant with Ma Crossover Expert, and Daily Stock Report, Sell Strategy, Chart Analysis, Stock Trading please list your email address in a valuable complementary news alert service now.